Давайте раз и навсегда закроем вопрос о том, как правильно писать валюты.

Вот рубль по-русски можно написать такими вариантами: руб., р., ₽, RUB, RUR.

А вот варианты с долларами: доллары, $, USD.

Так какой вариант выбрать? А как писать: в начале или в конце? А пробел нужен?

Лебедев в своем «Ководстве» пишет:

Как бы соблазнительно ни выглядел доллар слева от суммы, писать его в русских текстах можно только справа. (Исключение могут составлять финансовые и биржевые тексты, но это отраслевой стандарт, который не может распространяться на остальные области.)

Артемий Лебедев

Так же он отмечает:

В русском языке единица измерения, стоящая перед значением, означает примерно столько: «долларов сто». А не писать пробел перед знаком доллара, это все равно что писать 50руб.

Артемий Лебевев

Илья Бирман с этим не согласился.

Лебедев не понимает, что $ — это знак, а не сокращение. Когда написано «$100» я это читаю «сто долларов», и мне нисколько не мешает, что знак $ стоит перед числом. И ни одному человеку в мире это не мешает. Знак доллара всегда и везде ставятся перед числом, и без пробела; <…>

Илья Бирман

Потом, однако, признал в этом свою неправоту.

Есть очень много ясности в вопросах использования. И много темных мест.

Я много времени проработал дизайнером финансовых продуктов и теперь точно знаю, как надо.

Однозначные символы: $, ¥, ₽, €, ₣, £, ₩,…

Это все типографские символы. Лигатуры. Они входят в Стандарт Юникод, но не стандартизированы в ISO по правилам их использования.

Символы валют очень популярны, вы встретите их везде: на ценниках, в банковских приложениях, в общих и тематических статьях.

Однозначные символы нативны. Часто, они изображены на самих купюрах. Люди их быстро узнают и легко считывают. А значок доллара вообще равен значку денег.

Много, однако, неясностей.

Где писать?

Непонятно где их ставить, в начале или в конце? Лебедев топит за то, что нужно писать в конце, якобы в России у нас так. А если это международный сервис? Например, интернет-магазин, локализованный на разных языках. На русском писать так, а на английском по-другому?

Пробел нужен?

В США пишут без пробела $100 (хотя тоже не всегда). У нас символ ₽ намекает на то, что это единица изменения, хотя это спорно. По системе СИ единица изменения пишется через пробел и точка в конце не ставится.

Чей доллар?

Мало кто знает, но доллар – это название валюты очень многих стран. Не только США. Есть например, австралийский доллар, канадский, либерийский, доллар Намибии и еще пару десятков стран. Все они обозначаются символом $.

А еще есть аргентинское песо, боливийский боливиано, бразильский реал, кабо-вердийский эскудо и еще много валют, которые вообще не доллары, но обозначаются значком $.

Как тут быть, если в одной системе я использую сразу несколько из этих валют? Как их различать между собой?

Боливиец живет в своей стране, заходит в магазин, видит ценники и понимает, что условно, хлеб за 10 $ – это значит хлеб за десять боливийский боливиано.

А что случается, когда он заходит на брокерскую биржу, где целая система разных международных валют?

Символ?

Вообще не у всех валют есть однозначные символы. Их очень мало. Все, что есть в заголовке этого раздела и еще пару символов, этим наверное и ограничится. Если вы знаете еще какие-нибудь символы, напишите, пожалуйста, в комментарии.

Большая часть валют вообще не использует лигатуры: арабский дирхам, бахрейнский динар, белорусский рубль, венгерский форинт.

А даже если есть, то не факт, что они будут в Юникоде. А даже если есть в Юникоде, то не факт, что они будут в гарнитуре, которую вы используете в своем проекте. Попробуйте, например в Фигме ввести символ армянского драма ֏ на разных гарнитурах.

Как вводить?

На Windows все зависит от клавиатуры, с которой вы вводите. На клавиатуре Apple с русской раскладкой символ ₽ доступен по Alt + р.

Значок доллара тоже $ доступен, но не просто. На Mac OS, например нужно переключиться на английскую раскладку и потом Shift + 4. Со значком евро еще сложнее: на английской раскладке Shif + Alt + 4.

Остальные символы не доступны на клавиатурах, поэтому их придется гуглить.

Многозначные коды: USD, RUB, BTC, ETH, …

Коды валют стандартизированы в ISO 4217 и все они трехзначные. Вроде все круто, есть международный стандарт, будем его придерживаться. Но и здесь есть непонятные места.

Проблема в том, что этот стандарт не учитывает валюты непризнанных государств, типа приднестровского рубля RUP или абхазского апсара LTU. А в целом на этой можно закрыть глаза

Так же в этом стандарте нет криптовалют. Тоже можно закрыть глаза. Но криптовалют много. На сегодняшний день их более 18-ти тысяч, а количество комбинаций их трехзначных символов латинского алфавита составляет 17576. Поэтому очень много криптовалют используют четыре знака: FLOW, USDT, MANA, NEXO.

Где писать?

Все просто. Стандарт ISO 4217 не регламентирует с какой стороны от числа нужно писать код валюты, мол, придерживайтесь тех традиций, которые установлены в вашей системе.

Пробел?

Пробел точно ставится в любом случае.

Сокращения: руб., р., дол., …

В сокращенной англоязычной культуре не приняты сокращения (хотя раньше сокращали).

В России мы чаще всего видим именно сокращения р. или руб. вместо ₽.

Пробел и точка?

Пробел в русском языке обязательно.

Точка нужна, так как это не единица измерения, а сокращение слова «рубль».

Решение

Решение опубликую завтра утром. А пока что подпишитесь, пожалуйста на мой телеграм-канал.

«$» — ОДИН ИЗ САМЫХ УЗНАВАЕМЫХ СИМВОЛОВ СОВРЕМЕННОСТИ, большинство людей безошибочно идентифицируют «S» с одной или двумя вертикальными «палочками» как знак доллара. Доллар – основная денежная единица не только США, но и во многих других странах, — поэтому знак доллара «$» используется для обозначения не только американского доллара, но и валют прочих стран с добавлением к основному символу дополнительных букв, указывающих на принадлежность тому или иному государству: к примеру Тринидад и Тобаго – ТТ$, Барбадос – Bds$, Австралия – А$ или Au$, и так далее.

Почему же именно «S» стала основой для обозначения американской валюты, ведь в слове «доллар» даже нет такой буквы? Дело в том, что изначально «$» — знак не доллара, а песо.

Далее немного истории.

В восьми странах(Аргентина, Чили, Колумбия, Куба, Доминиканская Республика, Мексика, Филиппины и Уругвай) денежные знаки называются песо

История слова «доллар» началась в XVI-м веке в Чехии. Европа тогда впервые за долгое время стала богата серебром. Столетиями европейцы тратили золото и серебро на покупку шёлка, пряностей и другой экзотической роскоши, в результате чего запасы драгоценных металлов в Старом Свете порядком истощились. В начале XVI-го века в Тироле, Саксонии (в настоящее время — области Австрии и Германии) и Богемии (современная Чехия) обнаружились довольно большие залежи серебряной руды и серебряные монеты начали активно вытеснять из обращения золотые. «Йоахимсталер». Так назвалась монета шестнадцатого века, которая чеканилась возле шахты серебряной руды в чешском городе Йоахимстале.

Богемские йохимсталеры стали эталоном в чеканке серебряных монет и вскоре сокращённым словом «талер» уже называли любую серебряную валюту. Каждый народ переиначивал чешский термин на свой лад — скажем, голландцы произносили его как «даалдер», в Словении «талер» стал «толаром». В Дании из-за особенностей произношения монета называлась уже «далер».

В Великобритании несколько позже название трансформировалось в более созвучное и современное «доллар». Так, в Англии 17-18 веков «долларами» назывались любые похожие на талер серебрянные монеты – и уже в «Макбете» Шекспира можно найти упоминание о них:

Король Норвежский, мира запросил,

Но прежде, чем предать земле убитых,

Ему пришлось на острове Сент-Кольм

Нам десять тысяч долларов вручить…

Когда Испания начала активно осваивать богатства Нового Света, европейские месторождения драгметаллов утратили своё былое значение, на следующие несколько сотен лет «серебряный центр» мира переместился в Боливию, Перу и Мексику. Реалы, их ещё называли «испанскими долларами» или «peso de ocho» (англ. «piece of eight» — восьмая часть, «осьмушка», каждый реал стоил 1/8 английского фунта), отчеканенные из «индейского» серебра заполонили Европу и постепенно вытеснили с рынка талеры, став основной международной валютой. Чтобы понять, насколько велико было влияние испанских денег на культуру и экономику того времени, обратите внимание на названия некоторых современных национальных валют.

В восьми странах (Аргентина, Чили, Колумбия, Куба, Доминиканская Республика, Мексика, Филиппины и Уругвай) денежные знаки называются песо. Китайские юани и японские иены получили свои названия в честь формы испанских монет (кит. «юань» — круглый) — Япония и Китай взяли их за основу при создании своих денег. Риялы, которыми рассчитываются в Саудовской Аравии и катарские риалы также обязаны своими именами испанским реалам. И наконец, главное — когда молодое государство Соединённые Штаты Америки озаботилось чеканкой собственных денег, их назвали «доллар», испанские деньги тогда широко применялись при расчётах внутри страны.

