-

1

pound sign

2) Вычислительная техника: знак #, знак фунта, знак решётка (#), «, знак фунта стерлингов, знак «решётки», обозначение «фунта» (На стандартной клавиатуре в Англии вместо знака # на клавише нанесён знак фунта)

Универсальный англо-русский словарь > pound sign

См. также в других словарях:

-

Знак фунта — £ Символ фунта £ или ₤ принятый во всём мире символ обозначения фунта стерлингов. Кроме Великобритании этот символ использовался и используется и в других странах валютой которых является фунт. Символ представляет из себя латинскую букву «L» с… … Википедия

-

Символ фунта — Символ (знак) фунта (лиры, ливра) краткое обозначение британского фунта стерлингов в виде символов £ или ₤. Кроме Великобритании, он используется и в других странах, валютой которых является фунт (например, в Египте) или лира (например, в Турции) … Википедия

-

Марка (знак почтовой оплаты) — А. М. Горький коллекционировал почтовые марки (марка СССР, 1946, художник И. И. Дубасов) Содержание 1 Предыстория … Википедия

-

ДЕНЬГИ — знак, являющийся эквивалентом стоимости. Архаическими формами товарного эквивалента были скот, меха, раковины. Не случайно латинское название денег ресunia происходило от слова pecus скот. В дальнейшем в качестве денег повсеместно стали выступать … Символы, знаки, эмблемы. Энциклопедия

-

Доллар — (Dollar) Доллар – это денежная единица ряда различных стран Доллар: история, номинальное назначение, в каких странах имеет обращение Содержание >>>>>>>>>>>>>>>>>>> … Энциклопедия инвестора

-

Знаки валют — … Википедия

-

Список разменных денежных единиц — перечень единиц измерения денежных сумм, равных определённой доле базовой денежной единицы (валюты). Как правило, это монеты, реже банкноты или не имеющие физической формы счётные единицы, которые используется для мелких расчётов и называются… … Википедия

-

GBP — (Английский фунт стерлинга) История английского фунта стерлингов, появление британской валюты и ее место в современной экономике Информация об английском фунте стерлингов, истории появления, развития, описание монет и банкнот Содержание… … Энциклопедия инвестора

-

Ирландский фунт — У этого термина существуют и другие значения, см. Фунт (денежная единица). Ирландский фунт (рус.) Punt Éireannach (ирл.) Irish Pound … Википедия

-

Список существующих валют — содержит информацию о валютах, де юре или де факто используемых в различных государственных или территориальных образованиях мира, в том числе с неопределённым международным статусом (валюты, вышедшие из обращения, и валюты не существующих сейчас … Википедия

-

Бреттон-Вудская валютная система — (Bretton Woods monetary system) Определение Бреттон Вудской валютной системы, создание системы и проблемы функционирования Информация об определении Бреттон Вудской валютной системы, создание системы и проблемы функционирования Содержание >… … Энциклопедия инвестора

Денежные единицы Великобритании и США: фунт стерлингов, пенс, доллар и цент.

В денежном обращении в Великобритании и США находятся следующие банкноты и монеты:

Британские банкноты:

1 фунт стерлингов — one pound sterling (название банкноты: a pound note). Обозначается сокращенно знаком £, который ставится перед числом, — £1.

5 фунтов стерлингов — five pounds (£5) (название банкноты: a five pound note)

10 фунтов стерлингов — ten pounds (£10) (название банкноты: a ten pound note)

20 фунтов стерлингов — twenty pounds (£20) (название банкноты: a twenty pound note)

Британские монеты:

Полпенса — half penny / half a penny (название монеты: а half penny). Обозначается сокращенно буквой «р» [pi:], которая ставится после числа, — 1/2 р.

1 пенс — a penny = 1 р (разг. one р)

2 пенса — twopence [‘tapens] / two pence = 2р (разг. two р [tu: рi:] (название монеты: a twopenny piece)

10 пенсов — ten pence = 10 р (название монеты: a tenpenny piece)

50 пенсов — fifty pence = 50 р (название монеты: a fifty pence piece)

I paid a penny (one р = 1 р) for it. Я заплатил за это один пенс.

The cheapest seats are fifty (pence) (fifty p = 50 p) each. Самые дешевые места — по 50 пенсов (каждое место).

I was given one (pound) fifty (pence) change (£1.50). Мне дали сдачу один фунт и пятьдесят пенсов.

The return ticket is thirteen (pounds) twenty-seven (£13.27). Обратный билет стоит 13 фунтов и 27 пенсов.

Американские банкноты:

1 доллар — a dollar (название банкноты: a dollar bill). Сокращенно обозначается знаком $, который ставится перед числом, — $1.

2 доллара — two dollars ($2)

5 долларов — five dollars = $5 (название банкноты: а

five dollar bill)

20 долларов — twenty dollars = $20 (название банкноты: a twenty dollar bill)

100 долларов — one/a hundred dollars = $100 (название банкноты: a hundred dollar bill)

500 долларов — five hundred dollars = $500 (название банкноты: a five handred dollar bill)

5 000 долларов — five thousand dollars = $5,000 (название банкноты: a five thousand dollar bill)

10 000 долларов — ten thousand dollars = $10,000 (название банкноты: a ten thousand dollar bill)

Американские монеты:

1 цент (1/100 доллара) — a cent (название монеты: a cent). Обозначается сокращенно знаком ₵, который ставится после числа,— 1 ₵.

5 центов — five cents = 5 ₵ (название монеты: a nickel)

10 центов — ten cents = 10 ₵ (название монеты: a dime)

25 центов — twenty-five cents = 25 ₵ (название монеты: a quarter)

50 центов/полдоллара — half a dollar = 50 ₵ (название монеты: a half-dollar note)

1 доллар — a dollar = $1 (название монеты-банкноты: а dollar bill). Такие обозначения, как $.12 или $.60, встречающиеся при оформлении ценников и т. п., свидетельствуют, что долларов нет, а есть только 12 или 60 центов.

Суммы в долларах и центах обозначаются следующим образом: $25.04 (twenty-five dollars and four cents); $36.10 (thirty-six dollars and ten cents; $2,750.34 (two thousand seven hundred and fifty dollars and thirty-four cents).

Символ или знак фунта (£) — типографский символ, который входит в группу «Управляющие символы C1 и дополнение 1 к латинице» (англ. C1 Controls and Latin-1 Supplement) стандарта Юникод: оригинальное название — pound sign (англ.); код — U+00A3.

Как пишется значок фунт?

Символ — £ (от лат. Libra — либра, эквивалентная фунту). Код ISO 4217 — GBP (от англ. Great Britain Pound), также иногда используется устаревшая аббревиатура — UKL (United Kingdom Libra).

Как буквенно обозначается британский фунт?

Фунт Стерлингов ( Pound Sterling )

Фунт стерлингов — денежная единица Великобритании и некоторых других стран. Является одной из основных резервных мировых валют. Знак фунта £ используется как для обозначения фунта стерлингов Великобритании, так и для обозначения большинства одноименных валют.

Как сокращенно фунты?

Британские банкноты:

1 фунт стерлингов — one pound sterling (название банкноты: a pound note). Обозначается сокращенно знаком £, который ставится перед числом, — £1.

Где платят фунтами?

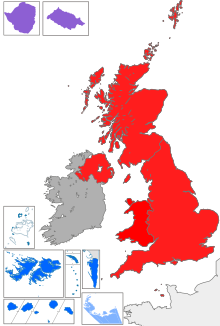

Фунт стерлингов (символ £; банковский код: GBP) делится на 100 пенсов (единственное число: пенни) и является валютой Соединенного Королевства, зависимых территорий короны (Остров Мэн и Нормандских островов) и Британских внешних территорий острова Южная Георгия и Южных Сандвичевых островов, Британская территория …

Что можно было купить на шиллинг?

1 шиллинг 6 пенсов в неделю зарабатывал десятилетний мальчик в Бетнал-Грин, трудившийся по двенадцать часов шесть дней в неделю. На эти деньги можно было купить пару черных шелковых чулок. 4 шиллинга 5 пенсов чистыми можно было заработать, сшив восемь пар брюк. 4 шиллинга 9 пенсов стоил жилет из шотландки.

Как обозначается фунт вес?

Английский фунт

Фунт (сокращение lb, от лат. libra) — одна из наиболее распространенных неметрических единиц измерения массы в англоязычных странах (США, Великобритания) и странах Британского содружества. Английский фунт делится на 16 унций и 7000 гранов, равен 0.45359237 кг (1 кг = 2.2046 фунта).

Что означает знак фунта?

Символ фунта — символ «£» (U+00A3), используемый для краткого представления фунта стерлингов, других денежных единиц с названиями «фунт», «лира» и «ливр». Символ лиры — редко встречающийся символ «₤» (U+20A4), используемый для представления денежных единиц с названием «лира», в том числе и турецкой.

Какая валюта в Соединенном Королевстве?

Фунт стерлингов

Как обозначаются Стерлинги?

