Всего найдено: 2

Здравствуйте! Подскажите, пожалуйста, как правильно писать слова: блокчейн данные, блокчейн индустрия, блокчейн пространство, блокчейн приложения, блокчейн технологии. Через дефис? Не могу найти ответа с обоснованием дефисного или раздельного написания этих слов.

Ответ справочной службы русского языка

Академический орфографический ресурс «АКАДЕМОС» Института русского языка им. В. В. Виноградова РАН фиксирует: блокчейн, блокчейн-платформа, блокчейн-технология. По аналогии корректно писать через дефис и другие слова с первой частью блокчейн. Это соответствует правилу: сложные существительные и сочетания с однословным приложением, если в их состав входят самостоятельно употребляющиеся существительные и обе части или только вторая часть склоняются, пишутся через дефис.

Добрый день. Подскажите, будет склоняться новое слово блокчейн (технология блокчейн(а), этапы развития блокчейн(а)? Тот же вопрос и по поводу биткоин… Спасибо!

Ответ справочной службы русского языка

Как самостоятельное существительное блокчейн нужно склонять. Однако в роли приложения склонять не нужно: технология блокчейн.

#статьи

- 21 сен 2022

-

0

Что такое блокчейн и как он работает

Рассказываем о том, как устроена самая популярная криптотехнология, где её применяют и какие у неё есть недостатки.

Иллюстрация: Катя Павловская для Skillbox Media

Автор, редактор, IT-журналист. Рассказывает о новых технологиях, цифровых профессиях и полезных инструментах для разработчиков. Любит играть на электрогитаре и программировать на Swift.

Блокчейн сейчас везде — на нём работают криптовалюты, мессенджеры, сложные банковские системы и модные токены с собачками. Выпускникам МФТИ выдают дипломы в виде NFT, а Эрмитаж продаёт виртуальные картины Ван Гога на блокчейн-аукционах. Самое время разобраться, что это за технология, как она устроена, зачем нужна и не пирамида ли это.

Блокчейн — это реестр для хранения и передачи цифровых активов. Активы могут быть любые: деньги, акции, игровые персонажи, произведения искусства — всё что угодно. Идея в том, что блокчейн позволяет взять какую-то вещь в Сети и сказать: «Это моё». И никто не сможет её у вас украсть, взломать или переписать.

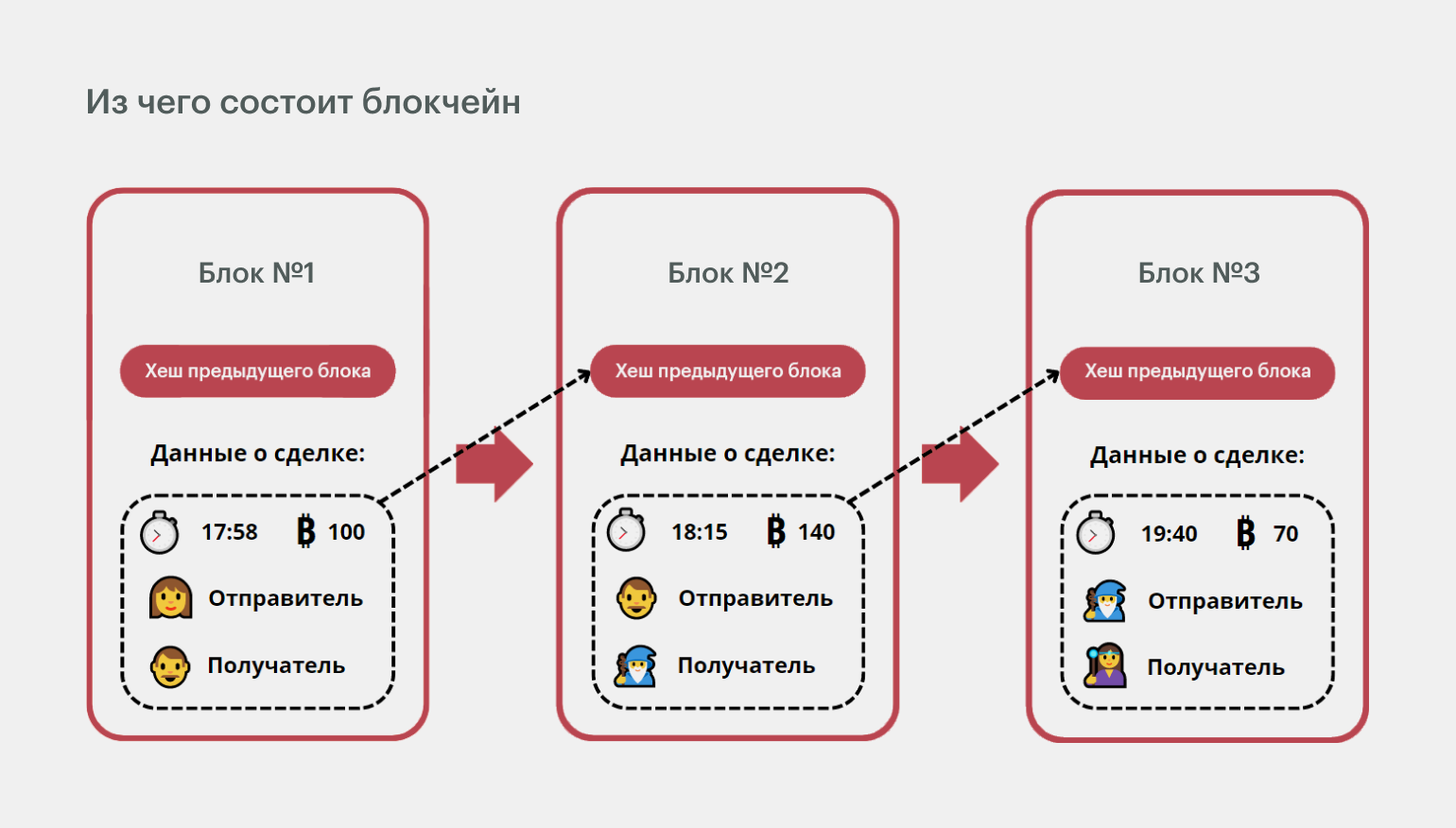

Все записи в блокчейне хранятся в виде блоков, связанных между собой специальными ключами. Если изменить какую-то запись, ключи у блоков не совпадут, и цепочка разрушится. Поэтому блоки в блокчейне нельзя удалять и редактировать — можно лишь посмотреть, что находится внутри. Кстати, с английского blockchain так и переводится — «цепочка блоков».

Изначально блокчейн был нишевой технологией для подписания цифровых документов. А потом энтузиасты догадались использовать его для перевода денег между людьми — без банков, WebMoney и прочих посредников. Так появилась криптовалюта биткоин — пока что самое известное воплощение технологии.

Допустим, вы программист в европейской компании. Приближается Международный день пожилых людей, и вы решили поздравить свою бабушку, которая живёт в России, — отправить ей немного денег на новое пальто.

Можно сделать это по-старинке — через обычный банк:

- Открываете приложение банка.

- Отправляете деньги бабушке на карту.

- Банк списывает деньги с вашего счёта.

- Зачисляет на счёт бабушке.

Звучит вроде просто и привычно, но есть загвоздка. Вся информация о переводе лежит на сервере в виде обычной строки в базе данных. Если кто-то взломает этот сервер и перепишет строку, бабушка денег не получит. Если банк вдруг схлопнется из-за кризиса, денег лишатся вообще все.

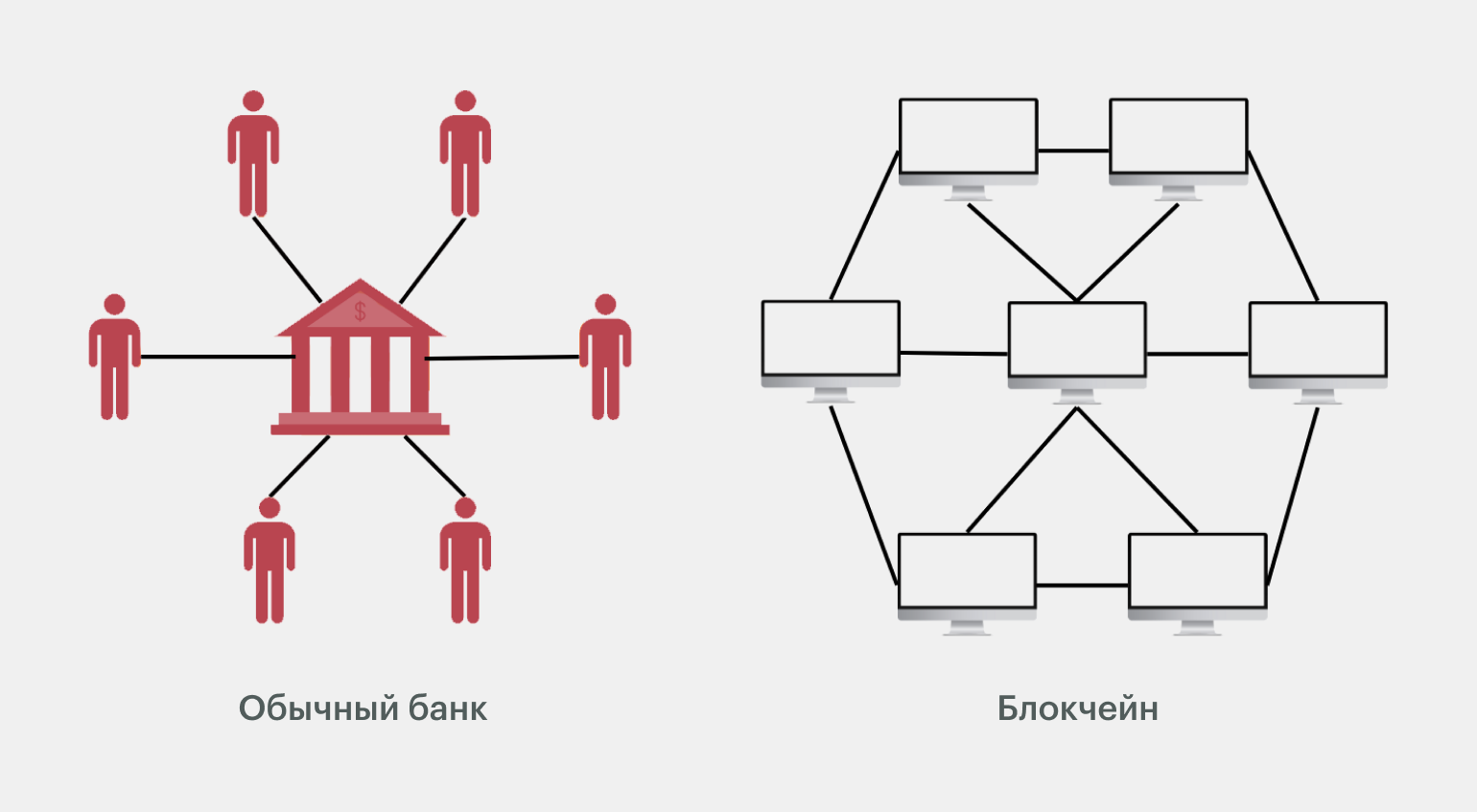

А теперь посмотрите, как изящно все эти проблемы решает блокчейн:

- Вы подключаетесь к блокчейн-сети.