Мы привыкли к обозначению доллара латинской буквой «S», обычно перечеркнутой двумя вертикальными линиями, но иногда и одной. Версия этого знака с одной вертикалью используется в печатных изданиях прессы, так как два тонких штриха намного хуже пропечатываются при использовании мелких кеглей газетных шрифтов.

Но откуда, собственно, взялось такое обозначение доллара? — История происхождения знака и его смысл темны и загадочны. Доллар просуществовал больше двух столетий (американская валюта появилась в 1785 году), и за этот период времени он успел обрасти множеством различных легенд и теорий, некоторые из которых весьма убедительны. Однако доказанной версии не существует, и мы можем лишь, рассмотрев основные предположения историков, склоняться к выбранному варианту.

Варианты начертания знака доллара

Одной из наиболее вероятных версий считают возможное происхождения знака доллара от испанского сокращения «P’s», некогда обозначавшего денежные единицы этого государства — песо или пиастр. От буквы «P» предположительно осталась лишь вертикальная черта, что позволило увеличить скорость записи, а буква «S» осталась неизменной в качестве фона. С другой стороны, в данном случае «S» — второстепенная буква-окончание, так как обозначает лишь множественное число песо. Поэтому кажется не вполне логичным упрощение в бухгалтерских документах буквы «Р», указывающей на конкретную денежную единицу.

Вот пишут даже, что в 1778 — нью-орлеанский бизнесмен Оливер Поллок придумал знак доллара. Считается, что первоначальный смысл значка $ связан с обозначением испанских пиастров, активно использовавшихся в Америке тех лет. В деловых бумагах пиастры традиционно сокращались до сочетания латинских букв PS, наложение которых одна на другую и давало используемый ныне знак.

Другая версия гласит, что буква «S» — это первая буква слова «Spain» (Испания). Такая точка зрения подкрепляется тем фактом, что «S» ставили на слитках золота, вывозимых из испанских колоний Нового Света. При отправке слитков в Испанию на них якобы наносили вертикальную черту, а после прибытия добавляли ещё одну для контроля за происхождением золота.

Серебряный реал Потоси: символ $ — монограмма из букв PTSI (Potosi)

Некоторые эксперты Штатов полагают, что истоком возникновения знака «$» послужило сокращение «PTSI» — так маркировалось серебро из боливийских рудников Потоси (крупнейшего мирового промышленного центра 16-17 столетий), которое шло на чеканку монет в песо с 1573 года по 1825 год. Эти монеты находились в обращении у североамериканских колоний Великобритании.

Перечеркнутая «$» может с тем же успехом быть остатками перечеркнутой восьмерки, — ведь некогда в Северной Америке были широко использованы испанские реалы для денежных расчетов. Они весили, и соответственно стоили одну восьмую английского фунта стерлингов, на письме обозначаясь как «1/8» -и потому их называли «piece of eight» («восьмушки»). Тогда второе перечёркивание могло происходить от европейской традиции переписчиков обозначать таким образом сокращения.

«Королевская» версия утверждает, что знак доллара – ни что иное, как стилизованный герб испанской королевской семьи, поскольку в 1492 году король Фердинанд II Арагонский избрал в качестве символа Геркулесовы столпы (Columnae Herculis) — так в античности называли скалы, обрамляющие вход в Гибралтарский пролив (Гибралтарская скала, Северная скала, гора Джебель-Муса в Марокко и гора Абила возле Сеуты). Символические Геркулесовы столпы обвивает лента с девизом «Non plus ultra» («не дальше» — имеется в виду «…пределов мира»). Однако с открытием новых земель за Гибралтаром Колумбом, девиз видоизменился на «Plus ultra», то есть «ещё дальше». Этот девиз избрал император Карл V, а когда в Мексике и Перу обнаружили крупнейшие серебряные рудники, символ «$» начал чеканиться на монетах Нового Света, которые широко обращались и в Европе.

Обвитые лентой Геркулесовы столбы (муниципалитет Севильи,Испания, XVI век)

Еще одна популярная версия говорит о том, чтосимвол доллара появился благодаря Соединенным Штатам Америки (сдается мне, что и версия-то эта придумана самими американцами). На английском языке название звучит как United States of Ameriсa (сокращенно — USA). Так вот, эта версия утверждает, что символ производен от названия американского государства на английском языке. При этом осуществляется смещение двух первых букв и (U и S), а часть буквы U изменилась: исчезла нижняя часть буквы, а остались только две вертикальные палочки, которые в сочетании с буквой S и дали символ национальной валюте страны. Слишком попахивает неподдельным патриотизмом. Эту версию пропагандировала американская писательница Айн Ренд.

«Серебряная» версия похожа на предыдущую упрощением буквы «U», однако согласно ей буквы «U» и «S» являются сокращением от «Silver Unit» («Серебряное объединение»).

Нельзя исключить также версию происхождения знака от обозначения древнеримской денежной единицы сестерций — sestertius от semis+tertius (полтретья, два с половиной), серебряная монета достоинством в два с половиной фунта меди. Сестерций обозначался буквами «LLS» или «IIS», иногда «HS». Эта аббревиатура расшифровывается так: «Libra-Libra-Semis», — то есть: «Фунт-Фунт-Половина». При сокращённом написании две буквы «L» с усечённой нижней поперечной чёрточкой накладывались на букву «S» и получался как бы знак доллара. Именно так обозначалась на письме денежная единица сестерций в Древнем Риме. Древнеримская тема была очень модной в эпоху Просвещения. Так, например, место расположения Конгресса США называется Капитолием (главный холм в Риме), а верхняя палата Конгресса США называетсяСенатом — так же, как в Древнем Риме.

Религиозная версия объясняет поисхождение знака от видоизмененного реверса австрийского талера с изображением распятого Иисуса и змеи, обвивающей крест. Масонская же версия, близкая поклонникам теории заговоров и тайных обществ, гласит: символ «$» является обозначением Храма царя Соломона (начальная буква от «Solomon» и две колонны).

Но истина может быть намного более тривиальной и находиться буквально у нас под носом: знак доллара мог быть выведен от… шиллинга, который обозначается буквой «S», которую иногда «подкрепляют» вертикальной чертой.

Что же касается международного порядка написания перед денежной суммой знака долара – то это традиция, которую американцы унаследовали от англичан – последние всегда ставили знак фунта непосредственно перед числом.

Какую версию мы забыли ? Дополняйте !

[источники]

источники

http://origin.iknowit.ru/paper1238.html

http://www.factroom.ru/world/dollar-sign

http://ria.ru/spravka/20080401/102641988.html

http://ru.wikipedia.org/wiki/%D0%A1%D0%B8%D0%BC%D0%B2%D0%BE%D0%BB_%D0%B4%D0%BE%D0%BB%D0%BB%D0%B0%D1%80%D0%B0

А вот например вашему вниманию 16 версий происхождения слова «Окей» или почему Почему американцев называют «пиндосами«. Посмотрите еще на Гибель «Америки» и узнайте про Мустанга как заблуждение. Ну и как же без этого — Официальная и тайная истории ФРС

Оригинал статьи находится на сайте ИнфоГлаз.рф Ссылка на статью, с которой сделана эта копия — http://infoglaz.ru/?p=59340

$

Символ (знак) доллара ($) — символ, обозначающий доллар, песо, эскудо и некоторые другие валюты различных стран, из которых наиболее известной является доллар США. В испаноязычных странах также называется цифрао или знаком песо. Написание знака доллара в русской типографике может варьировать в зависимости от контекста: в финансовых документах, деловой прессе и биржевых сводках он обычно пишется перед цифрами и без пробела ($100), в текстах более свободного стиля может использоваться после числа и отделяться пробелом (100 $).[1][2]

Содержание

- 1 История происхождения

- 1.1 Герб испанской короны Non plus ultra, 1492

- 1.2 Монеты Потоси

- 1.3 Испанский доллар

- 1.4 Римский сестерций

- 1.5 Аббревиатура «песо»

- 2 Область применения и способы использования

- 2.1 Использование одного и двух вертикальных штрихов

- 2.2 Цифрао (цифрано)

- 2.3 Альтернативные варианты использования символа

- 3 Валюты, обозначаемые символом $

- 4 Комментарии

- 5 Примечания

- 6 Ссылки

История происхождения

Изображение $

Есть несколько версий происхождения символа доллара, но доказанной не существует.

Герб испанской короны Non plus ultra, 1492

В 1492 году король Арагона Фердинанд II в качестве символа выбрал Геркулесовы столпы с вьющейся лентой с девизом Non plus ultra, что значит «не дальше» (пределов мира). Но после открытия Колумбом новых земель за Гибралтаром, появился девиз «Plus ultra» — «ещё дальше», ставший девизом императора Карла V, а с обнаружением крупнейших серебряных рудников в Мексике и Перу, этот символ стали чеканить на новых монетах Нового Света, имевших широкое хождение и в Европе.

Монеты Потоси

Знак, несомненно схожий со знаком доллара, размещался на монетах, чеканившихся с 1573 года по 1825 год в Потоси — крупнейшем мировом промышленном центре XVI—XVII веков[3]. Эти монеты были хорошо известны в североамериканских колониях Великобритании.

Испанский доллар

Одной из распространённых является версия происхождения от испанского герба на мексиканских пиастрах, широко обращавшихся на территории США до начала чеканки собственной монеты в 1794 году. В США эти монеты назывались «испанский доллар». Впервые символ засвидетельствован в деловой корреспонденции между Британской Северной Америкой и Мексикой в 1770-х годах.