Знак «£» используется в качестве сокращения многих денежных единиц, носящих название «фунт» (фунта стерлингов, гибралтарского, австралийского, ирландского и других фунтов), «лира» (итальянской, мальтийской и многих других), «либра» (перуанская либра) и иногда «ливр» (джерсийский фунт или ливр).

Сколько 1 фунт веса?

Сейчас английский фунт соответствует: (английская система мер) = 16 унциям = 7000 гранов; (метрическая система) = 0,45359237 кг.

Как обозначается цент?

Символ или знак цента (¢) — типографский символ, который входит в группу «Управляющие символы C1 и дополнение 1 к латинице» (англ. C1 Controls and Latin-1 Supplement) стандарта Юникод: оригинальное название — Cent sign (англ.); код — U+00A2.

Почему LBS это фунт?

В латыни было выражение libra pondo (фунт веса). И посмотрите, что произошло при переходе этого выражения в английский язык — слово pound произошло от одной части (pondo), а сокращение lbs- от второй! … Слово ounce происходит от латинского uncia (римская унция и дюйм).

Какие деньги в Англии сейчас?

Сегодня в Англии национальной валютой является фунт стерлингов, который равняется ста пенсам. Монеты производятся номиналом 1, 2, 5, 10, 20, 25, 50 пенсов, а также более большими — 1, 2 и 5 фунтов стерлингов.

Какая валюта используется в Великобритании?

Фунт стерлингов

Какая валюта используется в Лондоне?

Фунт стерлингов (GBP), равный 100 пенсам. В обращении банкноты в 50, 20, 10, 5, 2, 1 фунтов и монеты достоинством 1, 2, 5, 10, 20, 50 пенсов и 1 фунт.

Фунт Стерлингов ( Pound Sterling )

Фунт стерлингов — денежная единица Великобритании и некоторых других стран. Является одной из основных резервных мировых валют. Знак фунта £ используется как для обозначения фунта стерлингов Великобритании, так и для обозначения большинства одноименных валют.

Как сказать по английски 4 фунта?

Четыре фунта, одна унция. Four pounds, one ounce.

Почему фунт обозначается LB?

В англоязычных странах фунт (англ. pound от лат. pondus «вес» или lb сокр. от libra «весы») — одна из наиболее распространённых единиц массы и силы.

Как читать фунты на английском?

Английский фунт обозначается знаком £, стоящим перед числом вплотную к нему (£125), и читается: «one hundred and twenty-five pounds» или «one hundred and twenty-five pounds sterling».

Как выглядит 1 фунт стерлингов?

Фунт стерлингов состоит из 100 пенсов (ед. … пенни). Символ — £ (от лат. Libra — либра, эквивалентная фунту).

Чем обеспечен фунт стерлингов?

Прежде GBP выпускался только в металлическом виде и был обеспечен золотом и серебром, потому очень высоко ценился. Но с 1931 года было принято решение отказаться от привязки валюты к драгметаллам. Теперь британский фунт печатается и в бумажном виде.

Когда используется am is are?

Am/is/are употребляется в Present Simple в качестве глагола-связки. Он связывает подлежащее со следующим за ним существительным или прилагательным и является частью составного сказуемого. В таких предложениях глагол-связка на русский язык обычно не переводится.

Как правильно читать Деньги на английском?

Первое, на что хочется обратить внимание, — это то, что обозначая цены, англичане ставят значок валюты на первое место, а уж за ним сам показатель стоимости, но произносится название денежной валюты после цены в единственном числе, а когда сумма «круглая», то во множественном: € 1 – one Euro. $ 200 – two hundred …

Какая валюта используется в Англии?

— «паунд-фо-паунд» — сокр. P4P) — термин, употребляемый в единоборствах, в основном в боксе, в отношении бойца, который признан лучшим вне зависимости от весовой категории. Термин вошел в употребление благодаря боксёру Бенни Леонарду, который доминировал в качестве чемпиона-легковеса с мая 1917 по январь 1925 года.

Как выглядит фунт знак?

Символ фунта — символ «£» (U+00A3), используемый для краткого представления фунта стерлингов, других денежных единиц с названиями «фунт», «лира» и «ливр». Символ лиры — редко встречающийся символ «₤» (U+20A4), используемый для представления денежных единиц с названием «лира», в том числе и турецкой.

Что значит сокращение LB?

Аббревиатура lbs иногда используется для обозначения фунта массы: правильное обозначение в единственном и во множественном числах — lb. лат. Lectori benevolo salutem, L.B.S. — «Привет благосклонному читателю»; старинная формула авторского этикета.

Как читать на английском проценты?

Проценты в английском языке обозначаются словом percent. После числительных слову percent никогда не нужно окончание множественного числа –s, так как с французского языка это слово дословно переводится как «из сотни», «на сотню».

Что больше пенс или фунт?

Penny / Pence / Pound

Современный британский фунт стерлингов состоит из 100 пенсов. Минимальная по номиналу монета – 1 пенни (one penny), во множественном числе – пенсы (pence) есть монеты номиналом 5, 10, 20, 50 пенсов (five / ten / twenty / fifty pence), 1 и 2 фунта (one pound / two pounds).

Как обозначается цент?

Для обозначения цента используется строчная буква c , перечеркнутая вертикальной (иногда наклонной) чертой. В Ирландии и ЮАР буква c для обозначения цента не перечеркивается. В странах Еврозоны встречается обозначение евроцента как с перечеркиванием, так и без.

Бесплатный переводчик онлайн с английского на русский

Хотите общаться в чатах с собеседниками со всего мира, понимать, о чем поет Билли Айлиш, читать английские сайты на русском? PROMT.One мгновенно переведет ваш текст с английского на русский и еще на 20+ языков.

Точный перевод с транскрипцией

С помощью PROMT.One наслаждайтесь точным переводом с английского на русский, а для слов и фраз смотрите английскую транскрипцию, произношение и варианты переводов с примерами употребления в разных контекстах. Бесплатный онлайн-переводчик PROMT.One — достойная альтернатива Google Translate и другим сервисам, предоставляющим перевод с английского на русский и с русского на английский.

Нужно больше языков?

PROMT.One бесплатно переводит онлайн с английского на азербайджанский, арабский, греческий, иврит, испанский, итальянский, казахский, китайский, корейский, немецкий, португальский, татарский, турецкий, туркменский, узбекский, украинский, финский, французский, эстонский и японский.

фунт, фунт стерлингов, загон, тюрьма, растереть, бить, биться, истолочь, толочь

существительное ↓

- фунт (единица веса; англ. = 453,6 г; ист. = 373,2 г)

apothecaries [avoirdupois] pound — аптекарский [английский торговый] фунт

- фунт стерлингов (тж. pound sterling)

pound note — банкнота в один фунт стерлингов

in pounds sterling — в фунтах стерлингов

- фунт (денежная единица Австралии (до 1966 г.), Новой Зеландии (до 1967 г.), Египта и некоторых др. стран)

one’s pound of flesh — точное количество, причитающееся по закону (обыкн. безжалостно требуемое с должника и т. п.)

he insisted on his pound of flesh — он безжалостно требовал выполнения сделки

pound for pound — по сравнению с …

a pound to a penny — по всей видимости; ≅ бьюсь об заклад

pounds, shillings and pence — деньги

- загон для (отбившегося от стада) скота

- место для хранения невостребованных или невыкупленных вещей

- место заключения, тюрьма

- диал. пруд, запруда

- гидр. бьеф (тж. pound lock)

- спец. нижняя секция рыбного трала

- магазин по продаже живых омаров

- тяжёлый удар

- глухой звук удара

ещё 7 вариантов

глагол ↓

- загонять в затон (тж. pound up)

- заключать в тюрьму

- огораживать (поле и т. п.)

- pass оказаться в огороженном месте, из которого трудно выбраться (об охотнике)

- диал. запруживать воду

ещё 14 вариантов

Мои примеры

Словосочетания

the pounding of feet on the hallway — топот ног по коридору

a half pound of cheese — полфунта сыра

a wodge of ten pound notes — кипа десятифунтовых купюр

by the pound — в фунтах, фунтами

per pound net — за фунт чистого веса

one pound ten — один фунт и десять пенсов

penny-wise and pound foolish — экономный в мелочах и расточительный в крупном

to pound with pestle — растирать в ступке

dog pound — приют для собак

to pound smb. senseless — избить кого-л. до потери сознания

per pound price — цена за фунт

to operate / pound a typewriter — печатать на машинке

Примеры с переводом

The grapes cost $2 a pound.

Виноград стоит два доллара за фунт.

He pounded his fist on the table.

Он стукнул кулаком по столу.

As I hadn’t a hammer, I had to pound the nail in with a stone.

Молотка у меня не было, поэтому я забивал гвоздь камнем.

This machine will pound the rocks into powder.

Эта машина перемалывает камень в порошок.

Who’s that pounding at / on the door in the middle of the night?

Кто это ломится в дверь посреди ночи?

This box holds a pound of candy.

В этой коробке помещается один фунт конфет.

Our company spent £ 50,000 on advertising last month.

В прошлом месяце наша компания потратила пятьдесят тысяч фунтов на рекламу.