- Заводите бабушке кошелёк и отправляете туда деньги.

- Перевод заносится в блокчейн и шифруется.

- Информацию о переводе получают все участники сети — а в крупных блокчейнах это миллионы человек.

Если кто-то захочет удалить данные о вашем переводе, ему придётся делать это сразу на всех компьютерах сети — а не на одном каком-то сервере. Такая фишка блокчейна называется децентрализацией. Представьте себе банк, где у каждого клиента есть копия всех платежей и переводов — вот это и будет блокчейн.

Итак, мы оформили перевод — в цепочке сразу появился новый блок. Если бабушка захочет отправить вам деньги обратно, это будет уже новый блок — мы помним, что удалять и редактировать записи в блокчейне нельзя.

Чтобы соединять между собой звенья цепочки, разработчики придумали хитрость — в каждый новый блок добавляется хеш предыдущего блока. Хеш — это зашифрованные данные о сделке в виде уникального набора букв и цифр. Если поменять какую-то запись, хеши у блоков не совпадут, и сеть не примет изменения.

Например, в биткоине все операции хешируются алгоритмом SHA-256. Он превращает любую информацию в строку размером 256 бит. Без разницы, будет ли это «Война и мир» Толстого или строчка из песни Михаила Боярского — на выходе получится шифрованная колбаса весом в 256 бит. Выглядит она примерно так:

c9f9053e2fb3fcec35ceeafab7bda50ece7d924f886c117b142dfa2df1d63574

В нашем случае, если перевести эту колбасу на русский, выйдет что-то вроде: «Петя Иванов отправил Зинаиде Степановне Ивановой 5000 рублей 1 октября 2022 года в 14:30».

Тут есть нюанс: если Петю заменить, скажем, на Диму, получится совершенно другой хеш. Следующий блок заметит изменения и отправит сигнал всем участникам сети: «Что-то тут нечисто, нас хотят взломать». И если большинство компьютеров знать не знают никакого Диму, блок останется неизменным.

Вернёмся к нашей Зинаиде Степановне. Предположим, деньги ей не особо нужны, и она решает отправить их вашему брату, который учится на первом курсе в Москве. Вот как система будет работать в таком случае:

Шаг 1. Блокчейн возьмёт хеш предыдущего блока.

Шаг 2. Добавит к нему новые данные:

3e84907df11600de355a07de0e255fcae469522c418f4f12945b586f619bedc6

+

«Данные о сделке Зинаиды Степановны и Васи».

Шаг 3. В таком виде запись снова хешируется, и получится ещё один блок:

0118b7211febd23303ed123e3c441301dba8062fa1dcaaa4bb682ef4b8fcc3fe

Этот процесс можно сравнить со старой детской игрой в снежный ком, когда каждый по очереди называет своё имя плюс имена предыдущих участников. Если кто-то сбился или назвал не все имена, цепочка прерывается и игрок выбывает.

Сама по себе транзакция — это просто набор данных, вроде записи в тетради. Чтобы превратить её в блок, нужны вычислительные мощности — и чем больше сеть, тем больше железа она требует для работы. Поэтому созданием новых блоков в больших блокчейнах занимаются специальные люди с мощными компьютерами — майнеры.

Вот как выглядит день из жизни обычного майнера:

- Взять транзакцию из общей очереди.

- Подобрать для неё уникальный хеш.

- Соединить его с хешем предыдущей транзакции.

- Всё это дело снова хешировать и сделать новый блок.

В награду за свой труд майнеры получают кусочек от общего цифрового пирога — например, в случае биткоина это, внезапно, биткоины. Но не стоит думать, что майнинг — золотое дно. Чтобы хоть что-то заработать на добыче цифровой валюты, нужны ресурсы — в основном электричество и графические процессоры.

Если раньше майнить биткоины можно было на обычном компьютере, то теперь для этого строят целые заводы по вычислению хеша — майнинговые фермы. Выглядят они жутковато:

Фото: Bloomberg / Getty Images

Фото: компания BitRiver

Фото: компания BitRiver

Фото: Bloomberg / Getty Images

Так как блокчейн трудно взломать или подделать, его часто применяют для защиты цифровых активов: файлов, документов, сделок или транзакций. Например, можно составить и заверить ипотечный договор без обращения к нотариусу. Или оформить права собственности на землю и недвижимость, как это уже делают в Грузии.

Вот для чего используют блокчейн крупные российские и зарубежные компании:

- Сбербанк — для учёта ипотечных закладных и других ценных бумаг.

- S7 Airlines — для продажи авиабилетов без посредников.

- «Норникель» — для выпуска токенов, обеспеченных полезными ископаемыми.

- Maersk — для отслеживания морских перевозок.

- Renault — для сертификации автомобильных запчастей.

- IBM — для разработки системы межбанковских переводов (аналога Swift).

А вот наиболее распространённые сферы, которые без блокчейна уже трудно представить:

Криптовалюты. Если вы были в интернете в последние пять лет, то наверняка слышали про пиринговые валюты: Bitcoin, Litecoin, Ethereum и другие. Интерес к ним сейчас не шквальный, но их по-прежнему ценят фрилансеры, блогеры, программисты, цифровые кочевники и все, кому важен свободный обмен деньгами без посредников.

Скриншот: Skillbox Media

Смарт-контракты. С помощью блокчейна можно заключить безопасный договор с любым контрагентом — например, арендатором квартиры. Штука в том, что такой договор можно настроить на какое-то действие и добавить в прошивку умного устройства. Допустим, кто-то давно не платит проценты по кредиту за машину — блокчейн передаёт эти данные на сервер, и доступ к машине блокируется до уплаты долга.

Государственное управление. После того как взлетел биткоин, блокчейн перестал быть забавой для гиков и технократов — теперь его внедряют банки, госкомпании и даже некоторые государства. Например, правительство Тайваня использует блокчейн на базе Ethereum для защиты от кибератак со стороны Китая.

Медицина. Данные о здоровье — лакомый кусочек для мошенников, хакеров и фармацевтических компаний. Чтобы избежать утечек, многие клиники переносят медицинские карты пациентов в блокчейн — так их невозможно украсть, взломать или подделать. Ещё такие карты удобно заполнять и передавать между учреждениями.

Интернет вещей. Любое умное устройство работает в паре с каким-то сервером: передаёт данные, скачивает обновления, обращается к условной «Алисе». Если этот сервер взломает хакер, он может управлять устройством удалённо — например, установить во всём доме температуру 32 °C. Чтобы этого избежать, многие компании хранят данные пользователей децентрализованно — то есть в блокчейн-сетях.

Представьте, что вы решили испечь торт. Можно взять в магазине готовые коржи и поиграться с начинкой — добавить крем, фрукты или варенье. А можно сделать основу самостоятельно и получить такой торт, какой захотите, — например, двухметровый шоколадный торт в виде зайца Багз Банни.

В случае с блокчейном принцип тот же — если вам не хочется писать код с нуля, можно взять готовую платформу и настроить под свои задачи. Вы продумываете общую идею, название и логотип, прописываете некоторые фишки, а платформа берёт на себя все технические вещи: логику, безопасность, проведение транзакций.

Самые известные платформы:

- Ethereum — позволяет создавать приложения на основе смарт-контрактов в разных сферах: финансы, страхование, инвестфонды, онлайн-игры. Широко используется в России — например, Сбербанком и Минцифры.

- Bitcoin — финансовая платформа для выпуска одноимённой криптовалюты. На механизмах Bitcoin работают и другие валюты — тот же Dogecoin, который активно поддерживает Илон Маск.

- Hyperledger — блокчейн-платформа от Linux Foundation. Есть фреймворки для создания цифровых паспортов, облачных сервисов и бухгалтерских книг.

- Corda — система для хранения и передачи активов между финансовыми организациями: акций, облигаций, кредитов и других обязательств.

- Solana — блокчейн-фреймворк, нацеленный на скорость: может проводить 65 000 транзакций в секунду (для сравнения, Ethereum — всего 30). Из минусов — не всегда стабильная работа и ограниченная децентрализация.

- Polkadot — позволяет объединять несколько блокчейнов в одну экосистему. Проект от создателя Ethereum Гэвина Вуда.

Далеко не у всех блокчейнов есть свои собственные платформы — к примеру, криптовалюта Litecoin работает на блокчейн-сети Bitcoin. Это не хорошо и не плохо, просто так сложилось. Если вы захотите сделать свой блокчейн, можете взять за основу готовый фреймворк — исходный код большинства платформ лежит на GitHub.

Если интересно узнать, как разрабатывают блокчейны, почитайте нашу статью про создание блокчейнов на языке C# — рассказываем, как всё устроено и пробуем запустить первый проект.

Выбор зависит от конкретной задачи. Допустим, вам надо написать блокчейн-сеть с нуля. Для этого лучше использовать языки низкого уровня вроде Rust, Go и C++. Они дают программисту полный доступ к «железу» и памяти, поэтому хорошо подходят для создания высоконагруженных систем.

Помимо этого, есть две группы языков, на которых обычно пишут блокчейны.