Римский сестерций

Нельзя исключить также версию происхождения знака от обозначения древнеримской денежной единицы сестерций — sestertius от semis+tertius (полтрети, два с половиной), серебряная монета достоинством в два с половиной фунта меди. Сестерций обозначался буквами «LLS» или «IIS», иногда «HS». Эта аббревиатура расшифровывается так: «Libra-Libra-Semis», — то есть: «Фунт-Фунт-Половина». При сокращённом написании две буквы «L» с усечённой нижней поперечной чёрточкой накладывались на букву «S» и получался как бы знак доллара. Именно так обозначалась на письме денежная единица сестерций в Древнем Риме. Древнеримская тема была очень модной в эпоху Просвещения. Так, например, место расположения Конгресса США называется Капитолием (главный холм в Риме), а верхняя палата Конгресса США называется Сенатом — так же, как в Древнем Риме.

Аббревиатура «песо»

Существует также версия, что «$» — это ошибочная аббревиатура слова песо — «peso», ps или ps. В конце XVIII века это сокращение пишется слитно и при этом «p» сокращается до вертикальной линии[4][5][6][7].

Область применения и способы использования

Использование одного и двух вертикальных штрихов

Традиционно символ доллара ($) пишется с двумя вертикальными чёрточками, однако в современных компьютерных шрифтах все чаще используется начертание с одной чертой. Но и тот, и другой вариант — это одна графема. В частности, в стандарте Unicode различие между символом доллара с одной и двумя чертами не делается, и обоим вариантам соответствует единый код — U+0024, всё зависит от конкретного шрифта. Немногие исключения, где символ доллара по-прежнему выводится с двумя штрихами,— это такие шрифты, как Bodoni MT, Bradley Hand ITC, Brush Script MT, Chiller, Engravers MT, Forte, Garamond, Gigi, Harrington, Jokerman, Kunstler Script, Magneto, Modern No. 20, Palace Script MT и Rage Italic.

|

|

|

| Знак доллара США с одной чертой | Знак доллара США с двумя чертами |

| Примеры вывода символа $ в различных шрифтах | |||||||

|---|---|---|---|---|---|---|---|

| Blackadder ITC | $ | Bodoni MT | $ | Bradley Hand ITC | $ | Brush Script MT | $ |

| Chiller | $ | Curlz MT | $ | Engravers MT | $ | Forte | $ |

| Garamond | $ | Georgia | $ | Gigi | $ | Goudy Stout | $ |

| Harrington | $ | High Tower Text | $ | Jokerman | $ | Juice ITC | $ |

| Kristen ITC | $ | Kunstler Script | $ | Magneto | $ | Modern No. 20 | $ |

| MS Reference Sans Serif |

$ | OCR A Extended | $ | Old English Text MT | $ | Palace Script MT | $ |

| Rage Italic | $ | Snap ITC talic | $ | Tahoma | $ | Tempus Sans ITC | $ |

Цифрао (цифрано)

|

|

Цифрао или цифрано (Cifrão, Cifrao или cifrano) — особое название для разновидности знака доллара с двумя вертикальными чертами (в печатных источниках может встречаться и с одной чертой, поскольку основные стандарты не делают разницы между символом доллара с одной и двумя чертами), которое используется для обозначения таких валют, как португальский эскудо, эскудо Кабо-Верде, эскудо Восточного (Португальского) Тимора, а также бразильский реал. Символ характеризуется тем, что при записи разделяет основную валюту (эскудо или реал) и разменную монету (сентаво) —

Альтернативные варианты использования символа

Знак доллара ($) также применяется для других целей:

- в языке программирования Бейсик ставится в конце имени строковой переменной или имени функции, возвращающей значение строкового типа;

- в Паскале применяется для записи чисел в 16-ричной системе;

- в PHP, Perl и многих других языках с символа $ начинается имя переменной;

- в языке TCL обозначает значение переменной;

- в табличных процессорах, например, OpenOffice.org Calc и Microsoft Excel используется для указания неизменяемой ячейки в формуле;

- в регулярных выражениях обозначает конец строки;

- в языке ассемблера (AT&T-синтаксис) указывает на числовое значение константы;

- в некоторых других случаях используется как указатель на служебные переменные.

Валюты, обозначаемые символом $

Основная статья: Знаки валют (список)

Символом $ (с одной или двумя вертикальными черточками) могут обозначаться такие валюты, как доллар, песо (кроме филиппинского, имеющего собственный символ), эскудо (их символ имеет специальное название — цифрао или цифрано), реал, кордоба и некоторые другие. При этом выбор числа чёрточек для каждой конкретной валюты чаще продиктован не столько традицией использования символа в данной стране, сколько подручными или наиболее распространенными шрифтами, где всё чаще символ доллара изображён с одной вертикальной чертой.

Список валют, обозначаемых символом $

Комментарии

- ↑ Официальная страница стандарта ISO 4217. См. также Общероссийский классификатор валют ОК (МК (ИСО 4217) 003-97) 014—2000 (утв. Постановлением Госстандарта РФ от 25.12.2000 № 405-ст) (ред. от 01.11.2009) (с изм. и доп., вступающими в силу с 01.01.2010). Для существующих валют код приводится по текущей версии стандарта ISO 4217, для исторических — код, указанный в предыдущих версиях стандарта

- ↑ Знаки валют в данной колонке приводятся в соответствии с источниками, указанными в статье Знаки валют (список), а именно: данными Конвертера валют Yahoo! (Currency Converter Yahoo!Finance), настройками по умолчанию денежного формата ячейки в электронных таблицах Microsoft Excel (версия 14.0.4536.1000), Google Docs (на 01.06.2010 г.), Lotus Symphony (Beta 3, Release 3.0.0), изображениями на монетах, банкнотах, почтовых марках, а также в документах на сайтах центральных банков стран-эмитентов соответствующих валют

- ↑

Ангилья •

Антигуа и Барбуда •

Гренада •

Доминика •

Монтсеррат •

Сент-Винсент и Гренадины •

Сент-Китс и Невис •

Сент-Люсия

Примечания

- ↑ ГРАМОТА.РУ — справочно-информационный интернет-портал «Русский язык» | Справка | Справочное бюро

- ↑ § 74. Доллар куда будем ставить? «Ководство. Параграфы о дизайне».

- ↑ http://www.carlclegg.com/pillars/potosi.html

- ↑ Cajori, Florian ([1929]1993). A History of Mathematical Notations (Vol. 2). Nueva York: Dover, pp. 15-29.

- ↑ Moreno, Alvaro J. (1965). El signo de pesos: cuál es su origen y qué representa? México: Alvaro J. Moreno.

- ↑ Riesco Terrero, Ángel (1983). Diccionario de abreviaturas hispanas de los siglos XIII al XVIII: Con un apendice de expresiones y formulas juridico-diplomaticas de uso corriente. Salamanca: Imprenta Varona, p. 350. ISBN 84-300-9090-8

- ↑ «Origin of the $ Sign» Agencia de Grabado e Imprenta del Departamento del Tesoro de Estados Unidos.

- ↑ Unicode, версия 5.2, раздел «Символы валют» (20A0—20CF)

Ссылки

- 230 лет назад появился знак доллара

- Доллар куда будем ставить?

| |

|

|---|---|

| Статьи о символах | Знак валюты · Символ денария · Символ доллара · Символ драма · Символ драхмы · Символ евро · Символ иены (юаня) · Символ риала · Символ рубля · Символ рупии · Символ франка · Символ фунта (лиры) |

| Существующие валюты | ฿ · |

| Исторические валюты | ₳ · ₢ · $ · ₯ · ₶ · ₷ · ₠ · ƒ · ₣ · L (₤) · Lm · ₧ · I/. · Kčs · Sk |

| Разменные денежные единицы | ¢ · ₥ · ₰ · р (d) · a · де · ко |

| Античные денежные единицы |

Древний Рим:

Wikimedia Foundation.

Игры ⚽ Нужно решить контрольную?

Полезное

|

One-dollar bill (obverse) |

|

| ISO 4217 | |

|---|---|

| Code | USD (numeric: 840) |

| Subunit | 0.01 |

| Unit | |

| Symbol | $, US$, U$ |

| Nickname |

List

|

| Denominations | |

| Superunit | |

| 10 | Eagle |

| Subunit | |

| 1⁄10 | Dime |

| 1⁄100 | Cent |

| 1⁄1000 | Mill |

| Symbol | |

| Cent | ¢ |

| Mill | ₥ |

| Banknotes | |

| Freq. used | $1, $5, $10, $20, $50, $100 |

| Rarely used | $2 (still printed); $500, $1,000, $5,000, $10,000 (discontinued, still legal tender) |

| Coins | |

| Freq. used | 1¢, 5¢, 10¢, 25¢ |

| Rarely used | 50¢, $1 (still minted); 1⁄2¢ 2¢, 3¢, 20¢, $2.50, $3, $5, $10, $20 (discontinued, still legal tender) |

| Demographics | |

| Date of introduction | April 2, 1792; 230 years ago[1] |

| Replaced | Continental currency Various foreign currencies, including: Pound sterling Spanish dollar |

| User(s) | see § Formal (11), § Informal (11) |

| Issuance | |

| Central bank | Federal Reserve |

| Website | federalreserve.gov |

| Printer | Bureau of Engraving and Printing |

| Mint | United States Mint |

| Website | usmint.gov |

| Valuation | |

| Inflation | 6.4% |

| Source | BLS, January 2023 |

| Method | CPI |

| Pegged by | see § Pegged currencies |

The United States dollar (symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color.