ещё 23 примера свернуть

Примеры, ожидающие перевода

He came pounding down the stairs.

The pound was up against the dollar.

Eliot appreciated Pound’s caustic wit.

Для того чтобы добавить вариант перевода, кликните по иконке ☰, напротив примера.

Фразовые глаголы

pound out — распрямлять, колотить, расплющивать

Возможные однокоренные слова

impound — конфисковать, заключать, запирать, загонять скот, запруживать воду

poundage — пошлина с веса, процент с фунта стерлингов

pounder — пестик, ступка, дробилка, предмет весом в один фунт

pounded — толченый

pounding — битье

poundal — паундаль, фунтал, единица силы

Формы слова

verb

I/you/we/they: pound

he/she/it: pounds

ing ф. (present participle): pounding

2-я ф. (past tense): pounded

3-я ф. (past participle): pounded

noun

ед. ч.(singular): pound

мн. ч.(plural): pounds

Фунт Стерлингов ( Pound Sterling )

Фунт стерлингов — денежная единица Великобритании и некоторых других стран. Является одной из основных резервных мировых валют. Знак фунта £ используется как для обозначения фунта стерлингов Великобритании, так и для обозначения большинства одноименных валют.

Как сказать по английски 4 фунта?

Четыре фунта, одна унция. Four pounds, one ounce.

Почему фунт обозначается LB?

В англоязычных странах фунт (англ. pound от лат. pondus «вес» или lb сокр. от libra «весы») — одна из наиболее распространённых единиц массы и силы.

Как читать фунты на английском?

Английский фунт обозначается знаком £, стоящим перед числом вплотную к нему (£125), и читается: «one hundred and twenty-five pounds» или «one hundred and twenty-five pounds sterling».

Как выглядит 1 фунт стерлингов?

Фунт стерлингов состоит из 100 пенсов (ед. … пенни). Символ — £ (от лат. Libra — либра, эквивалентная фунту).

Чем обеспечен фунт стерлингов?

Прежде GBP выпускался только в металлическом виде и был обеспечен золотом и серебром, потому очень высоко ценился. Но с 1931 года было принято решение отказаться от привязки валюты к драгметаллам. Теперь британский фунт печатается и в бумажном виде.

Когда используется am is are?

Am/is/are употребляется в Present Simple в качестве глагола-связки. Он связывает подлежащее со следующим за ним существительным или прилагательным и является частью составного сказуемого. В таких предложениях глагол-связка на русский язык обычно не переводится.

Как правильно читать Деньги на английском?

Первое, на что хочется обратить внимание, — это то, что обозначая цены, англичане ставят значок валюты на первое место, а уж за ним сам показатель стоимости, но произносится название денежной валюты после цены в единственном числе, а когда сумма «круглая», то во множественном: € 1 – one Euro. $ 200 – two hundred …

Какая валюта используется в Англии?

— «паунд-фо-паунд» — сокр. P4P) — термин, употребляемый в единоборствах, в основном в боксе, в отношении бойца, который признан лучшим вне зависимости от весовой категории. Термин вошел в употребление благодаря боксёру Бенни Леонарду, который доминировал в качестве чемпиона-легковеса с мая 1917 по январь 1925 года.

Как выглядит фунт знак?

Символ фунта — символ «£» (U+00A3), используемый для краткого представления фунта стерлингов, других денежных единиц с названиями «фунт», «лира» и «ливр». Символ лиры — редко встречающийся символ «₤» (U+20A4), используемый для представления денежных единиц с названием «лира», в том числе и турецкой.

Что значит сокращение LB?

Аббревиатура lbs иногда используется для обозначения фунта массы: правильное обозначение в единственном и во множественном числах — lb. лат. Lectori benevolo salutem, L.B.S. — «Привет благосклонному читателю»; старинная формула авторского этикета.

Как читать на английском проценты?

Проценты в английском языке обозначаются словом percent. После числительных слову percent никогда не нужно окончание множественного числа –s, так как с французского языка это слово дословно переводится как «из сотни», «на сотню».

Что больше пенс или фунт?

Penny / Pence / Pound

Современный британский фунт стерлингов состоит из 100 пенсов. Минимальная по номиналу монета – 1 пенни (one penny), во множественном числе – пенсы (pence) есть монеты номиналом 5, 10, 20, 50 пенсов (five / ten / twenty / fifty pence), 1 и 2 фунта (one pound / two pounds).

Как обозначается цент?

Для обозначения цента используется строчная буква c , перечеркнутая вертикальной (иногда наклонной) чертой. В Ирландии и ЮАР буква c для обозначения цента не перечеркивается. В странах Еврозоны встречается обозначение евроцента как с перечеркиванием, так и без.

-

1

pound

Ⅰ

1) фунт (

англ.

= 453,6 г)

Ⅱ

pound [paυnd]

2) тюрьма́

1) загоня́ть в заго́н

2) заключа́ть в тюрьму́

Ⅲ

pound [paυnd]

1) бить, колоти́ть

2) толо́чь

3) бомбардирова́ть (at, on)

4) с трудо́м продвига́ться (along)

5) колоти́ться, си́льно би́ться ( о сердце)

а) расплю́щивать, распрямля́ть ( ударами);

Англо-русский словарь Мюллера > pound

-

2

pound in

Англо-русский словарь Мюллера > pound in

-

3

pound

Персональный Сократ > pound

-

4

pound

1. n фунт стерлингов

2. n фунт

pounds, shillings and pence — деньги

3. n загон для скота

4. n место для хранения невостребованных или невыкупленных вещей

an English pound, or twenty shillings — английский фунт, или 20 шиллингов

5. n место заключения, тюрьма

6. n диал. пруд, запруда

7. n гидр. бьеф

8. n спец. нижняя секция рыбного трала

9. n магазин по продаже живых омаров

10. v загонять в затон

11. v заключать в тюрьму

12. v огораживать

13. v оказаться в огороженном месте, из которого трудно выбраться

14. v диал. запруживать воду

15. n тяжёлый удар

16. n глухой звук удара

17. v бить, колотить

18. v сильно биться, колотиться

19. v тех. стучать; дрожать, вибрировать; сотрясаться

20. v биться

21. v бить, греметь

22. v воен. обстреливать, бомбардировать

23. v воен. наносить мощные удары

24. v воен. толочь, раздроблять, разбивать на мелкие куски

25. v воен. трамбовать

26. v воен. постоянно повторять; внушать

27. v воен. тяжело идти, бежать или скакать

28. v воен. тяжело врезаться в большую волну

29. v воен. работать усиленно

30. v воен. мчаться, нестись с грохотом

Синонимический ряд:

1. blow (noun) bang; bash; bastinado; bat; belt; biff; blow; bop; clout; crack; hit; lick; slam; slosh; smack; smash; sock; swat; thwack; wallop; whack; whop

2. pen (noun) cage; confine; coop; enclosure; kennel; pen; trap

3. weight (noun) measure; pound avoirdupois; pound scots; pound sterling; pound troy; weight

4. beat (verb) baste; batter; beat; belabor; belabour; bruise; buffet; drub; forge; hammer; hit; lam; lambaste; malleate; paste; pelt; pulsate; pummel; strike; thrash; throb; tromp; trounce; wallop; whop

6. pulverize (verb) bray; comminute; crush; grind; mash; powder; pulverise; pulverize; triturate

English-Russian base dictionary > pound

-

5

pound

[̈ɪpaund]

green pound «зеленый» фунт стерлингов (расчетное средство в Европейском экономическом сообществе) pound бить, колотить pound бомбардировать (at, on) pound загон (для скота) pound загонять в загон pound заключать в тюрьму pound колотиться, сильно биться (о сердце) pound толочь pound тюрьма pound тяжело скакать; с трудом продвигаться (along) pound тяжелый удар pound фунт (денежная единица Австралии до 1966 г., Египта и некоторых других стран); pound of flesh точное количество, причитающееся по закону pound фунт (англ.= =453,6 г) pound фунт pound фунт стерлингов (=20 шиллингам) pound фунт (денежная единица Австралии до 1966 г., Египта и некоторых других стран); pound of flesh точное количество, причитающееся по закону pound out колотить (по роялю); to pound one’s gums болтать языком; to pound one»s ear помять ушко pound out колотить (по роялю); to pound one’s gums болтать языком; to pound one»s ear помять ушко pound out колотить (по роялю); to pound one’s gums болтать языком; to pound one»s ear помять ушко pound out расплющивать, распрямлять (ударами)

English-Russian short dictionary > pound

-

6

pound

[paund]

Iсущ.

а) фунт

б) фунт

2) фунт (стерлингов) pound sterling

Our company spent £ 50,000 on advertising last month. — В прошлом месяце наша компания потратила пятьдесят тысяч фунтов на рекламу.

The pound fell 10 per cent against the dollar. — Фунт снизился по отношению к доллару на десять процентов.

3) фунт

••

II

1.сущ.

1)

Syn:

Syn:

3)

диал.

пруд, искусственный водоем

2.

гл.

1)

Syn:

2) огораживать, окружать, ограничивать

3)

диал.

перекрывать плотиной, запруживать

Syn:

III

1.сущ.