Языки общего назначения: Java, C#, Python или Kotlin. Это универсальный вариант: можно создать новую сеть, а можно написать приложение для какой-то платформы. Например, Java-код легко компилируется под Ethereum, Hyperledger и Quorum. При этом на базе Java работают некоторые известные платформы — скажем, NEM и IOTA.

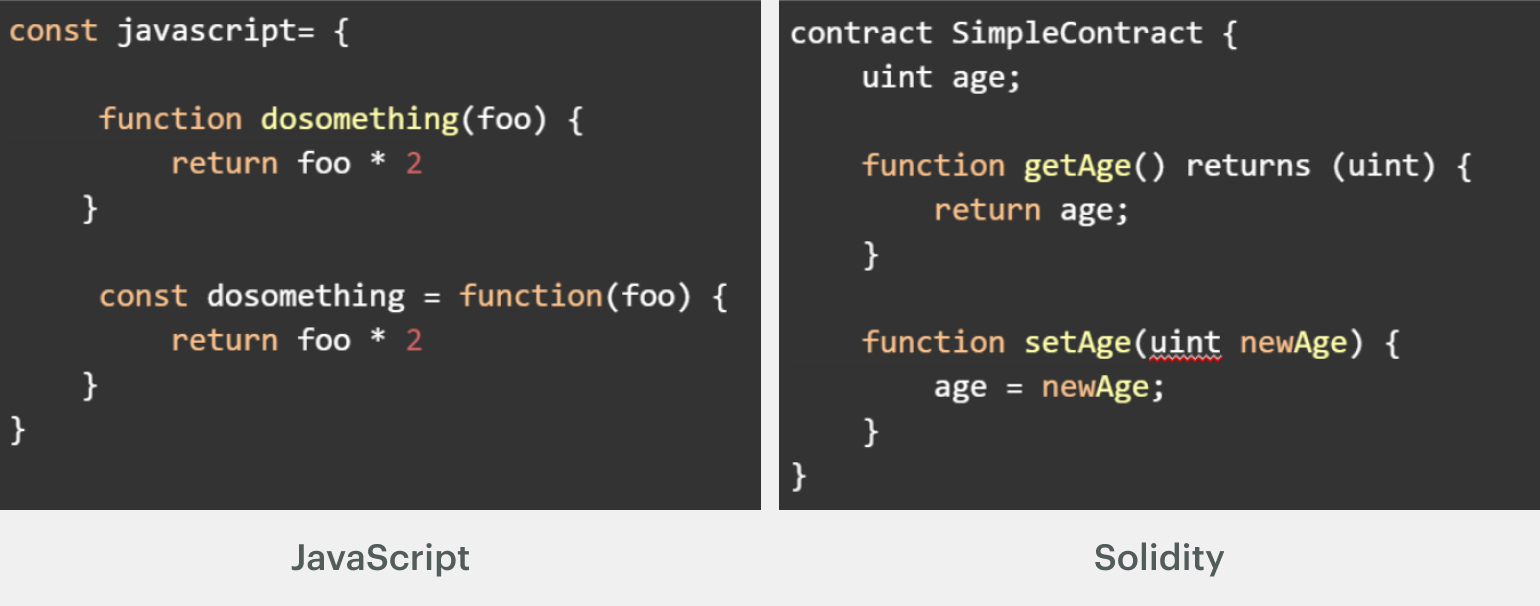

Языки, заточенные под блокчейн. Если нужно написать приложение в рамках какой-то платформы, часто используют специальные блокчейн-языки. Делают их обычно так: берут за основу популярный язык, урезают некоторые функции и добавляют фишки для создания умных контрактов. В результате можно писать хороший код для блокчейн-сетей, но где-то ещё его запустить очень сложно.

Возьмём, к примеру, язык Solidity для платформы Ethereum. Так как создатели взяли синтаксис от JavaScript, внешне языки очень похожи:

Разница в том, что JavaScript исполняется в браузере, а Solidity — в виртуальной машине Ethereum. Если этой машины нет, код на Solidity работать не будет. Поэтому его редко запускают где-то кроме блокчейн-платформы — для этого пришлось бы под каждое «железо» писать свою машину. Проще взять язык вроде Java, чья виртуалка есть на любом утюге.

Solidity — не единственный язык программирования смарт-контрактов. Как минимум есть ещё Simplicity, Vyper и Rholang. Если интересно, как вся эта кухня устроена изнутри, читайте наше интервью с блокчейн-разработчиком.

Как и у любой технологии, у блокчейна есть уязвимости и слабые стороны. Давайте разберём их по порядку.

Атака 51%. Чтобы в блокчейне появился новый блок, его должны одобрить больше половины участников. Но если к сети подключится хакер с достаточно мощным «железом», он сможет проталкивать в неё фальшивые блоки и обналичивать их на криптовалютных биржах. На практике этим редко кто занимается, и вот почему:

- Дорого — «железо» должно быть мощнее, чем у 50% всех майнеров вместе взятых. Например, в случае биткоина будет выгоднее майнить валюту, чем создавать поддельную.

- Сложно — в большинстве блокчейнов есть механизмы защиты от хакерских атак: Proof of Work и Proof of Stake.

Необратимость транзакции. Допустим, вашего соседа обманул мошенник и заставил отправить деньги на неизвестный счёт. Если сосед пользовался обычным банком, транзакцию можно попробовать отменить — обратиться в техподдержку или полицию. В случае с блокчейном отменить перевод нельзя технически, да и с точки зрения закона никакой защиты нет.

Приватные ключи. Чтобы зайти в свой аккаунт в блокчейне, нужно знать специальный хеш-ключ. Если его потерять, восстановить деньги будет очень сложно — достаточно вспомнить историю британца, который уже девять лет ищет на свалке жёсткий диск с биткоинами на сумму 176 млн долларов.

Дорогое обслуживание. Создание полноценного блокчейна требует много ресурсов: электричество, оборудование, время. Каждый участник сети должен хранить сотни гигабайт данных на своём компьютере. Поэтому для большинства задач гораздо проще и разумнее написать обычное клиент-серверное приложение, чем вкладываться в блокчейн.

По словам экспертов, к 2027 году в блокчейне будет храниться до 10% мирового ВВП. Например, цифровые дистрибьюторы смогут лицензировать фильмы, музыку и книги через NFT-токены. А государства полностью переведут в блокчейн выборы, закупки, регистрацию недвижимости и другие процедуры.

Что из этого сбудется — сложно сказать. Если интересно, как технология будет развиваться дальше, подпишитесь на нашу рассылку — будем больше рассказывать о мире блокчейнов, токенов и криптовалют. А если хотите попробовать себя в роли блокчейн-разработчика, загляните на наш бесплатный интенсив — расскажем, как написать блокчейн на Python за три дня.

Учись бесплатно:

вебинары по программированию, маркетингу и дизайну.

Участвовать

Научитесь: Профессия Python-разработчик

Узнать больше

https://gbcdn.mrgcdn.ru/uploads/post/2914/image/original-508188713607c6fa725369e0e451c93a.png

Биткоин падает, значит, блокчейн-технологии тоже все?

Нет, это не так. Биткоин — первое и наиболее известное применение блокчейн-технологии. Можно даже утверждать, что именно биткоин поспособствовал глобальному росту популярности технологии блокчейна и познакомил мир с ее преимуществами.

Но при этом блокчейн — не только про криптовалюты

Это универсальная технология, которая может использоваться в разных отраслях. И несмотря на то, что у криптовалют сейчас сложное время, технология продолжает активно развиваться. Как именно, расскажем в этом письме и на онлайн-интенсиве «Путь в IT. Трендовые технологии», который пройдет 18 июня в 11:00 МСК.

Что такое блокчейн

Блокчейн — это технология баз данных, которая лежит в основе надежного хранения и обмена ценностями в сети: криптовалютой, произведениями искусства и другими цифровыми активами. Благодаря блокчейну пользователи могут без посредников заключать любые сделки в сети.

Уникальность технологии в том, что в блокчейн можно только добавлять новую информацию, без права менять или удалять. Данные системы хранятся не на стороннем сервере, а на компьютерах участников блокчейн-сети.

Звучит сложно? Давайте разбираться с самого начала.

История блокчейна

Первое появление: защита цифровых документов

В 1991 году ученые-исследователи Стюарт Хабер и В. Скотт Сторнетта представили проект, который по сути очень напоминал технологию блокчейна. Ученые предложили вычислительно-практическое решение для цифровых документов с штампом времени. Эта технология должна была защитить документы от того, что их подделывают или оформляют задним числом.

«Меня очень беспокоил тот факт, что общество сильно зависит от ведения документации. Я начал понимать, что рано или поздно произойдет переход к полностью цифровому документообороту. Я знал, насколько легко можно вносить изменения в цифровые записи так, чтобы никто этого не заметил. Следовательно, если мы не сможем найти способ обеспечить сохранность наших документов, то как мы сможем построить на их основе сколько-нибудь надежную инфраструктуру? Поэтому вопрос, на который я хотел найти ответ, заключался в том, как создать неизменяемую запись», — рассказывает В. Сторнетта.

Второй этап: Сатоши Накамото и первые биткоины

В 2008 году некий Сатоши Накамото выпустил «Белую книгу», в которой была описана концепция одноранговой P2P-системы электронных денег. Мы до сих пор почти ничего не знаем про автора книги: неизвестно, был ли это один человек или группа людей. Было предпринято несколько попыток раскрыть личность Сатоши Накамото, но ни одна из них не привела к успеху.

В январе 2009 программист Хэл Финни получил первые 10 биткоинов от Сатоши Накамото. В следующие годы блокчейн использовался преимущественно для транзакций криптовалют.

Третий этап: Виталик Бутерин и Ethereum

Блокчейн можно использовать не только для криптовалют, но и для передачи других активов, а следовательно — для использования в самых разных сферах. При этом каждый раз создавать блокчейн с нуля для нового приложения неэффективно.

Чтобы решить эту проблему, в 2013 году программист Виталик Бутерин придумал Ethereum — платформу, на которой можно создавать новые блокчейн-приложения на базе смарт-контрактов. Смарт-контракты — это цифровые договоры, альтернатива юридическим договорам. Они существуют внутри системы Ethereum, и их исполнение гарантируется компьютерной программой.