The monetary policy of the United States is conducted by the Federal Reserve System, which acts as the nation’s central bank.

The U.S. dollar was originally defined under a bimetallic standard of 371.25 grains (24.057 g) (0.7735 troy ounces) fine silver or, from 1837, 23.22 grains (1.505 g) fine gold, or $20.67 per troy ounce. The Gold Standard Act of 1900 linked the dollar solely to gold. From 1934, its equivalence to gold was revised to $35 per troy ounce. Since 1971, all links to gold have been repealed.[2]

The U.S. dollar became an important international reserve currency after the First World War, and displaced the pound sterling as the world’s primary reserve currency by the Bretton Woods Agreement towards the end of the Second World War. The dollar is the most widely used currency in international transactions,[3] and a free-floating currency. It is also the official currency in several countries and the de facto currency in many others,[4][5] with Federal Reserve Notes (and, in a few cases, U.S. coins) used in circulation.

As of February 10, 2021, currency in circulation amounted to US$2.10 trillion, $2.05 trillion of which is in Federal Reserve Notes (the remaining $50 billion is in the form of coins and older-style United States Notes).[6]

Overview[edit]

In the Constitution[edit]

Article I, Section 8 of the U.S. Constitution provides that Congress has the power «[t]o coin money.»[7] Laws implementing this power are currently codified in Title 31 of the U.S. Code, under Section 5112, which prescribes the forms in which the United States dollars should be issued.[8] These coins are both designated in the section as «legal tender» in payment of debts.[8] The Sacagawea dollar is one example of the copper alloy dollar, in contrast to the American Silver Eagle which is pure silver. Section 5112 also provides for the minting and issuance of other coins, which have values ranging from one cent (U.S. Penny) to 100 dollars.[8] These other coins are more fully described in Coins of the United States dollar.

Article I, Section 9 of the Constitution provides that «a regular Statement and Account of the Receipts and Expenditures of all public Money shall be published from time to time,»[9] which is further specified by Section 331 of Title 31 of the U.S. Code.[10] The sums of money reported in the «Statements» are currently expressed in U.S. dollars, thus the U.S. dollar may be described as the unit of account of the United States.[11] «Dollar» is one of the first words of Section 9, in which the term refers to the Spanish milled dollar, or the coin worth eight Spanish reales.

The Coinage Act[edit]

In 1792, the U.S. Congress passed the Coinage Act, of which Section 9 authorized the production of various coins, including:[12]: 248

Dollars or Units—each to be of the value of a Spanish milled dollar as the same is now current, and to contain three hundred and seventy-one grains and four sixteenth parts of a grain of pure, or four hundred and sixteen grains of standard silver.

Section 20 of the Act designates the United States dollar as the unit of currency of the United States:[12]: 250–1

[T]he money of account of the United States shall be expressed in dollars, or units…and that all accounts in the public offices and all proceedings in the courts of the United States shall be kept and had in conformity to this regulation.

Decimal units[edit]

Unlike the Spanish milled dollar, the Continental Congress and the Coinage Act prescribed a decimal system of units to go with the unit dollar, as follows:[13][14] the mill, or one-thousandth of a dollar; the cent, or one-hundredth of a dollar; the dime, or one-tenth of a dollar; and the eagle, or ten dollars. The current relevance of these units:

- Only the cent (¢) is used as everyday division of the dollar.

- The dime is used solely as the name of the coin with the value of 10 cents.

- The mill (₥) is relatively unknown, but before the mid-20th century was familiarly used in matters of sales taxes, as well as gasoline prices, which are usually in the form of $ΧΧ.ΧΧ9 per gallon (e.g., $3.599, commonly written as $3.59+9⁄10).[15][16]

- The eagle is also largely unknown to the general public.[16] This term was used in the Coinage Act of 1792 for the denomination of ten dollars, and subsequently was used in naming gold coins.

The Spanish peso or dollar was historically divided into eight reales (colloquially, bits) – hence pieces of eight. Americans also learned counting in non-decimal bits of 12+1⁄2 cents before 1857 when Mexican bits were more frequently encountered than American cents; in fact this practice survived in New York Stock Exchange quotations until 2001.[17][18]

In 1854, Secretary of the Treasury James Guthrie proposed creating $100, $50, and $25 gold coins, to be referred to as a union, half union, and quarter union, respectively,[19] thus implying a denomination of 1 Union = $100. However, no such coins were ever struck, and only patterns for the $50 half union exist.

When currently issued in circulating form, denominations less than or equal to a dollar are emitted as U.S. coins, while denominations greater than or equal to a dollar are emitted as Federal Reserve Notes, disregarding these special cases:

- Gold coins issued for circulation until the 1930s, up to the value of $20 (known as the double eagle)

- Bullion or commemorative gold, silver, platinum, and palladium coins valued up to $100 as legal tender (though worth far more as bullion).

- Civil War paper currency issue in denominations below $1, i.e. fractional currency, sometimes pejoratively referred to as shinplasters.

Etymology[edit]

Further information: Dollar

In the 16th century, Count Hieronymus Schlick of Bohemia began minting coins known as joachimstalers, named for Joachimstal, the valley in which the silver was mined. In turn, the valley’s name is titled after Saint Joachim, whereby thal or tal, a cognate of the English word dale, is German for ‘valley.’[20] The joachimstaler was later shortened to the German taler, a word that eventually found its way into many languages, including:[20]

tolar (Czech, Slovak and Slovenian); daler (Danish and Swedish);

dalar and daler (Norwegian); daler or daalder (Dutch);

talari (Ethiopian);

tallér (Hungarian);

tallero (Italian);

دولار (Arabic); and dollar (English).

Though the Dutch pioneered in modern-day New York in the 17th century the use and the counting of money in silver dollars in the form of German-Dutch reichsthalers and native Dutch leeuwendaalders (‘lion dollars’), it was the ubiquitous Spanish American eight-real coin which became exclusively known as the dollar since the 18th century.[21]

Nicknames[edit]

The colloquialism buck(s) (much like the British quid for the pound sterling) is often used to refer to dollars of various nations, including the U.S. dollar. This term, dating to the 18th century, may have originated with the colonial leather trade, or it may also have originated from a poker term.[22]

Greenback is another nickname, originally applied specifically to the 19th-century Demand Note dollars, which were printed black and green on the backside, created by Abraham Lincoln to finance the North for the Civil War.[23] It is still used to refer to the U.S. dollar (but not to the dollars of other countries). The term greenback is also used by the financial press in other countries, such as

Australia,[24] New Zealand,[25] South Africa,[26] and India.[27]

Other well-known names of the dollar as a whole in denominations include greenmail, green, and dead presidents, the latter of which referring to the deceased presidents pictured on most bills. Dollars in general have also been known as bones (e.g. «twenty bones» = $20). The newer designs, with portraits displayed in the main body of the obverse (rather than in cameo insets), upon paper color-coded by denomination, are sometimes referred to as bigface notes or Monopoly money.[citation needed]

Piastre was the original French word for the U.S. dollar, used for example in the French text of the Louisiana Purchase. Though the U.S. dollar is called dollar in Modern French, the term piastre is still used among the speakers of Cajun French and New England French, as well as speakers in Haiti and other French-speaking Caribbean islands.

Nicknames specific to denomination:

- The quarter dollar coin is known as two bits, betraying the dollar’s origins as the «piece of eight» (bits or reales).[17]

- The $1 bill is nicknamed buck or single.

- The infrequently-used $2 bill is sometimes called deuce, Tom, or Jefferson (after Thomas Jefferson).

- The $5 bill is sometimes called Lincoln, fin, fiver, or five-spot.

- The $10 bill is sometimes called sawbuck, ten-spot, or Hamilton (after Alexander Hamilton).

- The $20 bill is sometimes called double sawbuck, Jackson (after Andrew Jackson), or double eagle.

- The $50 bill is sometimes called a yardstick, or a grant, after President Ulysses S. Grant.

- The $100 bill is called Benjamin, Benji, Ben, or Franklin, referring to its portrait of Benjamin Franklin. Other nicknames include C-note (C being the Roman numeral for 100), century note, or bill (e.g. two bills = $200).

- Amounts or multiples of $1,000 are sometimes called grand in colloquial speech, abbreviated in written form to G, K, or k (from kilo; e.g. $10k = $10,000). Likewise, a large or stack can also refer to a multiple of $1,000 (e.g. «fifty large» = $50,000).