1)

Syn:

Syn:

Syn:

2.

гл.

1) бить, колотить

to pound smb. senseless — избить кого-л. до потери сознания

Who’s that pounding at / on the door in the middle of the night? — Кто это ломится в дверь посреди ночи?

The noise of the drums pounded at our ears till we thought we would lose our hearing. — Стук барабанов был настолько сильным, что нам показалось, что мы сейчас оглохнем.

I had to pound the heavy wooden stick into the ground. — Мне нужно было забить тяжелый деревянный кол в землю.

As I hadn’t a hammer, I had to pound the nail in with a stone. — Молотка у меня не было, поэтому я забивал гвоздь камнем.

Syn:

2)

воен.

бомбардировать, обстреливать, наносить удары

The citizens yielded after the big guns had been pounding (away) at the town for a week. — Горожане сдались после того, как город в течении недели непрерывно обстреливали из тяжёлых артиллерийских орудий.

3) колотиться, сильно биться

Syn:

4) толочь, раздроблять, разбивать на мелкие куски

This machine will pound the rocks into powder. — Эта машина перемалывает камень в порошок.

5) тяжело идти, бежать или скакать

We could hear elephants pounding along (the forest path). — Мы слышали топот слонов (движущихся по лесной тропинке).

••

— pound into

— pound in

— pound out

— pound one’s gums

— pound one’s ear

— pound one’s beatАнгло-русский современный словарь > pound

-

7

pound

фунт

имя существительное:глагол:

Англо-русский синонимический словарь > pound

-

8

pound

̈ɪpaund I сущ.

1) единица веса — фунт а) единица, использовавшаяся ранее для измерения веса золота, серебра и т.д.;

=373,2 г б) современная мера веса, используемая в англоговорящих странах;

= 453,6 г)

2) денежная единица некоторых государств, в название которой входит слово ‘фунт’ а) фунт стерлингов (= 20 шиллингам) in pounds sterling б) австралийский фунт, египетский фунт и т.д. ∙ pound of flesh II

1. сущ.

1) а) загон( для скота) б) приют( для потерявшихся или бездомных животных) a dog pound ≈ приют для собак в) склад для хранения конфискованной собственности

2) а) тюрьма Syn: prison, jail б) условия тюремного заключения, условия пребывания в тюрьме

3) пруд, искусственный водоем

2. гл.

1) а) загонять( в загон) б) заключать( в тюрьму) Syn: impound

2) а) окружать, ограничивать (как в прямом, так и в переносном смысле) б) прен., разг. женить, сделать женатым, ‘окрутить’ I wish Harriot was fairly pounded, it would save us both a great deal of trouble. ≈ Уж лучше бы Гэрриот удачно женился, это бы сберегло наши нервы.

3) диал. перекрывать плотиной, запруживать, заполнять Syn: dam up

4) разделять на отсеки (тж. pound off) III

1. сущ.

1) а) тяжелый удар Syn: thump

1. б) глухой звук( от удара) Syn: thud

1.

2) синяк, ушиб;

контузия (результат удара) Syn: bruise

1., contusion

2. гл.

1) а) бить, колотить Who’s that pounding at/on the door in the middle of the night? ≈ Кто это ломится в дверь посреди ночи? б) воен. бомбардировать, наносить удары The citizens yielded after the big guns had been pounding (away) at the town for a week. ≈ Горожане сдались после недели бомбардировок из тяжелой артиллерии.

2) перен. а) выбивать, отстукивать( особ. что-л. На печатной машинке, при помощи клавиатуры) She pound out a story on the typewriter. ≈ Она отпечатала рассказ на машинке. б) вбивать( что-л. в чье-л. сознание) ;

убеждать Syn: drive

2.

3) колотиться, сильно биться (о сердце) Syn: pulsate, throb

2.

4) толочь, раздроблять, разбивать на мелкие куски

5) тяжело идти, бежать или скакать We could hear elephants pounding along( the forest path). ≈ Слышен вдали топот слонов. ∙ pound at pound in pound into pound on pound out pound gums pound ear

фунт (единица веса;

англ. = 452,6 г;

ист. = 373,2 г) — apothecaries * аптекарский фунт фунт стерлингов (тж. * sterling) — * note банкнота в один фунт стерлингов — in *s sterling в фунтах стерлингов фунт (денежная единица Австралии (до 1966 г.), Новой Зеландии (до 1967 г.), Египта и некоторых др. стран) > one’s * of flesh точное количество, причитающееся по закону( обыкн. безжалостно требуемое с должника и т. п.) > he insisted on his * of flesh он безжалостно требовал выполнения сделки > * for * по сравнению с… > a * to a penny по всей видимости;

бьюсь об заклад > *s, shillings and pence деньги > take care of the pence and the *s will take care of themselves копейка рубль бережет > in for a penny, in for a * взявшись за гуж, не говори, что не дюж! загон для ( отбившегося от стада) скота место для хранения невостребованных или невыкупленный вещей место заключения, тюрьма (диалектизм) пруд, запруда (гидрология) бьеф (тж. * lock) (специальное) нижняя секция рыбного трала магазин по продаже живых омаров загонять в загон (тж. * up) заключать в тюрьму огораживать (поле и т. п.) оказаться в огороженном месте, из которого трудно выбраться( об охотнике) (диалектизм) запруживать воду тяжелый удар глухой звук удара (часто at, on) бить, колотить — to * out a tune on the piano барабанить /колотить/ по клавишам — to * on the door колотить в дверь — she *ed him with her fists она колотила его кулаками сильно биться, колотиться (о сердце) (техническое) стучать( о движущихся частях машины) ;

дрожать, вибрировать;

сотрясаться биться (днищем о волну или грунт) бить, греметь — the drums *ed loudly гремели /громко били/ барабаны( военное) обстреливать, бомбардировать — the guns were *ing away орудия палили вовсю( военное) наносить мощные удары толочь, раздроблять, разбивать на мелкие куски — to * sugar толочь сахар — to * stones дробить камни трамбовать постоянно повторять;

внушать — day after day the facts were *ed home to them изо дня в день им вдалбливали эти факты тяжело идти, бежать или скакать — he *ed along the road он тяжело /с трудом/ шагал по дороге тяжело врезаться в большую волну (о корабле) работать усиленно (тж. * away) — to * the books долбить /зубрить/ — he is *ing away on the same line as before а он все свое долбит, он продолжает гнуть свою линию мчаться, нестись с грохотом > to * the pavement (американизм) исходить все улицы в поисках работы;

просить милостыню;

совершать обход( о полисмене) ;

утюжить мостовые > to * one’s ear спать

green ~ «зеленый» фунт стерлингов (расчетное средство в Европейском экономическом сообществе)

pound бить, колотить ~ бомбардировать (at, on) ~ загон (для скота) ~ загонять в загон ~ заключать в тюрьму ~ колотиться, сильно биться (о сердце) ~ толочь ~ тюрьма ~ тяжело скакать;

с трудом продвигаться( along) ~ тяжелый удар ~ фунт (денежная единица Австралии до 1966 г., Египта и некоторых других стран) ;

pound of flesh точное количество, причитающееся по закону ~ фунт (англ.= =453,6 г) ~ фунт ~ фунт стерлингов (=20 шиллингам)

~ фунт (денежная единица Австралии до 1966 г., Египта и некоторых других стран) ;

pound of flesh точное количество, причитающееся по закону

~ out колотить (по роялю) ;

to pound one’s gums болтать языком;

to pound one»s ear помять ушко

~ out колотить (по роялю) ;

to pound one’s gums болтать языком;

to pound one»s ear помять ушко

~ out колотить (по роялю) ;

to pound one’s gums болтать языком;

to pound one»s ear помять ушко ~ out расплющивать, распрямлять (ударами)Большой англо-русский и русско-английский словарь > pound

-

9

pound

I

[paʋnd]1. фунт ()

apothecaries [avoirdupois] pound — аптекарский [английский торговый] фунт

2. 1) фунт стерлингов (

pound sterling)

2) фунт ( () ())

one’s pound of flesh — точное количество, причитающееся по закону ( безжалостно требуемое с должника и т. п.)

he insisted on his pound of flesh — он безжалостно требовал выполнения сделки

pound for pound — по сравнению с…

a pound to a penny — по всей видимости; ≅ бьюсь об заклад

pounds, shillings and pence — деньги

in for a penny, in for a pound penny I

II

1. 1) загон для (отбившегося от стада) скота

2) место для хранения невостребованных невыкупленных вещей

2. место заключения, тюрьма

5.

нижняя секция рыбного трала

6. магазин по продаже живых омаров

1. загонять в затон (

pound up)

2. заключать в тюрьму

3. огораживать ()

4.