Таким образом, Ethereum — это не просто платежная система, а настоящее «криптотопливо», которое помогает компаниям внедрять технологии блокчейна в сторонние проекты.

Главные принципы, на которых строится блокчейн-сеть

Децентрализация

Хранение данных и контроль за принятием решений производится не централизованным субъектом, а распределенной сетью.

Неизменность

Данные не могут быть изменены. Ни один участник не может вмешаться в транзакцию после ее внесения в реестр. Если запись содержит ошибку, то для ее исправления необходимо добавить новую транзакцию.

Консенсус

Система блокчейна устанавливает набор правил, с помощью которых участники одобряют транзакции. Новые транзакции можно регистрировать только с согласия большинства участников сети.

Как работает блокчейн

Шаг 1. Записываем транзакцию

Блокчейн-транзакция отражает перемещение физических или цифровых активов от одной стороны к другой в блокчейн-сети.

Шаг 2. Достигаем консенсуса

Участники блокчейн-сети должны подтвердить, что транзакция действительна.

Шаг 3. Связываем блоки

Когда консенсус достигнут, транзакции записываются в блоки. Вместе с транзакциями в новый блок добавляется криптографический хеш. Хеш действует как цепочка, связывающая блоки вместе. После этого их редактирование невозможно.

Шаг 4. Обновляем общий реестр

Последняя копия реестра распространяется среди всех участников.

Какие бывают типы блокчейна

Публичный блокчейн

Общедоступные блокчейны имеют открытый исходный код. Все могут участвовать в них в качестве разработчиков, майнеров и пользователей.

Частный блокчейн

Блокчейны, где нужно получить согласие, прежде чем в них участвовать. Все транзакции остаются конфиденциальными и доступны только участникам системы.

Гибридный блокчейн

Блокчейн-системы, в которых можно контролировать, какие данные будут общедоступными, а какие конфиденциальными.

Где уже сейчас применяется технология блокчейна

Финансы

Блокчейн используется не только для транзакций цифровых валют, но и для обработки денежных потоков в долларах или евро.

Бизнес

Блокчейн связан далеко не только с цифровыми валютами. С помощью этой технологии можно отслеживать бизнес-процессы: от подтверждения подлинности товаров до контроля всех этапов международных продаж

Юриспруденция

В программе на блокчейне хранятся ценные бумаги. Технология гарантирует, что никто не может незаметно изменить их содержание.

Гейм-индустрия

Разработка игр play-to-earn, которые работают на блокчейне. Игроки зарабатывают токены на том, что сражаются, проходят миссии и участвуют в торговле.

Образование

Технология исключает возможность внесения изменений в данные. Это гарантирует подлинность дипломов. Например, один из университетов Кипра уже хранит информацию о выданных дипломах на блокчейн-платформе.

Сфера недвижимости

Сделки с недвижимостью сопровождает длительный процесс перехода права собственности. Работа блокчейна исключит из этой процедуры посредников, ускорит транзакции между покупателем и продавцом, сохраняя при этом необходимые данные в соответствующих реестрах.

А что дальше будет с блокчейном?

Технология все еще находится в зачаточном состоянии, и потенциальных способов ее применения огромное множество. Программисты активно работают над устранением недостатков существующих платформ. Многие компании только начинают задумываться об интегрировании блокчейна в свою деятельность.

По прогнозам экспертов, к 2024 году рынок блокчейн-решений вырастет до 60 миллиардов долларов. Большая часть роста, скорее всего, будет связана со сферой финансовых услуг. Рассказываем, как блокчейн может повлияет на наше будущее и почему технология затронет каждого.

Появятся цифровые паспорта

Более миллиарда человек по всему миру испытывают сложности с подтверждением своей личности. Microsoft думает, что это можно изменить, и разрабатывает децентрализованную систему цифровой идентификации. Корпорация предлагает присвоить каждому пользователю уникальный номер, который можно будет использовать везде: например, в банковских операциях или при получении медицинских услуг.

Изменится мировая финансовая система

Блокчейн может сократить затраты банков до 50%. Но если технология продолжит развиваться сегодняшними темпами, то ее повсеместное внедрение может привести к ликвидации некоторых участников мировой финансовой системы.

Произойдут реформы в здравоохранении

В частных блокчейнах можно будет хранить медицинские показатели, рецепты и медицинские карты. К этому блокчейну смогут подключаться врачи, фармацевты, страховщики. Благодаря технологии блокчейна можно будет следить за распространением лекарств и выявлять поддельные рецепты. Также можно будет контролировать расход медикаментов, исследовать медицинские данные населения.

Преимущества и недостатки блокчейна

Как у любой другой технологии, у блокчейна есть сильные и слабые стороны. Например, одна из потенциальных угроз для него — это «Атака 51%». Она происходит, когда хакеры захватывают более половины вычислительной мощности блокчейн-системы. В этом случае они могут управлять системой, отклоняя и одобряя транзакции.

|

Плюсы блокчейна: |

Минусы блокчейна: |

|

|

Хотите больше узнать о блокчейне?

Не пропустите мероприятие «Путь в IT. Трендовые технологии», которое пройдет 18 июня в 11:00 МСК. Вы познакомитесь не только с блокчейном, но и с другими хайповыми технологиями:

-

метавселенные;

-

нейронные сети;

-

data science и big data;

-

квантовые вычисления;

-

Web 3.0;

-

искусственным интеллектом.

Наши эксперты просто и понятно расскажут о каждой из этих технологий.

A blockchain is a distributed ledger with growing lists of records (blocks) that are securely linked together via cryptographic hashes.[1][2][3][4] Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data (generally represented as a Merkle tree, where data nodes are represented by leaves). The timestamp proves that the transaction data existed when the block was created. Since each block contains information about the previous block, they effectively form a chain (compare linked list data structure), with each additional block linking to the ones before it. Consequently, blockchain transactions are irreversible in that, once they are recorded, the data in any given block cannot be altered retroactively without altering all subsequent blocks.

Blockchains are typically managed by a peer-to-peer (P2P) computer network for use as a public distributed ledger, where nodes collectively adhere to a consensus algorithm protocol to add and validate new transaction blocks. Although blockchain records are not unalterable, since blockchain forks are possible, blockchains may be considered secure by design and exemplify a distributed computing system with high Byzantine fault tolerance.[5]

A blockchain was created by a person (or group of people) using the name (or pseudonym) Satoshi Nakamoto in 2008 to serve as the public distributed ledger for bitcoin cryptocurrency transactions, based on previous work by Stuart Haber, W. Scott Stornetta, and Dave Bayer.[6] The implementation of the blockchain within bitcoin made it the first digital currency to solve the double-spending problem without the need of a trusted authority or central server. The bitcoin design has inspired other applications[3][2] and blockchains that are readable by the public and are widely used by cryptocurrencies. The blockchain may be considered a type of payment rail.[7]

Private blockchains have been proposed for business use. Computerworld called the marketing of such privatized blockchains without a proper security model «snake oil»;[8] however, others have argued that permissioned blockchains, if carefully designed, may be more decentralized and therefore more secure in practice than permissionless ones.[4][9]

History

Cryptographer David Chaum first proposed a blockchain-like protocol in his 1982 dissertation «Computer Systems Established, Maintained, and Trusted by Mutually Suspicious Groups.»[10] Further work on a cryptographically secured chain of blocks was described in 1991 by Stuart Haber and W. Scott Stornetta.[4][11] They wanted to implement a system wherein document timestamps could not be tampered with. In 1992, Haber, Stornetta, and Dave Bayer incorporated Merkle trees into the design, which improved its efficiency by allowing several document certificates to be collected into one block.[4][12] Under their company Surety, their document certificate hashes have been published in The New York Times every week since 1995.[13]

The first decentralized blockchain was conceptualized by a person (or group of people) known as Satoshi Nakamoto in 2008. Nakamoto improved the design in an important way using a Hashcash-like method to timestamp blocks without requiring them to be signed by a trusted party and introducing a difficulty parameter to stabilize the rate at which blocks are added to the chain.[4] The design was implemented the following year by Nakamoto as a core component of the cryptocurrency bitcoin, where it serves as the public ledger for all transactions on the network.[3]

In August 2014, the bitcoin blockchain file size, containing records of all transactions that have occurred on the network, reached 20 GB (gigabytes).[14] In January 2015, the size had grown to almost 30 GB, and from January 2016 to January 2017, the bitcoin blockchain grew from 50 GB to 100 GB in size. The ledger size had exceeded 200 GB by early 2020.[15]

The words block and chain were used separately in Satoshi Nakamoto’s original paper, but were eventually popularized as a single word, blockchain, by 2016.[16]

According to Accenture, an application of the diffusion of innovations theory suggests that blockchains attained a 13.5% adoption rate within financial services in 2016, therefore reaching the early adopters’ phase.[17] Industry trade groups joined to create the Global Blockchain Forum in 2016, an initiative of the Chamber of Digital Commerce.

In May 2018, Gartner found that only 1% of CIOs indicated any kind of blockchain adoption within their organisations, and only 8% of CIOs were in the short-term «planning or [looking at] active experimentation with blockchain».[18] For the year 2019 Gartner reported 5% of CIOs believed blockchain technology was a ‘game-changer’ for their business.[19]

Structure and design

Blockchain formation. The main chain (black) consists of the longest series of blocks from the genesis block (green) to the current block. Orphan blocks (purple) exist outside of the main chain.