Dollar sign[edit]

The symbol $, usually written before the numerical amount, is used for the U.S. dollar (as well as for many other currencies). The sign was the result of a late 18th-century evolution of the scribal abbreviation ps for the peso, the common name for the Spanish dollars that were in wide circulation in the New World from the 16th to the 19th centuries. The p and the s eventually came to be written over each other giving rise to $.[28][29][30][31]

Another popular explanation is that it is derived from the Pillars of Hercules on the Spanish Coat of arms of the Spanish dollar. These Pillars of Hercules on the silver Spanish dollar coins take the form of two vertical bars (||) and a swinging cloth band in the shape of an S.[citation needed]

Yet another explanation suggests that the dollar sign was formed from the capital letters U and S written or printed one on top of the other. This theory, popularized by novelist Ayn Rand in Atlas Shrugged,[32] does not consider the fact that the symbol was already in use before the formation of the United States.[33]

History[edit]

Origins: the Spanish dollar[edit]

The U.S. dollar was introduced at par with the Spanish-American silver dollar (or Spanish peso, Spanish milled dollar, eight-real coin, piece-of-eight). The latter was produced from the rich silver mine output of Spanish America; minted in Mexico City, Potosí (Bolivia), Lima (Peru) and elsewhere; and was in wide circulation throughout the Americas, Asia and Europe from the 16th to 19th centuries. The minting of machine-milled Spanish dollars since 1732 boosted its worldwide reputation as a trade coin and positioned it to be model for the new currency of the United States.

Even after the United States Mint commenced issuing coins in 1792, locally minted dollars and cents were less abundant in circulation than Spanish American pesos and reales; hence Spanish, Mexican and American dollars all remained legal tender in the United States until the Coinage Act of 1857. In particular, Colonists’ familiarity with the Spanish two-real quarter peso was the reason for issuing a quasi-decimal 25-cent quarter dollar coin rather than a 20-cent coin.

For the relationship between the Spanish dollar and the individual state colonial currencies, see Connecticut pound, Delaware pound, Georgia pound, Maryland pound, Massachusetts pound, New Hampshire pound, New Jersey pound, New York pound, North Carolina pound, Pennsylvania pound, Rhode Island pound, South Carolina pound, and Virginia pound.

Coinage Act of 1792[edit]

Alexander Hamilton finalized the details of the 1792 Coinage Act and the establishment of the U.S. Mint.

On July 6, 1785, the Continental Congress resolved that the money unit of the United States, the dollar, would contain 375.64 grains of fine silver; on August 8, 1786, the Continental Congress continued that definition and further resolved that the money of account, corresponding with the division of coins, would proceed in a decimal ratio, with the sub-units being mills at 0.001 of a dollar, cents at 0.010 of a dollar, and dimes at 0.100 of a dollar.[13]

After the adoption of the United States Constitution, the U.S. dollar was defined by the Coinage Act of 1792. It specified a «dollar» based on the Spanish milled dollar to contain 371+4⁄16 grains of fine silver, or 416.0 grains (26.96 g) of «standard silver» of fineness 371.25/416 = 89.24%; as well as an «eagle» to contain 247+4⁄8 grains of fine gold, or 270.0 grains (17.50 g) of 22 karat or 91.67% fine gold.[34] Alexander Hamilton arrived at these numbers based on a treasury assay of the average fine silver content of a selection of worn Spanish dollars, which came out to be 371 grains. Combined with the prevailing gold-silver ratio of 15, the standard for gold was calculated at 371/15 = 24.73 grains fine gold or 26.98 grains 22K gold. Rounding the latter to 27.0 grains finalized the dollar’s standard to 24.75 grains of fine gold or 24.75*15 = 371.25 grains = 24.0566 grams = 0.7735 troy ounces of fine silver.

The same coinage act also set the value of an eagle at 10 dollars, and the dollar at 1⁄10 eagle. It called for silver coins in denominations of 1, 1⁄2, 1⁄4, 1⁄10, and 1⁄20 dollar, as well as gold coins in denominations of 1, 1⁄2 and 1⁄4 eagle. The value of gold or silver contained in the dollar was then converted into relative value in the economy for the buying and selling of goods. This allowed the value of things to remain fairly constant over time, except for the influx and outflux of gold and silver in the nation’s economy.[35]

Though a Spanish dollar freshly minted after 1772 theoretically contained 417.7 grains of silver of fineness 130/144 (or 377.1 grains fine silver), reliable assays of the period in fact confirmed a fine silver content of 370.95 grains (24.037 g) for the average Spanish dollar in circulation.

[36]

The new U.S. silver dollar of 371.25 grains (24.057 g) therefore compared favorably and was received at par with the Spanish dollar for foreign payments, and after 1803 the United States Mint had to suspend making this coin out of its limited resources since it failed to stay in domestic circulation. It was only after Mexican independence in 1821 when their peso’s fine silver content of 377.1 grains was firmly upheld, which the U.S. later had to compete with using a heavier 378.0 grains (24.49 g) Trade dollar coin.

Design[edit]

The early currency of the United States did not exhibit faces of presidents, as is the custom now;[37] although today, by law, only the portrait of a deceased individual may appear on United States currency.[38] In fact, the newly formed government was against having portraits of leaders on the currency, a practice compared to the policies of European monarchs.[39] The currency as we know it today did not get the faces they currently have until after the early 20th century; before that «heads» side of coinage used profile faces and striding, seated, and standing figures from Greek and Roman mythology and composite Native Americans. The last coins to be converted to profiles of historic Americans were the dime (1946) and the Dollar (1971).

Continental currency[edit]

Continental one third dollar bill (obverse)

After the American Revolution, the thirteen colonies became independent. Freed from British monetary regulations, they each issued £sd paper money to pay for military expenses. The Continental Congress also began issuing «Continental Currency» denominated in Spanish dollars. For its value relative to states’ currencies, see Early American currency.

Continental currency depreciated badly during the war, giving rise to the famous phrase «not worth a continental».[40] A primary problem was that monetary policy was not coordinated between Congress and the states, which continued to issue bills of credit. Additionally, neither Congress nor the governments of the several states had the will or the means to retire the bills from circulation through taxation or the sale of bonds.[41] The currency was ultimately replaced by the silver dollar at the rate of 1 silver dollar to 1000 continental dollars. This resulted in the clause «No state shall… make anything but gold and silver coin a tender in payment of debts» being written in to the United States Constitution article 1, section 10.

Silver and gold standards, 19th century[edit]

From implementation of the 1792 Mint Act to the 1900 implementation of the gold standard the dollar was on a bimetallic silver-and-gold standard, defined as either 371.25 grains (24.056 g) of fine silver or 24.75 grains of fine gold (gold-silver ratio 15).

Subsequent to the Coinage Act of 1834 the dollar’s fine gold equivalent was revised to 23.2 grains; it was slightly adjusted to 23.22 grains (1.505 g) in 1837 (gold-silver ratio ~16). The same act also resolved the difficulty in minting the «standard silver» of 89.24% fineness by revising the dollar’s alloy to 412.5 grains, 90% silver, still containing 371.25 grains fine silver. Gold was also revised to 90% fineness: 25.8 grains gross, 23.22 grains fine gold.

Following the rise in the price of silver during the California Gold Rush and the disappearance of circulating silver coins, the Coinage Act of 1853 reduced the standard for silver coins less than $1 from 412.5 grains to 384 grains (24.9 g), 90% silver per 100 cents (slightly revised to 25.0 g, 90% silver in 1873). The Act also limited the free silver right of individuals to convert bullion into only one coin, the silver dollar of 412.5 grains; smaller coins of lower standard can only be produced by the United States Mint using its own bullion.

Summary and links to coins issued in the 19th century:

- In base metal: 1/2 cent, 1 cent, 5 cents.

- In silver: half dime, dime, quarter dollar, half dollar, silver dollar.

- In gold: gold $1, $2.50 quarter eagle, $5 half eagle, $10 eagle, $20 double eagle

- Less common denominations: bronze 2 cents, nickel 3 cents, silver 3 cents, silver 20 cents, gold $3.

Note issues, 19th century[edit]

In order to finance the War of 1812, Congress authorized the issuance of Treasury Notes, interest-bearing short-term debt that could be used to pay public dues. While they were intended to serve as debt, they did function «to a limited extent» as money. Treasury Notes were again printed to help resolve the reduction in public revenues resulting from the Panic of 1837 and the Panic of 1857, as well as to help finance the Mexican–American War and the Civil War.

Paper money was issued again in 1862 without the backing of precious metals due to the Civil War. In addition to Treasury Notes, Congress in 1861 authorized the Treasury to borrow $50 million in the form of Demand Notes, which did not bear interest but could be redeemed on demand for precious metals. However, by December 1861, the Union government’s supply of specie was outstripped by demand for redemption and they were forced to suspend redemption temporarily. In February 1862 Congress passed the Legal Tender Act of 1862, issuing United States Notes, which were not redeemable on demand and bore no interest, but were legal tender, meaning that creditors had to accept them at face value for any payment except for public debts and import tariffs. However, silver and gold coins continued to be issued, resulting in the depreciation of the newly printed notes through Gresham’s Law. In 1869, Supreme Court ruled in Hepburn v. Griswold that Congress could not require creditors to accept United States Notes, but overturned that ruling the next year in the Legal Tender Cases. In 1875, Congress passed the Specie Payment Resumption Act, requiring the Treasury to allow U.S. Notes to be redeemed for gold after January 1, 1879.

Gold standard, 20th century[edit]

Though the dollar came under the gold standard de jure only after 1900, the bimetallic era was ended de facto when the Coinage Act of 1873 suspended the minting of the standard silver dollar of 412.5 grains (26.73 g = 0.8595 oz t), the only fully legal tender coin that individuals could convert bullion into in unlimited (or Free silver) quantities,[a] and right at the onset of the silver rush from the Comstock Lode in the 1870s. This was the so-called «Crime of ’73».