оказаться в огороженном месте, из которого трудно выбраться ()

II

1) тяжёлый удар

2) глухой звук удара

1. 1) ( at, on) бить, колотить

to pound out a tune on the piano — барабанить /колотить/ по клавишам

2) сильно биться, колотиться ()

3)

стучать (); дрожать, вибрировать; сотрясаться

5) бить, греметь

the drums pounded loudly — гремели /громко били/ барабаны

1) обстреливать, бомбардировать

2) наносить мощные удары

3. 1) толочь, раздроблять, разбивать на мелкие куски

2) трамбовать

3) постоянно повторять; внушать

day after day the facts were pounded home to them — изо дня в день им вдалбливали эти факты

4. 1) тяжело идти, бежать скакать

he pounded along the road — он тяжело /с трудом/ шагал по дороге

2) тяжело врезаться в большую волну ()

5. работать усиленно (

pound away)

to pound the books — долбить /зубрить/

he is pounding away on the same line as before — а он всё своё долбит, он продолжает гнуть свою линию

6. мчаться, нестись с грохотом

to pound the pavement — а) исходить все улицы в поисках работы; б) просить милостыню; в) совершать обход (); ≅ утюжить мостовые

НБАРС > pound

-

10

pound

Politics english-russian dictionary > pound

-

11

pound

сущ.

б)

See:

Australian pound, Cyprus pound, Egyptian pound, Falkland Islands pound, Gibraltar pound, Guernsey pound, Irish pound, Isle of Man pound, Jersey pound, Lebanese pound, New Zealand pound, Saint Helena pound, Sudanese pound, Syrian pound, euro, national currency

* * *

* * *

Финансы/Кредит/Валюта

денежная единица Египта, Мальты

Англо-русский экономический словарь > pound

-

12

pound

сущ.

б)

See:

euro, Cyprus pound, Egyptian pound, Falkland Islands pound, Gibraltar pound, Lebanese pound, Saint Helena pound, Syrian pound, Australian pound, New Zealand pound, Irish pound, national currency

The new English-Russian dictionary of financial markets > pound

-

13

pound

English-russian dctionary of contemporary Economics > pound

-

14

pound

English-Russian big polytechnic dictionary > pound

-

15

pound

English-Russian big medical dictionary > pound

-

16

pound

I

noun

2) фунт стерлингов (

=

20 шиллингам)

3) фунт (денежная единица Австралии до 1966 г., Египта и некоторых других стран)

pound of flesh точное количество, причитающееся по закону

II

1) загон (для скота)

2) тюрьма

1) загонять в загон

2) заключать в тюрьму

III

тяжелый удар

1) толочь

2) бить, колотить

3) колотиться, сильно биться (о сердце)

4) бомбардировать (at, on)

5) тяжело скакать; с трудом продвигаться (along)

pound out

to pound one’s gums болтать языком

to pound one’s ear помять ушко

* * *

* * *

* * *

[ paʊnd]

фунт, фунт стерлингов; загон, тюрьма, тяжелый удар

загонять в загон, заключать в тюрьму; бить, колотить; биться, толочь, растереть* * *

бить

биться

бомбардировать

загон

загородка

колотить

колотиться

огораживать

раздроблять

распрямлять

толочь

трамбовать

фунт

* * *

I сущ.

1) единица веса — фунт

2) а) фунт стерлингов (= 20 шиллингам)

б) австралийский фунт, египетский фунт и т.д.

II

1. сущ.

1) а) загон (для скота)

б) приют

в) склад для хранения конфискованной собственности

2) а) тюрьма

б) условия тюремного заключения, условия пребывания в тюрьме

3) пруд, искусственный водоем

2. гл.

1) а) загонять (в загон)

б) заключать (в тюрьму)

2) а) окружать, ограничивать

б) прен., разг. женить, сделать женатым

III

1. сущ.

1) а) тяжелый удар

б) глухой звук (от удара)

2) синяк, ушиб; контузия (результат удара)

2. гл.

1) а) бить

б) воен. бомбардировать, наносить удары

2) перен.

а) выбивать, отстукивать

б) вбивать (что-л. в чье-л. сознание)

3) колотиться, сильно биться (о сердце)Новый англо-русский словарь > pound

-

17

pound

The Americanisms. English-Russian dictionary. > pound

-

18

pound

1) фунт (0,453 кг); фунт-сила (4,448Н)

2) измельчать, толочь

3) дорож. трамбовать

•

pounds per square inch differential, psid — разность давлений равная 6894,757 Па;

Англо-русский словарь технических терминов > pound

-

19

pound

[paund]

n

— sell smth by the pound

— live on two pounds weekUSAGE:

Русское «фунт» соответствует в английском языке мере веса и денежной единице: £ — обозначение денежного знака — фунт стерлингов; lb — обозначение фунта — как меры веса

English-Russian combinatory dictionary > pound

-

20

pound in

1.

гл.

вбивать, вколачивать

As I hadn’t a hammer, I had to pound the nail in with a stone.

2.

разг.

вдалбливать (в голову), втолковывать

Instead of trying to pound the grammar in, why not let the children discover the rules as they write?

Англо-русский универсальный дополнительный практический переводческий словарь И. Мостицкого > pound in

Страницы

- Следующая →

- 1

- 2

- 3

- 4

- 5

- 6

- 7

См. также в других словарях:

-

Pound — may refer to:Units*Pound (currency), a unit of currency in various countries *Pound sign, £ *Pound sterling, the fundamental unit of currency in Great Britain * Pound (force), a unit of force *Pound (mass), various units of mass *Number sign, #,… … Wikipedia

-

POUND (E.) — Critique, traducteur, poète, Pound a marqué la poésie américaine contemporaine de son empreinte: nul n’a échappé à son influence. L’œuvre de Pound, tendue et intransigeante, assure à la poésie américaine continuité et permanence; de même qu’elle… … Encyclopédie Universelle

-

pound — pound1 [pound] n. pl. pounds; sometimes, after a number, pound [ME < OE pund, akin to Ger pfund: WGmc loanword < L pondo, a pound, orig. abl. of pondus, weight (in libra pondo, a pound in weight), akin to pendere: see PENDANT] 1. a) the… … English World dictionary

-

pound — [paʊnd] noun [countable] 1. written abbreviation £ the standard unit of currency in Britain, which is divided into 100 pence: • a twenty pound note • a shortfall of millions of pounds 2. the (British) pound the value of the British currency… … Financial and business terms

-

Pound — (engl. für ‚Pfund‘) steht für: pound (anglo amerikanische Gewichtseinheit) Pfund Sterling, die aktuelle britische Währung Pound (Software), eine Load Balancing Software £ oder ₤, das Pfundzeichen Pound ist der Name folgender Personen: Caspar… … Deutsch Wikipedia

-

pound — ● pound nom féminin Unité fondamentale britannique de masse (symbole lb). [La pound, dont le nom français correspondant est livre, est l unité d où sont dérivées les autres. C est la masse d un étalon en platine, l « Imperial Standard Pound »,… … Encyclopédie Universelle

-

Pound — 〈[ paʊnd] n.; s, od. s; 〉 engl. Gewichtseinheit, 453,6 g * * * Pound [paʊnd], das; , s [engl. pound, eigtl. = Pfund, < aengl. pund < lat. pondo, ↑ Pfund]: englische Gewichtseinheit (453,60 g; Abk.: lb. [Sg.], lbs. [Pl.]). * * * I … Universal-Lexikon

-

Pound — Pound, n.; pl. {Pounds}, collectively {Pound} or {Pounds}. [AS. pund, fr. L. pondo, akin to pondus a weight, pendere to weigh. See {Pendant}.] 1. A certain specified weight; especially, a legal standard consisting of an established number of… … The Collaborative International Dictionary of English

-

Pound — Pound, n.; pl. {Pounds}, collectively {Pound} or {Pounds}. [AS. pund, fr. L. pondo, akin to pondus a weight, pendere to weigh. See {Pendant}.] 1. A certain specified weight; especially, a legal standard consisting of an established number of… … The Collaborative International Dictionary of English

-

pound — Ⅰ. pound [1] ► NOUN 1) a unit of weight equal to 16 oz avoirdupois (0.4536 kg), or 12 oz troy (0.3732 kg). 2) (also pound sterling) (pl. pounds sterling) the basic monetary unit of the UK, equal to 100 pence. 3) another term for PUNT(Cf. ↑ … English terms dictionary

-

Pound — Pound, n. [AS. pund an inclosure: cf. forpyndan to turn away, or to repress, also Icel. pynda to extort, torment, Ir. pont, pond, pound. Cf. {Pinder}, {Pinfold}, {Pin} to inclose, {Pond}.] 1. An inclosure, maintained by public authority, in which … The Collaborative International Dictionary of English

Содержание

- 1 Русский

- 1.1 Морфологические и синтаксические свойства

- 1.2 Произношение

- 1.3 Семантические свойства

- 1.3.1 Значение

- 1.3.2 Синонимы

- 1.3.3 Антонимы

- 1.3.4 Гиперонимы

- 1.3.5 Гипонимы

- 1.4 Родственные слова

- 1.5 Этимология

- 1.6 Фразеологизмы и устойчивые сочетания

- 1.7 Перевод

- 1.8 Анаграммы

- 1.9 Библиография

Русский[править]

| В Викиданных есть лексема паунд (L183802). |

Морфологические и синтаксические свойства[править]

| падеж | ед. ч. | мн. ч. |

|---|---|---|

| Им. | па́унд | па́унды |

| Р. | па́унда | па́ундов |

| Д. | па́унду | па́ундам |

| В. | па́унд | па́унды |

| Тв. | па́ундом | па́ундами |

| Пр. | па́унде | па́ундах |

па́—унд

Существительное, неодушевлённое, мужской род, 2-е склонение (тип склонения 1a по классификации А. А. Зализняка).