A blockchain is a decentralized, distributed, and often public, digital ledger consisting of records called blocks that are used to record transactions across many computers so that any involved block cannot be altered retroactively, without the alteration of all subsequent blocks.[3][20] This allows the participants to verify and audit transactions independently and relatively inexpensively.[21] A blockchain database is managed autonomously using a peer-to-peer network and a distributed timestamping server. They are authenticated by mass collaboration powered by collective self-interests.[22] Such a design facilitates robust workflow where participants’ uncertainty regarding data security is marginal. The use of a blockchain removes the characteristic of infinite reproducibility from a digital asset. It confirms that each unit of value was transferred only once, solving the long-standing problem of double-spending. A blockchain has been described as a value-exchange protocol.[23] A blockchain can maintain title rights because, when properly set up to detail the exchange agreement, it provides a record that compels offer and acceptance.[citation needed]

Logically, a blockchain can be seen as consisting of several layers:[24]

- infrastructure (hardware)

- networking (node discovery, information propagation[25] and verification)

- consensus (proof of work, proof of stake)

- data (blocks, transactions)

- application (smart contracts/decentralized applications, if applicable)

Blocks

Blocks hold batches of valid transactions that are hashed and encoded into a Merkle tree.[3] Each block includes the cryptographic hash of the prior block in the blockchain, linking the two. The linked blocks form a chain.[3] This iterative process confirms the integrity of the previous block, all the way back to the initial block, which is known as the genesis block (Block 0).[26][27] To assure the integrity of a block and the data contained in it, the block is usually digitally signed.[28]

Sometimes separate blocks can be produced concurrently, creating a temporary fork. In addition to a secure hash-based history, any blockchain has a specified algorithm for scoring different versions of the history so that one with a higher score can be selected over others. Blocks not selected for inclusion in the chain are called orphan blocks.[27] Peers supporting the database have different versions of the history from time to time. They keep only the highest-scoring version of the database known to them. Whenever a peer receives a higher-scoring version (usually the old version with a single new block added) they extend or overwrite their own database and retransmit the improvement to their peers. There is never an absolute guarantee that any particular entry will remain in the best version of history forever. Blockchains are typically built to add the score of new blocks onto old blocks and are given incentives to extend with new blocks rather than overwrite old blocks. Therefore, the probability of an entry becoming superseded decreases exponentially[29] as more blocks are built on top of it, eventually becoming very low.[3][30]: ch. 08 [31] For example, bitcoin uses a proof-of-work system, where the chain with the most cumulative proof-of-work is considered the valid one by the network. There are a number of methods that can be used to demonstrate a sufficient level of computation. Within a blockchain the computation is carried out redundantly rather than in the traditional segregated and parallel manner.[32]

Block time

The block time is the average time it takes for the network to generate one extra block in the blockchain. By the time of block completion, the included data becomes verifiable. In cryptocurrency, this is practically when the transaction takes place, so a shorter block time means faster transactions. The block time for Ethereum is set to between 14 and 15 seconds, while for bitcoin it is on average 10 minutes.[33]

Hard forks

A hard fork is a change to the blockchain protocol that is not backward-compatible and requires all users to upgrade their software in order to continue participating in the network. In a hard fork, the network splits into two separate versions: one that follows the new rules and one that follows the old rules.

For example, Ethereum was hard-forked in 2016 to «make whole» the investors in The DAO, which had been hacked by exploiting a vulnerability in its code. In this case, the fork resulted in a split creating Ethereum and Ethereum Classic chains. In 2014 the Nxt community was asked to consider a hard fork that would have led to a rollback of the blockchain records to mitigate the effects of a theft of 50 million NXT from a major cryptocurrency exchange. The hard fork proposal was rejected, and some of the funds were recovered after negotiations and ransom payment. Alternatively, to prevent a permanent split, a majority of nodes using the new software may return to the old rules, as was the case of bitcoin split on 12 March 2013.[34]

A more recent hard-fork example is of Bitcoin in 2017, which resulted in a split creating Bitcoin Cash.[35] The network split was mainly due to a disagreement in how to increase the transactions per second to accommodate for demand.[36]

Decentralization

By storing data across its peer-to-peer network, the blockchain eliminates some risks that come with data being held centrally.[3] The decentralized blockchain may use ad hoc message passing and distributed networking.[37]

In a so-called «51% attack» a central entity gains control of more than half of a network and can then manipulate that specific blockchain record at will, allowing double-spending.[38]

Blockchain security methods include the use of public-key cryptography.[39]: 5 A public key (a long, random-looking string of numbers) is an address on the blockchain. Value tokens sent across the network are recorded as belonging to that address. A private key is like a password that gives its owner access to their digital assets or the means to otherwise interact with the various capabilities that blockchains now support. Data stored on the blockchain is generally considered incorruptible.[3]

Every node in a decentralized system has a copy of the blockchain. Data quality is maintained by massive database replication[40] and computational trust. No centralized «official» copy exists and no user is «trusted» more than any other.[39] Transactions are broadcast to the network using the software. Messages are delivered on a best-effort basis. Early blockchains rely on energy-intensive mining nodes to validate transactions,[27] add them to the block they are building, and then broadcast the completed block to other nodes.[30]: ch. 08 Blockchains use various time-stamping schemes, such as proof-of-work, to serialize changes.[41] Later consensus methods include proof of stake.[27] The growth of a decentralized blockchain is accompanied by the risk of centralization because the computer resources required to process larger amounts of data become more expensive.[42]

Finality

Finality is the level of confidence that the well-formed block recently appended to the blockchain will not be revoked in the future (is «finalized») and thus can be trusted. Most distributed blockchain protocols, whether proof of work or proof of stake, cannot guarantee the finality of a freshly committed block, and instead rely on «probabilistic finality»: as the block goes deeper into a blockchain, it is less likely to be altered or reverted by a newly found consensus.[43]

Byzantine Fault Tolerance-based proof-of-stake protocols purport to provide so called «absolute finality»: a randomly chosen validator proposes a block, the rest of validators vote on it, and, if a supermajority decision approves it, the block is irreversibly committed into the blockchain.[43] A modification of this method, an «economic finality», is used in practical protocols, like the Casper protocol used in Ethereum: validators which sign two different blocks at the same position in the blockchain are subject to «slashing», where their leveraged stake is forfeited.[43]

Openness

Open blockchains are more user-friendly than some traditional ownership records, which, while open to the public, still require physical access to view. Because all early blockchains were permissionless, controversy has arisen over the blockchain definition. An issue in this ongoing debate is whether a private system with verifiers tasked and authorized (permissioned) by a central authority should be considered a blockchain.[44][45][46][47][48] Proponents of permissioned or private chains argue that the term «blockchain» may be applied to any data structure that batches data into time-stamped blocks. These blockchains serve as a distributed version of multiversion concurrency control (MVCC) in databases.[49] Just as MVCC prevents two transactions from concurrently modifying a single object in a database, blockchains prevent two transactions from spending the same single output in a blockchain.[50]: 30–31 Opponents say that permissioned systems resemble traditional corporate databases, not supporting decentralized data verification, and that such systems are not hardened against operator tampering and revision.[44][46] Nikolai Hampton of Computerworld said that «many in-house blockchain solutions will be nothing more than cumbersome databases,» and «without a clear security model, proprietary blockchains should be eyed with suspicion.»[8][51]

Permissionless (public) blockchain

An advantage to an open, permissionless, or public, blockchain network is that guarding against bad actors is not required and no access control is needed.[29] This means that applications can be added to the network without the approval or trust of others, using the blockchain as a transport layer.[29]

Bitcoin and other cryptocurrencies currently secure their blockchain by requiring new entries to include proof of work. To prolong the blockchain, bitcoin uses Hashcash puzzles. While Hashcash was designed in 1997 by Adam Back, the original idea was first proposed by Cynthia Dwork and Moni Naor and Eli Ponyatovski in their 1992 paper «Pricing via Processing or Combatting Junk Mail».

In 2016, venture capital investment for blockchain-related projects was weakening in the USA but increasing in China.[52] Bitcoin and many other cryptocurrencies use open (public) blockchains. As of April 2018, bitcoin has the highest market capitalization.

Permissioned (private) blockchain

Permissioned blockchains use an access control layer to govern who has access to the network.[53] It has been argued that permissioned blockchains can guarantee a certain level of decentralization, if carefully designed, as opposed to permissionless blockchains, which are often centralized in practice.[9]

Disadvantages of permissioned blockchain

Nikolai Hampton argued in Computerworld that «There is also no need for a ’51 percent’ attack on a private blockchain, as the private blockchain (most likely) already controls 100 percent of all block creation resources. If you could attack or damage the blockchain creation tools on a private corporate server, you could effectively control 100 percent of their network and alter transactions however you wished.»[8] This has a set of particularly profound adverse implications during a financial crisis or debt crisis like the financial crisis of 2007–08, where politically powerful actors may make decisions that favor some groups at the expense of others,[54] and «the bitcoin blockchain is protected by the massive group mining effort. It’s unlikely that any private blockchain will try to protect records using gigawatts of computing power — it’s time-consuming and expensive.»[8] He also said, «Within a private blockchain there is also no ‘race’; there’s no incentive to use more power or discover blocks faster than competitors. This means that many in-house blockchain solutions will be nothing more than cumbersome databases.»[8]

Blockchain analysis

The analysis of public blockchains has become increasingly important with the popularity of bitcoin, Ethereum, litecoin and other cryptocurrencies.[55] A blockchain, if it is public, provides anyone who wants access to observe and analyse the chain data, given one has the know-how. The process of understanding and accessing the flow of crypto has been an issue for many cryptocurrencies, crypto exchanges and banks.[56][57] The reason for this is accusations of blockchain-enabled cryptocurrencies enabling illicit dark market trade of drugs, weapons, money laundering, etc.[58] A common belief has been that cryptocurrency is private and untraceable, thus leading many actors to use it for illegal purposes. This is changing and now specialised tech companies provide blockchain tracking services, making crypto exchanges, law-enforcement and banks more aware of what is happening with crypto funds and fiat-crypto exchanges. The development, some argue, has led criminals to prioritise the use of new cryptos such as Monero.[59][60][61] The question is about the public accessibility of blockchain data and the personal privacy of the very same data. It is a key debate in cryptocurrency and ultimately in the blockchain.[62]

Standardisation

In April 2016, Standards Australia submitted a proposal to the International Organization for Standardization to consider developing standards to support blockchain technology. This proposal resulted in the creation of ISO Technical Committee 307, Blockchain and Distributed Ledger Technologies.[63] The technical committee has working groups relating to blockchain terminology, reference architecture, security and privacy, identity, smart contracts, governance and interoperability for blockchain and DLT, as well as standards specific to industry sectors and generic government requirements.[64][non-primary source needed] More than 50 countries are participating in the standardization process together with external liaisons such as the Society for Worldwide Interbank Financial Telecommunication (SWIFT), the European Commission, the International Federation of Surveyors, the International Telecommunication Union (ITU) and the United Nations Economic Commission for Europe (UNECE).[64]

Many other national standards bodies and open standards bodies are also working on blockchain standards.[65] These include the National Institute of Standards and Technology[66] (NIST), the European Committee for Electrotechnical Standardization[67] (CENELEC), the Institute of Electrical and Electronics Engineers[68] (IEEE), the Organization for the Advancement of Structured Information Standards (OASIS), and some individual participants in the Internet Engineering Task Force[69] (IETF).