The Gold Standard Act of 1900 repealed the U.S. dollar’s historic link to silver and defined it solely as 23.22 grains (1.505 g) of fine gold (or $20.67 per troy ounce of 480 grains). In 1933, gold coins were confiscated by Executive Order 6102 under Franklin D. Roosevelt, and in 1934 the standard was changed to $35 per troy ounce fine gold, or 13.71 grains (0.888 g) per dollar.

After 1968 a series of revisions to the gold peg was implemented, culminating in the Nixon Shock of August 15, 1971, which suddenly ended the convertibility of dollars to gold. The U.S. dollar has since floated freely on the foreign exchange markets.

Federal Reserve Notes, 20th century to present[edit]

Obverse of a rare 1934 $500 Federal Reserve Note, featuring a portrait of President William McKinley

Reverse of a $500 Federal Reserve Note

Congress continued to issue paper money after the Civil War, the latest of which is the Federal Reserve Note that was authorized by the Federal Reserve Act of 1913. Since the discontinuation of all other types of notes (Gold Certificates in 1933, Silver Certificates in 1963, and United States Notes in 1971), U.S. dollar notes have since been issued exclusively as Federal Reserve Notes.

Emergence as reserve currency[edit]

The U.S. dollar first emerged as an important international reserve currency in the 1920s, displacing the British pound sterling as it emerged from the First World War relatively unscathed and since the United States was a significant recipient of wartime gold inflows. After the United States emerged as an even stronger global superpower during the Second World War, the Bretton Woods Agreement of 1944 established the U.S. dollar as the world’s primary reserve currency and the only post-war currency linked to gold. Despite all links to gold being severed in 1971, the dollar continues to be the world’s foremost reserve currency for international trade to this day.

The Bretton Woods Agreement of 1944 also defined the post-World War II monetary order and relations among modern-day independent states, by setting up a system of rules, institutions, and procedures to regulate the international monetary system. The agreement founded the International Monetary Fund and other institutions of the modern-day World Bank Group, establishing the infrastructure for conducting international payments and accessing the global capital markets using the U.S. dollar.

The monetary policy of the United States is conducted by the Federal Reserve System, which acts as the nation’s central bank. It was founded in 1913 under the Federal Reserve Act in order to furnish an elastic currency for the United States and to supervise its banking system, particularly in the aftermath of the Panic of 1907.

For most of the post-war period, the U.S. government has financed its own spending by borrowing heavily from the dollar-lubricated global capital markets, in debts denominated in its own currency and at minimal interest rates. This ability to borrow heavily without facing a significant balance of payments crisis has been described as the United States’s exorbitant privilege.

Coins[edit]

The United States Mint has issued legal tender coins every year from 1792 to the present. From 1934 to the present, the only denominations produced for circulation have been the familiar penny, nickel, dime, quarter, half dollar, and dollar.

| Denomination | Common name | Obverse | Reverse | Obverse portrait and design date | Reverse motif and design date | Weight | Diameter | Material | Edge | Circulation |

|---|---|---|---|---|---|---|---|---|---|---|

| Cent 1¢ |

penny |

|

|

Abraham Lincoln (1909) | Union Shield (2010) | 2.5 g (0.088 oz) |

0.75 in (19.05 mm) |

97.5% Zn covered by 2.5% Cu | Plain | Wide |

| Five cents 5¢ |

nickel |

|

|

Thomas Jefferson (2006) | Monticello (1938) | 5.0 g (0.176 oz) |

0.835 in (21.21 mm) |

75% Cu 25% Ni |

Plain | Wide |

| Dime 10¢ |

dime |

|

|

Franklin D. Roosevelt (1946) | Olive branch, torch, and oak branch (1946) | 2.268 g (0.08 oz) |

0.705 in (17.91 mm) |

91.67% Cu 8.33% Ni |

118 reeds | Wide |

| Quarter dollar 25¢ |

quarter |

|

|

George Washington (1932) | Washington crossing the Delaware (2021) | 5.67 g (0.2 oz) |

0.955 in (24.26 mm) |

91.67% Cu 8.33% Ni |

119 reeds | Wide |

| Half dollar 50¢ |

half |

|

|

John F. Kennedy (1964) | Presidential Seal (1964) | 11.34 g (0.4 oz) |

1.205 in (30.61 mm) |

91.67% Cu 8.33% Ni |

150 reeds | Limited |

| Dollar coin $1 |

dollar coin, golden dollar |

|

|

Sacagawea

(2000) |

Various; new design per year | 8.10 g (0.286 oz) |

1.043 in (26.50 mm) |

88.5% Cu 6% Zn 3.5% Mn 2% Ni |

Plain 2000-2006 Lettered 2007-Present |

Limited |

Gold and silver coins have been previously minted for general circulation from the 18th to the 20th centuries. The last gold coins were minted in 1933. The last 90% silver coins were minted in 1964, and the last 40% silver half dollar was minted in 1970.

The United States Mint currently produces circulating coins at the Philadelphia and Denver Mints, and commemorative and proof coins for collectors at the San Francisco and West Point Mints. Mint mark conventions for these and for past mint branches are discussed in Coins of the United States dollar#Mint marks.

The one-dollar coin has never been in popular circulation from 1794 to present, despite several attempts to increase their usage since the 1970s, the most important reason of which is the continued production and popularity of the one-dollar bill.[42] Half dollar coins were commonly used currency since inception in 1794, but has fallen out of use from the mid-1960s when all silver half dollars began to be hoarded.

The nickel is the only coin whose size and composition (5 grams, 75% copper, and 25% nickel) is still in use from 1865 to today, except for wartime 1942-1945 Jefferson nickels which contained silver.

Due to the penny’s low value, some efforts have been made to eliminate the penny as circulating coinage.

[43]

[44]

For a discussion of other discontinued and canceled denominations, see Obsolete denominations of United States currency#Coinage and Canceled denominations of United States currency#Coinage.

Collector coins[edit]

Collector coins are technically legal tender at face value but are usually worth far more due to their numismatic value or for their precious metal content. These include:

- American Eagle bullion coins

- American Silver Eagle $1 (1 troy oz) Silver bullion coin 1986–present

- American Gold Eagle $5 (1⁄10 troy oz), $10 (1⁄4 troy oz), $25 (1⁄2 troy oz), and $50 (1 troy oz) Gold bullion coin 1986–present

- American Platinum Eagle $10 (1⁄10 troy oz), $25 (1⁄4 troy oz), $50 (1⁄2 troy oz), and $100 (1 troy oz) Platinum bullion coin 1997–present

- American Palladium Eagle $25 (1 troy oz) Palladium bullion coin 2017–present

- United States commemorative coins—special issue coins, among these:

- $50.00 (Half Union) minted for the Panama-Pacific International Exposition (1915)

- Silver proof sets minted since 1992 with dimes, quarters and half-dollars made of silver rather than the standard copper-nickel

- Presidential dollar coins proof sets minted since 2007

Banknotes[edit]

| Denomination | Front | Reverse | Portrait | Reverse motif | First series | Latest series | Circulation |

|---|---|---|---|---|---|---|---|

| One dollar |

|

|

George Washington | Great Seal of the United States | Series 1963[b] Series 1935[c] |

Series 2017A[45] | Wide |

| Two dollars |

|

|

Thomas Jefferson | Declaration of Independence by John Trumbull | Series 1976 | Series 2017A | Limited |

| Five dollars |

|

|

Abraham Lincoln | Lincoln Memorial | Series 2006 | Series 2017A | Wide |

| Ten dollars |

|

|

Alexander Hamilton | U.S. Treasury | Series 2004A | Series 2017A | Wide |

| Twenty dollars |

|

|

Andrew Jackson | White House | Series 2004 | Series 2017A | Wide |

| Fifty dollars |

|

|

Ulysses S. Grant | United States Capitol | Series 2004 | Series 2017A | Wide |

| One hundred dollars |

|

|

Benjamin Franklin | Independence Hall | Series 2009A[46] | Series 2017A | Wide |

The U.S. Constitution provides that Congress shall have the power to «borrow money on the credit of the United States.»[47] Congress has exercised that power by authorizing Federal Reserve Banks to issue Federal Reserve Notes. Those notes are «obligations of the United States» and «shall be redeemed in lawful money on demand at the Treasury Department of the United States, in the city of Washington, District of Columbia, or at any Federal Reserve bank».[48] Federal Reserve Notes are designated by law as «legal tender» for the payment of debts.[49] Congress has also authorized the issuance of more than 10 other types of banknotes, including the United States Note[50] and the Federal Reserve Bank Note. The Federal Reserve Note is the only type that remains in circulation since the 1970s.

Federal Reserve Notes are printed by the Bureau of Engraving and Printing and are made from cotton fiber paper (as opposed to wood fiber used to make common paper). The «large-sized notes» issued before 1928 measured 7.42 in × 3.125 in (188.5 mm × 79.4 mm), while small-sized notes introduced that year measure 6.14 in × 2.61 in × 0.0043 in (155.96 mm × 66.29 mm × 0.11 mm).[51] The dimensions of the modern (small-size) U.S. currency is identical to the size of Philippine peso banknotes issued under United States administration after 1903, which had proven highly successful.[52] The American large-note bills became known as «horse blankets» or «saddle blankets.»[53]

Currently printed denominations are $1, $2, $5, $10, $20, $50, and $100. Notes above the $100 denomination stopped being printed in 1946 and were officially withdrawn from circulation in 1969. These notes were used primarily in inter-bank transactions or by organized crime; it was the latter usage that prompted President Richard Nixon to issue an executive order in 1969 halting their use. With the advent of electronic banking, they became less necessary. Notes in denominations of $500, $1,000, $5,000, $10,000, and $100,000 were all produced at one time; see large denomination bills in U.S. currency for details. With the exception of the $100,000 bill (which was only issued as a Series 1934 Gold Certificate and was never publicly circulated; thus it is illegal to own), these notes are now collectors’ items and are worth more than their face value to collectors.