Корень: -паунд-.

Произношение[править]

- МФА: [ˈpaʊnt]

Семантические свойства[править]

Значение[править]

- спорт. рейтинг лучших боксёров вне зависимости от весовой категории ◆ Отсутствует пример употребления (см. рекомендации).

Синонимы[править]

Антонимы[править]

Гиперонимы[править]

Гипонимы[править]

Родственные слова[править]

| Ближайшее родство | |

Этимология[править]

От англ. pound for pound «вне зависимости от весовой категории».

Фразеологизмы и устойчивые сочетания[править]

Перевод[править]

| Список переводов | |

Анаграммы[править]

- панду

Библиография[править]

|

|

Для улучшения этой статьи желательно:

|

Sterling

|

stg[1] |

||||

|---|---|---|---|---|

|

||||

| ISO 4217 | ||||

| Code | GBP (numeric: 826) | |||

| Subunit | 0.01 | |||

| Unit | ||||

| Unit | pound | |||

| Plural | pounds | |||

| Symbol | £ | |||

| Denominations | ||||

| Subunit | ||||

| 1⁄100 | penny | |||

| Plural | ||||

| penny | pence | |||

| Symbol | ||||

| penny | p | |||

| Banknotes | ||||

| Freq. used |

|

|||

| Rarely used |

|

|||

| Coins |

|

|||

| Rarely used | 25p[2][3] | |||

| Demographics | ||||

| Date of introduction | c. 800; 1223 years ago | |||

| User(s) |

|

|||

| Issuance | ||||

| Central bank | Bank of England | |||

| Website | www.bankofengland.co.uk | |||

| Printer | De La Rue[4] | |||

| Mint | Royal Mint | |||

| Website | www.royalmint.com | |||

| Valuation | ||||

| Inflation | 8.2% or 9.4% | |||

| Source | Office for National Statistics, 20 July 2022[5] | |||

| Method | CPIH or CPI | |||

| Pegged by | see § Pegged currencies |

Sterling (abbreviation: stg;[1] ISO code: GBP) is the currency of the United Kingdom and nine of its associated territories.[6] The pound (sign: £) is the main unit of sterling,[7] and the word «pound» is also used to refer to the British currency generally,[8] often qualified in international contexts as the British pound or the pound sterling.[7][8]

Sterling is the world’s oldest currency that is still in use and that has been in continuous use since its inception.[9] It is currently the fourth most-traded currency in the foreign exchange market, after the United States dollar, the euro, and the Japanese yen.[10] Together with those three currencies and Renminbi, it forms the basket of currencies which calculate the value of IMF special drawing rights. As of late 2022, sterling is also the fourth most-held reserve currency in global reserves.[11]

The Bank of England is the central bank for sterling, issuing its own banknotes, and regulating issuance of banknotes by private banks in Scotland and Northern Ireland. Sterling banknotes issued by other jurisdictions are not regulated by the Bank of England; their governments guarantee convertibility at par. Historically, sterling was also used to varying degrees by the colonies and territories of the British Empire.

Names[edit]

«Sterling» is the name of the currency as a whole while «pound» and «penny» are the units of account. This is analogous to the distinction between «renminbi» and «yuan» when discussing the official currency of the People’s Republic of China.

Sterling Pound 5, 10, 20, 50

Etymology[edit]

There are various theories regarding the origin of the word «sterling». The Oxford English Dictionary states that the «most plausible» etymology is a derivation from the Old English steorra for «star» with the added diminutive suffix «-ling», to yield «little star». The reference is to the silver penny used in Norman England in the twelfth century, which bore a small star.[12]

Another argument, according to which the Hanseatic League was the origin of both its definition and manufacture as well as its name is that the German name for the Baltic is «Ostsee», or «East Sea», and from this the Baltic merchants were called «Osterlings», or «Easterlings».[13] In 1260, Henry III granted them a charter of protection and land for their Kontor, the Steelyard of London, which by the 1340s was also called «Easterlings Hall», or Esterlingeshalle.[14] Because the League’s money was not frequently debased like that of England, English traders stipulated to be paid in pounds of the «Easterlings», which was contracted to «‘sterling».[15] The OED dismisses this theory as unlikely, since the stressed first syllable would not have been elided.[12]

Encyclopædia Britannica states the (pre-Norman) Anglo-Saxon kingdoms had silver coins called «sterlings» and that the compound noun «pound sterling» was derived from a pound (weight) of these sterlings.[16]

Symbol[edit]

The currency sign for the pound unit of sterling is £, which (depending on typeface) may be drawn with one or two bars:[17] the Bank of England has exclusively used the single bar variant since 1975.[18][19] Historically, a simple capital L (in the historic black-letter typeface,

Notable style guides recommend that the pound sign be used without any abbreviation or qualification to indicate sterling (e.g., £12,000).[25][26][27] Notations with a more explicit sterling abbreviation such as £ […] stg. (e.g., £12,000 stg.),[28] £stg. (e.g., £stg. 12,000),[29] stg or STG (e.g., Stg. 12,000 or STG 12,000),[1] or the ISO 4217 code GBP (e.g., 12,000 GBP) may be seen, but are not usually used unless disambiguation is absolutely necessary.

Currency code[edit]

The ISO 4217 currency code for sterling is «GBP», formed from the ISO 3166-1 alpha-2 code for the United Kingdom, «GB», and the first letter of «pound». Banking and finance often use the abbreviation stg or the pseudo-ISO code STG. The Crown Dependencies use their own abbreviations which are not ISO codes but may be used like them: GGP (Guernsey pound), JEP (Jersey pound) and IMP (Isle of Man pound). Stock prices are often quoted in pence, so traders may abbreviate the penny as GBX (sometimes GBp) when listing stock prices.

Cable[edit]

The exchange rate of sterling against the US dollar is referred to as «cable» in the wholesale foreign exchange markets.[30] The origins of this term are attributed to the fact that from the mid-19th century, the sterling/dollar exchange rate was transmitted via transatlantic cable.[31]

Slang terms [edit]

Historically almost every British coin had a widely recognised nickname, such as «tanner» for the sixpence and «bob» for the shilling.[32] Since decimalisation these have mostly fallen out of use except as parts of proverbs.

A common slang term for the pound unit is quid (singular and plural, except in the common phrase «quids in!»).[33] The term may have come via Italian immigrants from «scudo», the name for a number of currency units used in Italy until the 19th century; or from Latin ‘quid’ via the common phrase quid pro quo, literally, «what for what», or, figuratively, «An equal exchange or substitution».[34] The term «nicker» (also singular and plural) may also refer to the pound.

Crown Dependencies and British Overseas Territories[edit]

The currency of all the Crown Dependencies and most British Overseas Territories is either sterling or is pegged to sterling at par. These are Jersey, Guernsey, the Isle of Man, the Falkland Islands, Gibraltar, South Georgia and the South Sandwich Islands, Saint Helena and the British Antarctic Territory,[35][36] and Tristan da Cunha.[37]

Some British Overseas Territories have a local currency that is pegged to the U.S. dollar or the New Zealand dollar. The Sovereign Base Areas of Akrotiri and Dhekelia (in Cyprus) use the euro.

Subdivisions and other units[edit]

Decimal coinage[edit]

Since decimalisation on Decimal Day in 1971, the pound has been divided into 100 pence (denoted on coinage, until 1981, as «new pence»). The symbol for the penny is «p»; hence an amount such as 50p (£0.50) properly pronounced «fifty pence» is often pronounced «fifty pee» /fɪfti piː/. The old sign d was not reused for the new penny in order to avoid confusion between the two units. A decimal halfpenny (1/2p, worth 1.2 old pennies) was issued until 1984 but was withdrawn due to inflation.[38]

Pre-decimal[edit]

Sterling

(pre-decimal)

|

||||

| Unit | ||||

|---|---|---|---|---|

| Plural | Pounds | |||

| Symbol | £ | |||

| Denominations | ||||

| Superunit | ||||

| 1 | Pound | |||

| Subunit | ||||

| 1⁄20 | Shilling | |||

| 1⁄240 | Penny | |||

| Plural | ||||

| Shilling | Shillings | |||

| Penny | Pence | |||

| Symbol | ||||

| Shilling | s or / | |||

| Penny | d | |||

| Banknotes | ||||

| Freq. used |

|

|||

| Rarely used |

|

|||

| Coins |

|

|||

| This infobox shows the latest status before this currency was rendered obsolete. |

Main article: £sd

The Hatter’s hat shows an example of the old pre-decimal notation: the hat costs 10/6 (ten shillings and sixpence, a half guinea).