Centralized blockchain

Although most of blockchain implementation are decentralized and distributed, Oracle launched a centralized blockchain table feature in Oracle 21c database. The Blockchain Table in Oracle 21c database is a centralized blockchain which provide immutable feature. Compared to decentralized blockchains, centralized blockchains normally can provide a higher throughput and lower latency of transactions than consensus-based distributed blockchains.[70][71]

Types

Currently, there are at least four types of blockchain networks — public blockchains, private blockchains, consortium blockchains and hybrid blockchains.

Public blockchains

A public blockchain has absolutely no access restrictions. Anyone with an Internet connection can send transactions to it as well as become a validator (i.e., participate in the execution of a consensus protocol).[72][self-published source?] Usually, such networks offer economic incentives for those who secure them and utilize some type of a Proof of Stake or Proof of Work algorithm.

Some of the largest, most known public blockchains are the bitcoin blockchain and the Ethereum blockchain.

Private blockchains

A private blockchain is permissioned.[53] One cannot join it unless invited by the network administrators. Participant and validator access is restricted. To distinguish between open blockchains and other peer-to-peer decentralized database applications that are not open ad-hoc compute clusters, the terminology Distributed Ledger (DLT) is normally used for private blockchains.

Hybrid blockchains

A hybrid blockchain has a combination of centralized and decentralized features.[73] The exact workings of the chain can vary based on which portions of centralization and decentralization are used.

Sidechains

A sidechain is a designation for a blockchain ledger that runs in parallel to a primary blockchain.[74][75] Entries from the primary blockchain (where said entries typically represent digital assets) can be linked to and from the sidechain; this allows the sidechain to otherwise operate independently of the primary blockchain (e.g., by using an alternate means of record keeping, alternate consensus algorithm, etc.).[76][better source needed]

Uses

Bitcoin’s transactions are recorded on a publicly viewable blockchain.

Blockchain technology can be integrated into multiple areas. The primary use of blockchains is as a distributed ledger for cryptocurrencies such as bitcoin; there were also a few other operational products that had matured from proof of concept by late 2016.[52] As of 2016, some businesses have been testing the technology and conducting low-level implementation to gauge blockchain’s effects on organizational efficiency in their back office.[77]

In 2019, it was estimated that around $2.9 billion were invested in blockchain technology, which represents an 89% increase from the year prior. Additionally, the International Data Corp has estimated that corporate investment into blockchain technology will reach $12.4 billion by 2022.[78] Furthermore, According to PricewaterhouseCoopers (PwC), the second-largest professional services network in the world, blockchain technology has the potential to generate an annual business value of more than $3 trillion by 2030. PwC’s estimate is further augmented by a 2018 study that they have conducted, in which PwC surveyed 600 business executives and determined that 84% have at least some exposure to utilizing blockchain technology, which indicates a significant demand and interest in blockchain technology.[79]

In 2019 the BBC World Service radio and podcast series Fifty Things That Made the Modern Economy identified blockchain as a technology that would have far-reaching consequences for economics and society. The economist and Financial Times journalist and broadcaster Tim Harford discussed why the underlying technology might have much wider applications and the challenges that needed to be overcome.[80] First broadcast 29 June 2019.

The number of blockchain wallets quadrupled to 40 million between 2016 and 2020.[81]

A paper published in 2022 discussed the potential use of blockchain technology in sustainable management[82]

Cryptocurrencies

Most cryptocurrencies use blockchain technology to record transactions. For example, the bitcoin network and Ethereum network are both based on blockchain.

The criminal enterprise Silk Road, which operated on Tor, utilized cryptocurrency for payments, some of which the US federal government has seized through research on the blockchain and forfeiture.[83]

Governments have mixed policies on the legality of their citizens or banks owning cryptocurrencies. China implements blockchain technology in several industries including a national digital currency which launched in 2020.[84] To strengthen their respective currencies, Western governments including the European Union and the United States have initiated similar projects.[85]

Smart contracts

Blockchain-based smart contracts are proposed contracts that can be partially or fully executed or enforced without human interaction.[86] One of the main objectives of a smart contract is automated escrow. A key feature of smart contracts is that they do not need a trusted third party (such as a trustee) to act as an intermediary between contracting entities — the blockchain network executes the contract on its own. This may reduce friction between entities when transferring value and could subsequently open the door to a higher level of transaction automation.[87] An IMF staff discussion from 2018 reported that smart contracts based on blockchain technology might reduce moral hazards and optimize the use of contracts in general. But «no viable smart contract systems have yet emerged.» Due to the lack of widespread use their legal status was unclear.[88][89]

Financial services

According to Reason, many banks have expressed interest in implementing distributed ledgers for use in banking and are cooperating with companies creating private blockchains,[90][91][92] and according to a September 2016 IBM study, this is occurring faster than expected.[93]

Banks are interested in this technology not least because it has the potential to speed up back office settlement systems.[94] Moreover, as the blockchain industry has reached early maturity institutional appreciation has grown that it is, practically speaking, the infrastructure of a whole new financial industry, with all the implications which that entails.[95]

Banks such as UBS are opening new research labs dedicated to blockchain technology in order to explore how blockchain can be used in financial services to increase efficiency and reduce costs.[96][97]

Berenberg, a German bank, believes that blockchain is an «overhyped technology» that has had a large number of «proofs of concept», but still has major challenges, and very few success stories.[98]

The blockchain has also given rise to initial coin offerings (ICOs) as well as a new category of digital asset called security token offerings (STOs), also sometimes referred to as digital security offerings (DSOs).[99] STO/DSOs may be conducted privately or on public, regulated stock exchange and are used to tokenize traditional assets such as company shares as well as more innovative ones like intellectual property, real estate,[100] art, or individual products. A number of companies are active in this space providing services for compliant tokenization, private STOs, and public STOs.

Games

Blockchain technology, such as cryptocurrencies and non-fungible tokens (NFTs), has been used in video games for monetization. Many live-service games offer in-game customization options, such as character skins or other in-game items, which the players can earn and trade with other players using in-game currency. Some games also allow for trading of virtual items using real-world currency, but this may be illegal in some countries where video games are seen as akin to gambling, and has led to gray market issues such as skin gambling, and thus publishers typically have shied away from allowing players to earn real-world funds from games.[101] Blockchain games typically allow players to trade these in-game items for cryptocurrency, which can then be exchanged for money.[102]

The first known game to use blockchain technologies was CryptoKitties, launched in November 2017, where the player would purchase NFTs with Ethereum cryptocurrency, each NFT consisting of a virtual pet that the player could breed with others to create offspring with combined traits as new NFTs.[103][102] The game made headlines in December 2017 when one virtual pet sold for more than US$100,000.[104] CryptoKitties also illustrated scalability problems for games on Ethereum when it created significant congestion on the Ethereum network in early 2018 with approximately 30% of all Ethereum transactions[clarification needed] being for the game.[105][106]

By the early 2020s, there had not been a breakout success in video games using blockchain, as these games tend to focus on using blockchain for speculation instead of more traditional forms of gameplay, which offers limited appeal to most players. Such games also represent a high risk to investors as their revenues can be difficult to predict.[102] However, limited successes of some games, such as Axie Infinity during the COVID-19 pandemic, and corporate plans towards metaverse content, refueled interest in the area of GameFi, a term describing the intersection of video games and financing typically backed by blockchain currency, in the second half of 2021.[107] Several major publishers, including Ubisoft, Electronic Arts, and Take Two Interactive, have stated that blockchain and NFT-based games are under serious consideration for their companies in the future.[108]

In October 2021, Valve Corporation banned blockchain games, including those using cryptocurrency and NFTs, from being hosted on its Steam digital storefront service, which is widely used for personal computer gaming, claiming that this was an extension of their policy banning games that offered in-game items with real-world value. Valve’s prior history with gambling, specifically skin gambling, was speculated to be a factor in the decision to ban blockchain games.[109] Journalists and players responded positively to Valve’s decision as blockchain and NFT games have a reputation for scams and fraud among most PC gamers,[101][109] Epic Games, which runs the Epic Games Store in competition to Steam, said that they would be open to accepted blockchain games in the wake of Valve’s refusal.[110]

Supply chain

There have been several different efforts to employ blockchains in supply chain management.