Though still predominantly green, the post-2004 series incorporate other colors to better distinguish different denominations. As a result of a 2008 decision in an accessibility lawsuit filed by the American Council of the Blind, the Bureau of Engraving and Printing is planning to implement a raised tactile feature in the next redesign of each note, except the $1 and the current version of the $100 bill. It also plans larger, higher-contrast numerals, more color differences, and distribution of currency readers to assist the visually impaired during the transition period.[d]

Countries that use US dollar[edit]

Formal[edit]

Informal[edit]

Monetary policy[edit]

The Federal Reserve Act created the Federal Reserve System in 1913 as the central bank of the United States. Its primary task is

to conduct the nation’s monetary policy to promote maximum employment, stable prices, and moderate long-term interest rates in the U.S. economy. It is also tasked to promote the stability of the financial system and regulate financial institutions, and to act as lender of last resort.[60][61]

The Monetary policy of the United States is conducted by the Federal Open Market Committee, which is composed of the Federal Reserve Board of Governors and 5 out of the 12 Federal Reserve Bank presidents, and is implemented by all twelve regional Federal Reserve Banks.

Monetary policy refers to actions made by central banks that determine the size and growth rate of the money supply available in the economy, and which would result in desired objectives like low inflation, low unemployment, and stable financial systems. The economy’s aggregate money supply is the total of

- M0 money, or Monetary Base — «dollars» in currency and bank money balances credited to the central bank’s depositors, which are backed by the central bank’s assets,

- plus M1, M2, M3 money — «dollars» in the form of bank money balances credited to banks’ depositors, which are backed by the bank’s assets and investments.

The FOMC influences the level of money available to the economy by the following means:

- Reserve requirements — specifies a required minimum percentage of deposits in a commercial bank that should be held as a reserve (i.e. as deposits with the Federal Reserve), with the rest available to loan or invest. Higher requirements mean less money loaned or invested, helping keep inflation in check. Raising the federal funds rate earned on those reserves also helps achieve this objective.

- Open market operations — the Federal Reserve buys or sells US Treasury bonds and other securities held by banks in exchange for reserves; more reserves increase a bank’s capacity to loan or invest elsewhere.

- Discount window lending — banks can borrow from the Federal Reserve.

Monetary policy directly affects interest rates; it indirectly affects stock prices, wealth, and currency exchange rates. Through these channels, monetary policy influences spending, investment, production, employment, and inflation in the United States. Effective monetary policy complements fiscal policy to support economic growth.

The adjusted monetary base has increased from approximately $400 billion in 1994, to $800 billion in 2005, and to over $3 trillion in 2013.[62]

When the Federal Reserve makes a purchase, it credits the seller’s reserve account (with the Federal Reserve). This money is not transferred from any existing funds—it is at this point that the Federal Reserve has created new high-powered money. Commercial banks then decide how much money to keep in deposit with the Federal Reserve and how much to hold as physical currency. In the latter case, the Federal Reserve places an order for printed money from the U.S. Treasury Department.[63] The Treasury Department, in turn, sends these requests to the Bureau of Engraving and Printing (to print new dollar bills) and the Bureau of the Mint (to stamp the coins).

The Federal Reserve’s monetary policy objectives to keep prices stable and unemployment low is often called the dual mandate. This replaces past practices under a gold standard where the main concern is the gold equivalent of the local currency, or under a gold exchange standard where the concern is fixing the exchange rate versus another gold-convertible currency (previously practiced worldwide under the Bretton Woods Agreement of 1944 via fixed exchange rates to the U.S. dollar).

International use as reserve currency[edit]

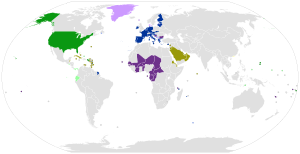

Worldwide use of the U.S. dollar:

United States

External adopters of the US dollar

Currencies pegged to the US dollar

Currencies pegged to the US dollar w/ narrow band

Worldwide use of the euro:

External adopters of the euro

Currencies pegged to the euro

Currencies pegged to the euro w/ narrow band

Ascendancy[edit]

The primary currency used for global trade between Europe, Asia, and the Americas has historically been the Spanish-American silver dollar, which created a global silver standard system from the 16th to 19th centuries, due to abundant silver supplies in Spanish America.[64]

The U.S. dollar itself was derived from this coin. The Spanish dollar was later displaced by the British pound sterling in the advent of the international gold standard in the last quarter of the 19th century.

The U.S. dollar began to displace the pound sterling as international reserve currency from the 1920s since it emerged from the First World War relatively unscathed and since the United States was a significant recipient of wartime gold inflows.[65]

After the U.S. emerged as an even stronger global superpower during the Second World War, the Bretton Woods Agreement of 1944 established the post-war international monetary system, with the U.S. dollar ascending to become the world’s primary reserve currency for international trade, and the only post-war currency linked to gold at $35 per troy ounce.[66]

As international reserve currency[edit]

The U.S. dollar is joined by the world’s other major currencies — the euro, pound sterling, Japanese yen and Chinese renminbi — in the currency basket of the special drawing rights of the International Monetary Fund. Central banks worldwide have huge reserves of U.S. dollars in their holdings and are significant buyers of U.S. treasury bills and notes.[67]

Foreign companies, entities, and private individuals hold U.S. dollars in foreign deposit accounts called eurodollars (not to be confused with the euro), which are outside the jurisdiction of the Federal Reserve System. Private individuals also hold dollars outside the banking system mostly in the form of US$100 bills, of which 80% of its supply is held overseas.

The United States Department of the Treasury exercises considerable oversight over the SWIFT financial transfers network,[68] and consequently has a huge sway on the global financial transactions systems, with the ability to impose sanctions on foreign entities and individuals.[69]

In the global markets[edit]

The U.S. dollar is predominantly the standard currency unit in which goods are quoted and traded, and with which payments are settled in, in the global commodity markets.[70] The U.S. Dollar Index is an important indicator of the dollar’s strength or weakness versus a basket of six foreign currencies.

The United States Government is capable of borrowing trillions of dollars from the global capital markets in U.S. dollars issued by the Federal Reserve, which is itself under U.S. government purview, at minimal interest rates, and with virtually zero default risk. In contrast, foreign governments and corporations incapable of raising money in their own local currencies are forced to issue debt denominated in U.S. dollars, along with its consequent higher interest rates and risks of default.[71]

The United States’s ability to borrow in its own currency without facing a significant balance of payments crisis has been frequently described as its exorbitant privilege.[72]

A frequent topic of debate is whether the strong dollar policy of the United States is indeed in America’s own best interests, as well as in the best interest of the international community.[73]

Currencies fixed to the U.S. dollar[edit]

For a more exhaustive discussion of countries using the U.S. dollar as official or customary currency, or using currencies which are pegged to the U.S. dollar, see International use of the U.S. dollar#Dollarization and fixed exchange rates and Currency substitution#US dollar.

Countries using the U.S. dollar as their official currency include:

- In the Americas: Panama, Ecuador, El Salvador, British Virgin Islands, Turks and Caicos Islands, and the Caribbean Netherlands.

- The constituent states of the former Trust Territory of the Pacific Islands: Palau, the Federated States of Micronesia, and the Marshall Islands.

- Others: East Timor.

Among the countries using the U.S. dollar together with other foreign currencies and their local currency are Cambodia and Zimbabwe.

Currencies pegged to the U.S. dollar include:

- In the Caribbean: the Bahamian dollar, Barbadian dollar, Belize dollar, Bermudan dollar, Cayman Islands dollar, East Caribbean dollar, Netherlands Antillean guilder and the Aruban florin.

- The currencies of five oil-producing Arab countries: the Saudi riyal, United Arab Emirates dirham, Omani rial, Qatari riyal and the Bahraini dinar.

- Others: the Hong Kong dollar, Macanese pataca, Jordanian dinar, Lebanese pound.

Value[edit]

|

|

|

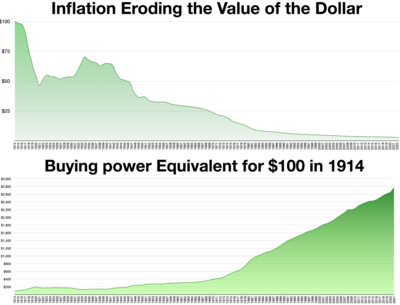

Inflation value of dollar

The 6th paragraph of Section 8 of Article 1 of the U.S. Constitution provides that the U.S. Congress shall have the power to «coin money» and to «regulate the value» of domestic and foreign coins. Congress exercised those powers when it enacted the Coinage Act of 1792. That Act provided for the minting of the first U.S. dollar and it declared that the U.S. dollar shall have «the value of a Spanish milled dollar as the same is now current».[74]

The table above shows the equivalent amount of goods that, in a particular year, could be purchased with $1. The table shows that from 1774 through 2012 the U.S. dollar has lost about 97.0% of its buying power.[75]

The decline in the value of the U.S. dollar corresponds to price inflation, which is a rise in the general level of prices of goods and services in an economy over a period of time.[76] A consumer price index (CPI) is a measure estimating the average price of consumer goods and services purchased by households. The United States Consumer Price Index, published by the Bureau of Labor Statistics, is a measure estimating the average price of consumer goods and services in the United States.[77] It reflects inflation as experienced by consumers in their day-to-day living expenses.[78] A graph showing the U.S. CPI relative to 1982–1984 and the annual year-over-year change in CPI is shown at right.