Before decimalisation in 1971, the pound was divided into 20 shillings, and each shilling into 12 pence, making 240 pence to the pound. The symbol for the shilling was «s.» – not from the first letter of «shilling», but from the Latin solidus. The symbol for the penny was «d.», from the French denier, from the Latin denarius (the solidus and denarius were Roman coins). A mixed sum of shillings and pence, such as 3 shillings and 6 pence, was written as «3/6» or «3s. 6d.» and spoken as «three and six» or «three and sixpence» except for «1/1», «2/1» etc., which were spoken as «one and a penny», «two and a penny», etc. 5 shillings, for example, was written as «5s.» or, more commonly, «5/–» (five shillings, no pence).

Various coin denominations had, and in some cases continue to have, special names, such as florin (2/–), crown (5/–), half crown (2/6d), farthing (1⁄4d), sovereign (£1) and guinea (q.v.). See Coins of the pound sterling and List of British coins and banknotes for details.

By the 1950s, coins of Kings George III, George IV and William IV had disappeared from circulation, but coins (at least the penny) bearing the head of every British monarch from Queen Victoria onwards could be found in circulation. Silver coins were replaced by those in cupro-nickel in 1947, and by the 1960s the silver coins were rarely seen. Silver/cupro-nickel sixpences, shillings (from any period after 1816) and florins (2 shillings) remained legal tender after decimalisation (as 2½p, 5p and 10p respectively) until 1980, 1990 and 1993 respectively, but are now officially demonetised.[39][40]

History (600–1945)[edit]

The pound sterling emerged after the adoption of the Carolingian monetary system in England c. 800. Here is a summary of changes to its value in terms of silver or gold until 1914.[41][42]

Value of £1 sterling in grams and troy ounces

| year | silver | gold | ||

|---|---|---|---|---|

| grams | troy ounces | grams | troy ounces | |

| 800 | 349.9 g | 11.25 ozt | – | – |

| 1158 | 323.7 g | 10.41 ozt | – | – |

| 1351 | 258.9 g | 8.32 ozt | 23.21 g | 0.746 ozt |

| 1412 | 215.8 g | 6.94 ozt | 20.89 g | 0.672 ozt |

| 1464 | 172.6 g | 5.55 ozt | 15.47 g | 0.497 ozt |

| 1551 | 115.1 g | 3.70 ozt | 10.31 g | 0.331 ozt |

| 1601 | 111.4 g | 3.58 ozt | variable | |

| 1717 | 111.4 g | 3.58 ozt | 7.32238 g | 0.235420 ozt |

| 1816 | – | – | 7.32238 g | 0.235420 ozt |

Anglo-Saxon[edit]

The pound was a unit of account in Anglo-Saxon England. By the ninth century it was equal to 240 silver pence.[44]

The accounting system of dividing one pound into twenty shillings, a shilling into twelve pence, and a penny into four farthings was adopted[when?] from that introduced by Charlemagne to the Frankish Empire (see livre carolingienne).[citation needed] The penny was abbreviated to «d», from denarius, the Roman equivalent of the penny; the shilling to «s» from solidus (later evolving into a simple /); and the pound to «L» (subsequently £) from Libra or Livre.[when?]

The origins of sterling lie in the reign of King Offa of Mercia (757–796), who introduced a «sterling» coin made by physically dividing a Tower pound (5,400 grains, 349.9 grams) of silver into 240 parts.[45] In practice, the weights of the coins were not consistent, 240 of them seldom added up to a full pound; there were no shilling or pound coins and these units were used only as an accounting convenience.[46]

Halfpennies and farthings worth 1⁄2 and 1⁄4 penny respectively were also minted, but small change was more commonly produced by cutting up a whole penny.[47]

Medieval, 1158[edit]

Penny of Henry III, 13th century

The early pennies were struck from fine silver (as pure as was available). In 1158, a new coinage was introduced by King Henry II (known as the Tealby penny), with a Tower Pound (5,400 grains, 349.9 g) of 92.5% silver minted into 240 pennies, each penny containing 20.82 grains (1.349 g) of fine silver.[41] Called sterling silver, the alloy is harder than the 99.9% fine silver that was traditionally used, and sterling silver coins did not wear down as rapidly as fine silver ones.

The introduction of the larger French gros tournois coins in 1266, and their subsequent popularity, led to additional denominations in the form of groats worth four pence and half groats worth two pence.[48] A gold penny weighing twice the silver penny and valued at 20 silver pence was also issued in 1257 but was not successful.[49]

The English penny remained nearly unchanged from 800 and was a prominent exception in the progressive debasements of coinage which occurred in the rest of Europe. The Tower Pound, originally divided into 240 pence, devalued to 243 pence by 1279.[50]

Edward III, 1351[edit]

Edward III noble (80 pence), 1354–55

During the reign of King Edward III, the introduction of gold coins received from Flanders as payment for English wool provided substantial economic and trade opportunities but also unsettled the currency for the next 200 years.[41]: 41 The first monetary changes in 1344 consisted of

- English pennies reduced to 20+1⁄4 grains (1.312 g; 0.042 ozt) of sterling silver (or 20.25gr @ 0.925 fine = 18.73 gr pure silver) and

- Gold double florins weighing 108 gr (6.998 g; 0.225 ozt) and valued at 6 shillings (or 72 pence).[41] (or 108gr @ 0.9948 fine = 107.44 gr pure gold).

The resulting gold-silver ratio of 1:12.55 was much higher than the ratio of 1:11 prevailing in the Continent, draining England of its silver coinage and requiring a more permanent remedy in 1351 in the form of

- Pennies reduced further to 18 gr (1.2 g; 0.038 ozt) of sterling silver (or 18 @ 0.925 fine = 15.73 gr pure silver) and

- New gold nobles weighing 120 grains (7.776 grams; 0.250 troy ounces) of the finest gold possible at the time (191/192 or 99.48% fine),[51] (meaning 120gr @ 0.9948 fine = 119.38 gr pure gold) and valued at 6 shillings and 8 pence (80 pence, or 1⁄3rd of a pound). The pure gold-silver ratio was thus 1:(80 × 15.73 / 119.38) = 1:10.5.

These gold nobles, together with half-nobles (40 pence) and farthings or quarter-nobles (20 pence),[51] would become the first English gold coins produced in quantity.[52]

Henry IV, 1412[edit]

The exigencies of the Hundred Years’ War during the reign of King Henry IV resulted in further debasements toward the end of his reign, with the English penny reduced to 15 grains sterling silver (0.899 g fine silver)[clarification needed] and the half-noble reduced to 54 grains (3.481 g fine gold).[clarification needed][41] The gold-silver ratio went down to 40 × 0.899 / 3.481 = 10.3.

After the French monetary reform of 1425, the gold half-noble (1⁄6th pound, 40 pence) was worth close to one Livre Parisis (French pound) or 20 sols, while the silver half-groat (2 pence, fine silver 1.798 g) was worth close to 1 sol parisis (1.912 g).[53] Also, after the Flemish monetary reform of 1434, the new Dutch florin was valued close to 40 pence while the Dutch stuiver (shilling) of 1.63 g fine silver was valued close to 2 pence sterling at 1.8 g.[54] This approximate pairing of English half-nobles and half-groats to Continental livres and sols persisted up to the 1560s.

Great slump, 1464[edit]

The Great Bullion Famine and the Great Slump of the mid-15th century resulted in another reduction in the English penny to 12 grains sterling silver (0.719 g fine silver) and the introduction of a new half-angel gold coin of 40 grains (2.578 g), worth 1⁄6th pound or 40 pence.[41] The gold-silver ratio rose again to 40 × 0.719⁄2.578 = 11.2. The reduction in the English penny approximately matched those with the French sol Parisis and the Flemish stuiver; furthermore, from 1469 to 1475 an agreement between England and the Burgundian Netherlands made the English groat (4-pence) mutually exchangeable with the Burgundian double patard (or 2-stuiver) minted under Charles the Rash.[55][56]

40 pence or 1⁄6th pound sterling made one Troy Ounce (480 grains, 31.1035 g) of sterling silver. It was approximately on a par with France’s livre parisis of one French ounce (30.594 g), and in 1524 it would also be the model for a standardised German currency in the form of the Guldengroschen, which also weighed 1 German ounce of silver or 29.232 g (0.9398 ozt).[41]: 361

Tudor, 1551[edit]

Crown (5/–) of Edward VI, 1551

The last significant depreciation in sterling’s silver standard occurred amidst the 16th century influx of precious metals from the Americas arriving through the Habsburg Netherlands. Enforcement of monetary standards amongst its constituent provinces was loose, spending under King Henry VIII was extravagant, and England loosened the importation of cheaper continental coins for exchange into full-valued English coins.[55][57] All these contributed to The Great Debasement which resulted in a significant 1⁄3rd reduction in the bullion content of each pound sterling in 1551.[58][42]

The troy ounce of sterling silver was henceforth raised in price by 50% from 40 to 60 silver pennies (each penny weighing 8 grains sterling silver and containing 0.4795 g (0.01542 ozt) fine silver).[42] The gold half-angel of 40 grains (2.578 g (0.0829 ozt) fine gold) was raised in price from 40 pence to 60 pence (5 shillings or 1⁄4 pound) and was henceforth known as the Crown.