- Shipping industry — Incumbent shipping companies and startups have begun to leverage blockchain technology to facilitate the emergence of a blockchain-based platform ecosystem that would create value across the global shipping supply chains.[111]

- Precious commodities mining — Blockchain technology has been used for tracking the origins of gemstones and other precious commodities. In 2016, The Wall Street Journal reported that the blockchain technology company Everledger was partnering with IBM’s blockchain-based tracking service to trace the origin of diamonds to ensure that they were ethically mined.[112] As of 2019, the Diamond Trading Company (DTC) has been involved in building a diamond trading supply chain product called Tracr.[113]

- Food supply — As of 2018, Walmart and IBM were running a trial to use a blockchain-backed system for supply chain monitoring for lettuce and spinach — all nodes of the blockchain were administered by Walmart and were located on the IBM cloud.[114]

- Fashion industry — There is an opaque relationship between brands, distributors, and customers in the fashion industry, which will prevent the sustainable and stable development of the fashion industry. Blockchain makes up for this shortcoming and makes information transparent, solving the difficulty of sustainable development of the industry.[115]

Domain names

There are several different efforts to offer domain name services via the blockchain. These domain names can be controlled by the use of a private key, which purports to allow for uncensorable websites. This would also bypass a registrar’s ability to suppress domains used for fraud, abuse, or illegal content.[116]

Namecoin is a cryptocurrency that supports the «.bit» top-level domain (TLD). Namecoin was forked from bitcoin in 2011. The .bit TLD is not sanctioned by ICANN, instead requiring an alternative DNS root.[116] As of 2015, .bit was used by 28 websites, out of 120,000 registered names.[117] Namecoin was dropped by OpenNIC in 2019, due to malware and potential other legal issues.[118] Other blockchain alternatives to ICANN include The Handshake Network,[117] EmerDNS, and Unstoppable Domains.[116]

Specific TLDs include «.eth», «.luxe», and «.kred», which are associated with the Ethereum blockchain through the Ethereum Name Service (ENS). The .kred TLD also acts as an alternative to conventional cryptocurrency wallet addresses as a convenience for transferring cryptocurrency.[119]

Other uses

Blockchain technology can be used to create a permanent, public, transparent ledger system for compiling data on sales, tracking digital use and payments to content creators, such as wireless users[120] or musicians.[121] The Gartner 2019 CIO Survey reported 2% of higher education respondents had launched blockchain projects and another 18% were planning academic projects in the next 24 months.[122] In 2017, IBM partnered with ASCAP and PRS for Music to adopt blockchain technology in music distribution.[123] Imogen Heap’s Mycelia service has also been proposed as a blockchain-based alternative «that gives artists more control over how their songs and associated data circulate among fans and other musicians.»[124][125]

New distribution methods are available for the insurance industry such as peer-to-peer insurance, parametric insurance and microinsurance following the adoption of blockchain.[126][127] The sharing economy and IoT are also set to benefit from blockchains because they involve many collaborating peers.[128] The use of blockchain in libraries is being studied with a grant from the U.S. Institute of Museum and Library Services.[129]

Other blockchain designs include Hyperledger, a collaborative effort from the Linux Foundation to support blockchain-based distributed ledgers, with projects under this initiative including Hyperledger Burrow (by Monax) and Hyperledger Fabric (spearheaded by IBM).[130][131][132] Another is Quorum, a permissioned private blockchain by JPMorgan Chase with private storage, used for contract applications.[133]

Oracle introduced a blockchain table feature in its Oracle 21c database.[70][71]

Blockchain is also being used in peer-to-peer energy trading.[134][135][136]

Blockchain could be used in detecting counterfeits by associating unique identifiers to products, documents and shipments, and storing records associated with transactions that cannot be forged or altered.[137][138] It is however argued that blockchain technology needs to be supplemented with technologies that provide a strong binding between physical objects and blockchain systems.[139] The EUIPO established an Anti-Counterfeiting Blockathon Forum, with the objective of «defining, piloting and implementing» an anti-counterfeiting infrastructure at the European level.[140][141] The Dutch Standardisation organisation NEN uses blockchain together with QR Codes to authenticate certificates.[142]

2022 Jan 30 Beijing and Shanghai are among the cities designated by China to trial blockchain applications.[143]

Blockchain interoperability

With the increasing number of blockchain systems appearing, even only those that support cryptocurrencies, blockchain interoperability is becoming a topic of major importance. The objective is to support transferring assets from one blockchain system to another blockchain system. Wegner[144] stated that «interoperability is the ability of two or more software components to cooperate despite differences in language, interface, and execution platform». The objective of blockchain interoperability is therefore to support such cooperation among blockchain systems, despite those kinds of differences.

There are already several blockchain interoperability solutions available.[145] They can be classified into three categories: cryptocurrency interoperability approaches, blockchain engines, and blockchain connectors.

Several individual IETF participants produced the draft of a blockchain interoperability architecture.[146]

Energy consumption concerns

Some cryptocurrencies use blockchain mining — the peer-to-peer computer computations by which transactions are validated and verified. This requires a large amount of energy. In June 2018, the Bank for International Settlements criticized the use of public proof-of-work blockchains for their high energy consumption.[147][148][149]

Early concern over the high energy consumption was a factor in later blockchains such as Cardano (2017), Solana (2020) and Polkadot (2020) adopting the less energy-intensive proof-of-stake model. Researchers have estimated that Bitcoin consumes 100,000 times as much energy as proof-of-stake networks.[150][151]

In 2021, a study by Cambridge University determined that Bitcoin (at 121 terawatt-hours per year) used more electricity than Argentina (at 121TWh) and the Netherlands (109TWh).[152] According to Digiconomist, one bitcoin transaction required 708 kilowatt-hours of electrical energy, the amount an average U.S. household consumed in 24 days.[153]

In February 2021, U.S. Treasury secretary Janet Yellen called Bitcoin «an extremely inefficient way to conduct transactions», saying «the amount of energy consumed in processing those transactions is staggering».[154] In March 2021, Bill Gates stated that «Bitcoin uses more electricity per transaction than any other method known to mankind», adding «It’s not a great climate thing.»[155]

Nicholas Weaver, of the International Computer Science Institute at the University of California, Berkeley, examined blockchain’s online security, and the energy efficiency of proof-of-work public blockchains, and in both cases found it grossly inadequate.[156][157] The 31TWh-45TWh of electricity used for bitcoin in 2018 produced 17-23 million tonnes of CO2.[158][159] By 2022, the University of Cambridge and Digiconomist estimated that the two largest proof-of-work blockchains, Bitcoin and Ethereum, together used twice as much electricity in one year as the whole of Sweden, leading to the release of up to 120 million tonnes of CO2 each year.[160]

Some cryptocurrency developers are considering moving from the proof-of-work model to the proof-of-stake model.[161]

Academic research

In October 2014, the MIT Bitcoin Club, with funding from MIT alumni, provided undergraduate students at the Massachusetts Institute of Technology access to $100 of bitcoin. The adoption rates, as studied by Catalini and Tucker (2016), revealed that when people who typically adopt technologies early are given delayed access, they tend to reject the technology.[162] Many universities have founded departments focusing on crypto and blockchain, including MIT, in 2017. In the same year, Edinburgh became «one of the first big European universities to launch a blockchain course», according to the Financial Times.[163]

Adoption decision

Motivations for adopting blockchain technology (an aspect of innovation adoptation) have been investigated by researchers. For example, Janssen, et al. provided a framework for analysis,[164] and Koens & Poll pointed out that adoption could be heavily driven by non-technical factors.[165] Based on behavioral models, Li[166] has discussed the differences between adoption at the individual level and organizational levels.

Collaboration

Scholars in business and management have started studying the role of blockchains to support collaboration.[167][168] It has been argued that blockchains can foster both cooperation (i.e., prevention of opportunistic behavior) and coordination (i.e., communication and information sharing). Thanks to reliability, transparency, traceability of records, and information immutability, blockchains facilitate collaboration in a way that differs both from the traditional use of contracts and from relational norms. Contrary to contracts, blockchains do not directly rely on the legal system to enforce agreements.[169] In addition, contrary to the use of relational norms, blockchains do not require a trust or direct connections between collaborators.

Blockchain and internal audit

| External video |

|---|

The need for internal audits to provide effective oversight of organizational efficiency will require a change in the way that information is accessed in new formats.[171] Blockchain adoption requires a framework to identify the risk of exposure associated with transactions using blockchain. The Institute of Internal Auditors has identified the need for internal auditors to address this transformational technology. New methods are required to develop audit plans that identify threats and risks. The Internal Audit Foundation study, Blockchain and Internal Audit, assesses these factors.[172] The American Institute of Certified Public Accountants has outlined new roles for auditors as a result of blockchain.[173]

Journals

In September 2015, the first peer-reviewed academic journal dedicated to cryptocurrency and blockchain technology research, Ledger, was announced. The inaugural issue was published in December 2016.[174] The journal covers aspects of mathematics, computer science, engineering, law, economics and philosophy that relate to cryptocurrencies.[175][176] The journal encourages authors to digitally sign a file hash of submitted papers, which are then timestamped into the bitcoin blockchain. Authors are also asked to include a personal bitcoin address on the first page of their papers for non-repudiation purposes.[177]

See also

- Changelog – a record of all notable changes made to a project

- Checklist – an informational aid used to reduce failure

- Economics of digitization

- Privacy and blockchain

- Version control – a record of all changes (mostly of software project) in a form of a graph

References

- ^ Morris, David Z. (15 May 2016). «Leaderless, Blockchain-Based Venture Capital Fund Raises $100 Million, And Counting». Fortune. Archived from the original on 21 May 2016. Retrieved 23 May 2016.

- ^ a b Popper, Nathan (21 May 2016). «A Venture Fund With Plenty of Virtual Capital, but No Capitalist». The New York Times. Archived from the original on 22 May 2016. Retrieved 23 May 2016.

- ^ a b c d e f g h i «Blockchains: The great chain of being sure about things». The Economist. 31 October 2015. Archived from the original on 3 July 2016. Retrieved 18 June 2016.

The technology behind bitcoin lets people who do not know or trust each other build a dependable ledger. This has implications far beyond the crypto currency.

- ^ a b c d e Narayanan, Arvind; Bonneau, Joseph; Felten, Edward; Miller, Andrew; Goldfeder, Steven (2016). Bitcoin and cryptocurrency technologies: a comprehensive introduction. Princeton, New Jersey: Princeton University Press. ISBN 978-0-691-17169-2.

- ^ Iansiti, Marco; Lakhani, Karim R. (January 2017). «The Truth About Blockchain». Harvard Business Review. Cambridge, Massachusetts: Harvard University. Archived from the original on 18 January 2017. Retrieved 17 January 2017.

The technology at the heart of bitcoin and other virtual currencies, blockchain is an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way.

- ^ Oberhaus, Daniel (27 August 2018). «The World’s Oldest Blockchain Has Been Hiding in the New York Times Since 1995». Vice. Retrieved 9 October 2021.

- ^ Lunn, Bernard (10 February 2018). «Blockchain may finally disrupt payments from Micropayments to credit cards to SWIFT». dailyfintech.com. Archived from the original on 27 September 2018. Retrieved 18 November 2018.

- ^ a b c d e Hampton, Nikolai (5 September 2016). «Understanding the blockchain hype: Why much of it is nothing more than snake oil and spin». Computerworld. Archived from the original on 6 September 2016. Retrieved 5 September 2016.