The value of the U.S. dollar declined significantly during wartime, especially during the American Civil War, World War I, and World War II.[79] The Federal Reserve, which was established in 1913, was designed to furnish an «elastic» currency subject to «substantial changes of quantity over short periods», which differed significantly from previous forms of high-powered money such as gold, national banknotes, and silver coins.[80] Over the very long run, the prior gold standard kept prices stable—for instance, the price level and the value of the U.S. dollar in 1914 were not very different from the price level in the 1880s. The Federal Reserve initially succeeded in maintaining the value of the U.S. dollar and price stability, reversing the inflation caused by the First World War and stabilizing the value of the dollar during the 1920s, before presiding over a 30% deflation in U.S. prices in the 1930s.[81]

Under the Bretton Woods system established after World War II, the value of gold was fixed to $35 per ounce, and the value of the U.S. dollar was thus anchored to the value of gold. Rising government spending in the 1960s, however, led to doubts about the ability of the United States to maintain this convertibility, gold stocks dwindled as banks and international investors began to convert dollars to gold, and as a result, the value of the dollar began to decline. Facing an emerging currency crisis and the imminent danger that the United States would no longer be able to redeem dollars for gold, gold convertibility was finally terminated in 1971 by President Nixon, resulting in the «Nixon shock».[82]

The value of the U.S. dollar was therefore no longer anchored to gold, and it fell upon the Federal Reserve to maintain the value of the U.S. currency. The Federal Reserve, however, continued to increase the money supply, resulting in stagflation and a rapidly declining value of the U.S. dollar in the 1970s. This was largely due to the prevailing economic view at the time that inflation and real economic growth were linked (the Phillips curve), and so inflation was regarded as relatively benign.[82] Between 1965 and 1981, the U.S. dollar lost two thirds of its value.[75]

In 1979, President Carter appointed Paul Volcker Chairman of the Federal Reserve. The Federal Reserve tightened the money supply and inflation was substantially lower in the 1980s, and hence the value of the U.S. dollar stabilized.[82]

Over the thirty-year period from 1981 to 2009, the U.S. dollar lost over half its value.[75] This is because the Federal Reserve has targeted not zero inflation, but a low, stable rate of inflation—between 1987 and 1997, the rate of inflation was approximately 3.5%, and between 1997 and 2007 it was approximately 2%. The so-called «Great Moderation» of economic conditions since the 1970s is credited to monetary policy targeting price stability.[83]

There is an ongoing debate about whether central banks should target zero inflation (which would mean a constant value for the U.S. dollar over time) or low, stable inflation (which would mean a continuously but slowly declining value of the dollar over time, as is the case now). Although some economists are in favor of a zero inflation policy and therefore a constant value for the U.S. dollar,[81] others contend that such a policy limits the ability of the central bank to control interest rates and stimulate the economy when needed.[84]

Pegged currencies[edit]

Exchange rates[edit]

Historical exchange rates[edit]

| Currency units | 1970[i] | 1980[i] | 1985[i] | 1990[i] | 1993 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2018[88] |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Euro | — | — | — | — | — | 0.9387 | 1.0832 | 1.1171 | 1.0578 | 0.8833 | 0.8040 | 0.8033 | 0.7960 | 0.7293 | 0.6791 | 0.7176 | 0.6739 | 0.7178 | 0.7777 | 0.7530 | 0.7520 | 0.9015 | 0.8504 |

| Japanese yen | 357.6 | 240.45 | 250.35 | 146.25 | 111.08 | 113.73 | 107.80 | 121.57 | 125.22 | 115.94 | 108.15 | 110.11 | 116.31 | 117.76 | 103.39 | 93.68 | 87.78 | 79.70 | 79.82 | 97.60 | 105.74 | 121.05 | 111.130 |

| Pound sterling | 8s 4d =0.4167 |

0.4484[ii] | 0.8613[ii] | 0.6207 | 0.6660 | 0.6184 | 0.6598 | 0.6946 | 0.6656 | 0.6117 | 0.5456 | 0.5493 | 0.5425 | 0.4995 | 0.5392 | 0.6385 | 0.4548 | 0.6233 | 0.6308 | 0.6393 | 0.6066 | 0.6544 | 0.7454 |

| Swiss franc | 4.12 | 1.68 | 2.46[89] | 1.39 | 1.48 | 1.50 | 1.69 | 1.69 | 1.62 | 1.40 | 1.24 | 1.15 | 1.29 | 1.23 | 1.12 | 1.08 | 1.03 | 0.93 | 0.93 | 0.90 | 0.92 | 1.00 | 0.98 |

| Canadian dollar[90] | 1.081 | 1.168 | 1.321 | 1.1605 | 1.2902 | 1.4858 | 1.4855 | 1.5487 | 1.5704 | 1.4008 | 1.3017 | 1.2115 | 1.1340 | 1.0734 | 1.0660 | 1.1412 | 1.0298 | 0.9887 | 0.9995 | 1.0300 | 1.1043 | 1.2789 | 1.2842 |

| Mexican peso[91] | 0.01250–0.02650[iii] | 2.80[iii] | 2.67[iii] | 2.50[iii] | 3.1237 | 9.553 | 9.459 | 9.337 | 9.663 | 10.793 | 11.290 | 10.894 | 10.906 | 10.928 | 11.143 | 13.498 | 12.623 | 12.427 | 13.154 | 12.758 | 13.302 | 15.837 | 19.911 |

| Chinese Renminbi[92] | 2.46 | 1.7050 | 2.9366 | 4.7832 | 5.7620 | 8.2783 | 8.2784 | 8.2770 | 8.2771 | 8.2772 | 8.2768 | 8.1936 | 7.9723 | 7.6058 | 6.9477 | 6.8307 | 6.7696 | 6.4630 | 6.3093 | 6.1478 | 6.1620 | 6.2840 | 6.383 |

| Pakistani rupee | 4.761 | 9.9 | 15.9284 | 21.707 | 28.107 | 51.9 | 51.9 | 63.5 | 60.5 | 57.75 | 57.8 | 59.7 | 60.4 | 60.83 | 67 | 80.45 | 85.75 | 88.6 | 90.7 | 105.477 | 100.661 | 104.763 | 139.850 |

| Indian rupee | 7.56 | 8.000 | 12.38 | 16.96 | 31.291 | 43.13 | 45.00 | 47.22 | 48.63 | 46.59 | 45.26 | 44.00 | 45.19 | 41.18 | 43.39 | 48.33 | 45.65 | 46.58 | 53.37 | 58.51 | 62.00 | 64.1332 | 68.11 |

| Singapore dollar | — | — | 2.179 | 1.903 | 1.6158 | 1.6951 | 1.7361 | 1.7930 | 1.7908 | 1.7429 | 1.6902 | 1.6639 | 1.5882 | 1.5065 | 1.4140 | 1.4543 | 1.24586 | 1.2565 | 1.2492 | 1.2511 | 1.2665 | 1.3748 | 1.343 |

Current exchange rates[edit]

| Current USD exchange rates | |

|---|---|

| From Google Finance: | AUD CAD CHF CNY EUR GBP HKD JPY CAD TWD KRW |

| From Yahoo! Finance: | AUD CAD CHF CNY EUR GBP HKD JPY CAD TWD KRW |

| From XE.com: | AUD CAD CHF CNY EUR GBP HKD JPY CAD TWD KRW |

| From OANDA: | AUD CAD CHF CNY EUR GBP HKD JPY CAD TWD KRW |

See also[edit]

- Counterfeit United States currency

- Dedollarisation

- Currency substitution

- International use of the U.S. dollar

- List of the largest trading partners of the United States

- Monetary policy of the United States

- Petrodollar recycling

- Strong dollar policy

- U.S. Dollar Index

Notes[edit]

- ^ Silver bullion can be converted in unlimited quantities of Trade dollars of 420 grains, but these were meant for export and had legal tender limits in the US. See Trade dollar (United States coin).

- ^ Obverse

- ^ Reverse

- ^ See Federal Reserve Note for details and references.

- ^ Alongside Cambodian riel

- ^ Alongside East Timor centavo coins

- ^ Alongside Ecuadorian centavo coins

- ^ Alongside Bitcoin

- ^ Alongside Liberian dollar

- ^ Alongside Panamanian balboa

- ^ Alongside Zimdollar

- ^ United States of America

- ^ Kingdom of the Netherlands

- ^ United Kingdom of Great Britain and Northern Ireland

- ^ Alongside Pound sterling

- ^ United Kingdom of Great Britain and Northern Ireland

- ^ A modest amount of United States coinage circulates alongside the Canadian dollar and is accepted at par by most retailers, banks and coin redemption machines

- ^ United States of America

- ^ United States of America

- ^ United States of America

- ^ Kingdom of the Netherlands

- ^ Kingdom of the Netherlands