- ^ a b Bakos, Yannis; Halaburda, Hanna; Mueller-Bloch, Christoph (February 2021). «When Permissioned Blockchains Deliver More Decentralization Than Permissionless». Communications of the ACM. 64 (2): 20–22. doi:10.1145/3442371. S2CID 231704491.

- ^ Sherman, Alan T.; Javani, Farid; Zhang, Haibin; Golaszewski, Enis (January 2019). «On the Origins and Variations of Blockchain Technologies». IEEE Security Privacy. 17 (1): 72–77. arXiv:1810.06130. doi:10.1109/MSEC.2019.2893730. ISSN 1558-4046. S2CID 53114747.

- ^ Haber, Stuart; Stornetta, W. Scott (January 1991). «How to time-stamp a digital document». Journal of Cryptology. 3 (2): 99–111. CiteSeerX 10.1.1.46.8740. doi:10.1007/bf00196791. S2CID 14363020.

- ^ Bayer, Dave; Haber, Stuart; Stornetta, W. Scott (March 1992). Improving the Efficiency and Reliability of Digital Time-Stamping. Sequences. Vol. 2. pp. 329–334. CiteSeerX 10.1.1.71.4891. doi:10.1007/978-1-4613-9323-8_24. ISBN 978-1-4613-9325-2.

- ^ Oberhaus, Daniel (27 August 2018). «The World’s Oldest Blockchain Has Been Hiding in the New York Times Since 1995». www.vice.com. Retrieved 9 October 2021.

- ^ Nian, Lam Pak; Chuen, David LEE Kuo (2015). «A Light Touch of Regulation for Virtual Currencies». In Chuen, David LEE Kuo (ed.). Handbook of Digital Currency: Bitcoin, Innovation, Financial Instruments, and Big Data. Academic Press. p. 319. ISBN 978-0-12-802351-8.

- ^ «Blockchain Size». Archived from the original on 19 May 2020. Retrieved 25 February 2020.

- ^ Johnsen, Maria (12 May 2020). Blockchain in Digital Marketing: A New Paradigm of Trust. Maria Johnsen. p. 6. ISBN 979-8-6448-7308-1.

{{cite book}}: CS1 maint: url-status (link) - ^ «The future of blockchain in 8 charts». Raconteur. 27 June 2016. Archived from the original on 2 December 2016. Retrieved 3 December 2016.

- ^ «Hype Killer — Only 1% of Companies Are Using Blockchain, Gartner Reports | Artificial Lawyer». Artificial Lawyer. 4 May 2018. Archived from the original on 22 May 2018. Retrieved 22 May 2018.

- ^ Kasey Panetta. (31 October 2018). «Digital Business: CIO Agenda 2019: Exploit Transformational Technologies.» Gartner website Retrieved 27 March 2021.

- ^ Armstrong, Stephen (7 November 2016). «Move over Bitcoin, the blockchain is only just getting started». Wired. Archived from the original on 8 November 2016. Retrieved 9 November 2016.

- ^ Catalini, Christian; Gans, Joshua S. (23 November 2016). «Some Simple Economics of the Blockchain» (PDF). SSRN. doi:10.2139/ssrn.2874598. hdl:1721.1/130500. S2CID 46904163. SSRN 2874598. Archived (PDF) from the original on 6 March 2020. Retrieved 16 September 2019.

- ^ Tapscott, Don; Tapscott, Alex (8 May 2016). «Here’s Why Blockchains Will Change the World». Fortune. Archived from the original on 13 November 2016. Retrieved 16 November 2016.

- ^ Bheemaiah, Kariappa (January 2015). «Block Chain 2.0: The Renaissance of Money». Wired. Archived from the original on 14 November 2016. Retrieved 13 November 2016.

- ^ Chen, Huashan; Pendleton, Marcus; Njilla, Laurent; Xu, Shouhuai (12 June 2020). «A Survey on Ethereum Systems Security: Vulnerabilities, Attacks, and Defenses». ACM Computing Surveys. 53 (3): 3–4. arXiv:1908.04507. doi:10.1145/3391195. ISSN 0360-0300. S2CID 199551841.

- ^ Shishir, Bhatia (2 February 2006). Structured Information Flow (SIF) Framework for Automating End-to-End Information Flow for Large Organizations (Thesis). Virginia Tech.

- ^ «Genesis Block Definition». Investopedia. Retrieved 10 August 2022.

- ^ a b c d Bhaskar, Nirupama Devi; Chuen, David LEE Kuo (2015). «Bitcoin Mining Technology». Handbook of Digital Currency. pp. 45–65. doi:10.1016/B978-0-12-802117-0.00003-5. ISBN 978-0-12-802117-0.

- ^ Knirsch, Unterweger & Engel 2019, p. 2.

- ^ a b c Antonopoulos, Andreas (20 February 2014). «Bitcoin security model: trust by computation». Radar. O’Reilly. Archived from the original on 31 October 2016. Retrieved 19 November 2016.

- ^ a b Antonopoulos, Andreas M. (2014). Mastering Bitcoin. Unlocking Digital Cryptocurrencies. Sebastopol, CA: O’Reilly Media. ISBN 978-1449374037. Archived from the original on 1 December 2016. Retrieved 3 November 2015.

- ^ Nakamoto, Satoshi (October 2008). «Bitcoin: A Peer-to-Peer Electronic Cash System» (PDF). bitcoin.org. Archived (PDF) from the original on 20 March 2014. Retrieved 28 April 2014.

- ^ «Permissioned Blockchains». Explainer. Monax. Archived from the original on 20 November 2016. Retrieved 20 November 2016.

- ^ Kumar, Randhir; Tripathi, Rakesh (November 2019). «Implementation of Distributed File Storage and Access Framework using IPFS and Blockchain». 2019 Fifth International Conference on Image Information Processing (ICIIP). IEEE: 246–251. doi:10.1109/iciip47207.2019.8985677. ISBN 978-1-7281-0899-5. S2CID 211119043.

- ^ Lee, Timothy (12 March 2013). «Major glitch in Bitcoin network sparks sell-off; price temporarily falls 23%». Arstechnica. Archived from the original on 20 April 2013. Retrieved 25 February 2018.

- ^ Smith, Oli (21 January 2018). «Bitcoin price RIVAL: Cryptocurrency ‘faster than bitcoin’ will CHALLENGE market leaders». Express. Retrieved 6 April 2021.

- ^ «Bitcoin split in two, here’s what that means». CNN. 1 August 2017. Retrieved 7 April 2021.

- ^ Hughes, Laurie; Dwivedi, Yogesh K.; Misra, Santosh K.; Rana, Nripendra P.; Raghavan, Vishnupriya; Akella, Viswanadh (December 2019). «Blockchain research, practice and policy: Applications, benefits, limitations, emerging research themes and research agenda». International Journal of Information Management. 49: 114–129. doi:10.1016/j.ijinfomgt.2019.02.005. hdl:10454/17473. S2CID 116666889.

- ^ Roberts, Jeff John (29 May 2018). «Bitcoin Spinoff Hacked in Rare ‘51% Attack’«. Fortune. Archived from the original on 22 December 2021. Retrieved 27 December 2022.

- ^ a b Brito, Jerry; Castillo, Andrea (2013). Bitcoin: A Primer for Policymakers (PDF) (Report). Fairfax, VA: Mercatus Center, George Mason University. Archived (PDF) from the original on 21 September 2013. Retrieved 22 October 2013.

- ^ Raval, Siraj (2016). Decentralized Applications: Harnessing Bitcoin’s Blockchain Technology. O’Reilly Media, Inc. pp. 1–2. ISBN 978-1-4919-2452-5.

- ^ Kopfstein, Janus (12 December 2013). «The Mission to Decentralize the Internet». The New Yorker. Archived from the original on 31 December 2014. Retrieved 30 December 2014.

The network’s ‘nodes’ — users running the bitcoin software on their computers — collectively check the integrity of other nodes to ensure that no one spends the same coins twice. All transactions are published on a shared public ledger, called the ‘block chain.’

- ^ Gervais, Arthur; Karame, Ghassan O.; Capkun, Vedran; Capkun, Srdjan. «Is Bitcoin a Decentralized Currency?». InfoQ. InfoQ & IEEE computer society. Archived from the original on 10 October 2016. Retrieved 11 October 2016.

- ^ a b c Deirmentzoglou, Evangelos; Papakyriakopoulos, Georgios; Patsakis, Constantinos (2019). «A Survey on Long-Range Attacks for Proof of Stake Protocols». IEEE Access. 7: 28712–28725. doi:10.1109/ACCESS.2019.2901858. eISSN 2169-3536. S2CID 84185792.

- ^ a b Voorhees, Erik (30 October 2015). «It’s All About the Blockchain». Money and State. Archived from the original on 1 November 2015. Retrieved 2 November 2015.

- ^ Reutzel, Bailey (13 July 2015). «A Very Public Conflict Over Private Blockchains». PaymentsSource. New York, NY: SourceMedia, Inc. Archived from the original on 21 April 2016. Retrieved 18 June 2016.

- ^ a b Casey MJ (15 April 2015). «Moneybeat/BitBeat: Blockchains Without Coins Stir Tensions in Bitcoin Community». The Wall Street Journal. Archived from the original on 10 June 2016. Retrieved 18 June 2016.

- ^ «The ‘Blockchain Technology’ Bandwagon Has A Lesson Left To Learn». dinbits.com. 3 November 2015. Archived from the original on 29 June 2016. Retrieved 18 June 2016.

- ^ DeRose, Chris (26 June 2015). «Why the Bitcoin Blockchain Beats Out Competitors». American Banker. Archived from the original on 30 March 2016. Retrieved 18 June 2016.

- ^ Greenspan, Gideon (19 July 2015). «Ending the bitcoin vs blockchain debate». multichain.com. Archived from the original on 8 June 2016. Retrieved 18 June 2016.

- ^ Tapscott, Don; Tapscott, Alex (May 2016). The Blockchain Revolution: How the Technology Behind Bitcoin is Changing Money, Business, and the World. ISBN 978-0-670-06997-2.

- ^ Barry, Levine (11 June 2018). «A new report bursts the blockchain bubble». MarTech. Archived from the original on 13 July 2018. Retrieved 13 July 2018.