Prior to 1551, English coin denominations closely matched with corresponding sol (2d) and livre (40d) denominations in the Continent, namely:

- Silver; see farthing (1⁄4d), halfpenny (1⁄2d), penny (1d), half-groat (2d), and groat (4d)

- Gold; see 1351: 1⁄4 noble (20d), 1⁄2 noble (40d) and noble or angel (80d).

After 1551 new denominations were introduced,[59] weighing similarly to 1464-issued coins but increased in value 1+1⁄2 times, namely:

- In silver: the threepence (3d), replacing the half-groat; the sixpence (6d), replacing the groat; and a new shilling or testoon (1/–).

- In silver or gold: the half crown (2/6d or 30d), replacing the 1⁄4 angel of 20d; and the crown (5/- or 60d), replacing the 1⁄2 angel of 40d.

- And in gold: the new half sovereign (10/–) and sovereign (£1 or 20/–)

1601 to 1816[edit]

A golden guinea coin minted during the reign of King James II in 1686. The «Elephant and Castle» motif below his head is the symbol of the Royal African Company, Britain’s foremost slave trading company.[60] The RAC transported the gold used in the coin from West Africa to England after purchasing it from African merchants in the Guinea region, who in turn sourced it from the Ashanti Empire.[61]

The silver basis of sterling remained essentially unchanged until the 1816 introduction of the Gold Standard, save for the increase in the number of pennies in a troy ounce from 60 to 62 (hence, 0.464 g fine silver in a penny). Its gold basis remained unsettled, however, until the gold guinea was fixed at 21 shillings in 1717.

The guinea was introduced in 1663 with 44+1⁄2 guineas minted out of 12 troy ounces of 22-karat gold (hence, 7.6885 g fine gold) and initially worth £1 or 20 shillings. While its price in shillings was not legally fixed at first, its persistent trade value above 21 shillings reflected the poor state of clipped underweight silver coins tolerated for payment. Milled shillings of full weight were hoarded and exported to the Continent, while clipped, hand-hammered shillings stayed in circulation (as Gresham’s law describes).[62]

In the 17th century, English merchants tended to pay for imports in silver but were generally paid for exports in gold.[citation needed] This effect was notably driven by trade with the Far East, as the Chinese insisted on payments for their exports being settled in silver. From the mid-17th century, around 28,000 metric tons (27,600 long tons) of silver were received by China, principally from European powers, in exchange for Chinese tea and other goods. In order to be able to purchase Chinese exports in this period, England initially had to export to other European nations and request payment in silver,[citation needed] until the British East India Company was able to foster the indirect sale of opium to the Chinese.[63]

Domestic demand for silver bullion in Britain further reduced silver coinage in circulation, as the improving fortunes of the merchant class led to increased demand for tableware. Silversmiths had always regarded coinage as a source of raw material, already verified for fineness by the government. As a result, sterling silver coins were being melted and fashioned into «sterling silverware» at an accelerating rate. An Act of the Parliament of England in 1697 tried to stem this tide by raising the minimum acceptable fineness on wrought plate from sterling’s 92.5% to a new Britannia silver standard of 95.83%. Silverware made purely from melted coins would be found wanting when the silversmith took his wares to the assay office, thus discouraging the melting of coins.[citation needed]

During the time of Sir Isaac Newton, Master of the Mint, the gold guinea was fixed at 21 shillings (£1/1/-) in 1717. But without addressing the problem of underweight silver coins, and with the high resulting gold-silver ratio of 15.2, it gave sterling a firmer footing in gold guineas rather than silver shillings, resulting in a de facto gold standard. Silver and copper tokens issued by private entities partly relieved the problem of small change until the Great Recoinage of 1816.[64]

Establishment of modern currency[edit]

The Bank of England was founded in 1694, followed by the Bank of Scotland a year later. Both began to issue paper money.

Currency of Great Britain (1707) and the United Kingdom (1801)[edit]

In the 17th century Scots currency was pegged to sterling at a value of £12 Scots = £1 sterling.[65]

In 1707, the kingdoms of England and Scotland merged into the Kingdom of Great Britain. In accordance with the Treaty of Union, the currency of Great Britain was sterling, with the pound Scots soon being replaced by sterling at the pegged value.

In 1801, Great Britain and the Kingdom of Ireland were united to form the United Kingdom of Great Britain and Ireland. However, the Irish pound was not replaced by sterling until January 1826.[66] The conversion rate had long been £13 Irish to £12 sterling.[citation needed] In 1928, six years after the Anglo-Irish Treaty restored Irish autonomy within the British Empire, the Irish Free State established a new Irish pound, pegged at par to sterling.[67]

Use in the Empire[edit]

Sterling circulated in much of the British Empire. In some areas it was used alongside local currencies. For example, the gold sovereign was legal tender in Canada despite the use of the Canadian dollar. Several colonies and dominions adopted the pound as their own currency. These included Australia, Barbados,[68] British West Africa, Cyprus, Fiji, British India, the Irish Free State, Jamaica, New Zealand, South Africa and Southern Rhodesia. Some of these retained parity with sterling throughout their existence (e.g. the South African pound), while others deviated from parity after the end of the gold standard (e.g. the Australian pound). These currencies and others tied to sterling constituted the core of the sterling area.

The original English colonies on mainland North America were not party to the sterling area because the above-mentioned silver shortage in England coincided with these colonies’ formative years. As a result of equitable trade (and rather less equitable piracy), the Spanish milled dollar became the most common coin within the English colonies.

Gold standard[edit]

«Shield reverse» sovereign of Queen Victoria, 1842

During the American War of Independence and the Napoleonic wars, Bank of England notes were legal tender, and their value floated relative to gold. The Bank also issued silver tokens to alleviate the shortage of silver coins. In 1816, the gold standard was adopted officially,[citation needed] with silver coins minted at a rate of 66 shillings to a troy pound (weight) of sterling silver, thus rendering them as «token» issues (i.e. not containing their value in precious metal). In 1817, the sovereign was introduced, valued at 20/–. Struck in 22‑carat gold, it contained 113 grains or 7.32238 g (0.235420 ozt) of fine gold and replaced the guinea as the standard British gold coin without changing the gold standard.

By the 19th century, sterling notes were widely accepted outside Britain. The American journalist Nellie Bly carried Bank of England notes on her 1889–1890 trip around the world in 72 days.[69] During the late 19th and early 20th centuries, many other countries adopted the gold standard. As a consequence, conversion rates between different currencies could be determined simply from the respective gold standards. £1 sterling was equal to US$4.87 in the United States, Can$4.87 in Canada, ƒ12.11 in Dutch territories, F 25.22 in French territories (or equivalent currencies of the Latin Monetary Union), 20ℳ 43₰ in Germany, Rbls 9.46 in Russia or K 24.02 in Austria-Hungary.[citation needed] After the International Monetary Conference of 1867 in Paris, the possibility of the UK joining the Latin Monetary Union was discussed, and a Royal Commission on International Coinage examined the issues,[70] resulting in a decision against joining monetary union.

First world war: suspension of the gold standard[edit]

The gold standard was suspended at the outbreak of First World War in 1914, with Bank of England and Treasury notes becoming legal tender. Before that war, the United Kingdom had one of the world’s strongest economies, holding 40% of the world’s overseas investments. But after the end of the war, the country was highly indebted: Britain owed £850 million (about £44.1 billion today)[71] with interest costing the country some 40% of all government spending.[72] The British government under Prime Minister David Lloyd George and Chancellor of the Exchequer Austen Chamberlain tried to make up for the deficit with a deflationary policy, but this only led to the Depression of 1920–21.[73]

By 1917, production of gold sovereigns had almost halted (the remaining production was for collector’s sets and other very specific occasions), and by 1920, the silver coinage was debased from its original .925 fine to just .500 fine.[citation needed] That was due to a drastic increase in silver prices from an average 27/6d. [£1.375] per troy pound in the period between 1894 and 1913, to 89/6d. [£4.475] in August 1920.[74]

Interwar period: gold standard reinstated[edit]

To try to resume stability, a version of the gold standard was reintroduced in 1925, under which the currency was fixed to gold at its pre-war peg, but one could only exchange currency for gold bullion, not for coins. On 21 September 1931, this was abandoned during the Great Depression, and sterling suffered an initial devaluation of some 25%.[75]

Since the suspension of the gold standard in 1931, sterling has been a fiat currency, with its value determined by its continued acceptance in the national and international economy.

World War II[edit]

In 1940, an agreement with the US pegged sterling to the US dollar at a rate of £1 = US$4.03. (Only the year before, it had been US$4.86.)[76] This rate was maintained through the Second World War and became part of the Bretton Woods system which governed post-war exchange rates.

History (1946–present)[edit]

Bretton Woods[edit]

Under continuing economic pressure, and despite months of denials that it would do so, on 19 September 1949 the government devalued the pound by 30.5% to US$2.80.[77] The 1949 sterling devaluation prompted several other currencies to be devalued against the dollar.

In 1961, 1964, and 1966, sterling came under renewed pressure, as speculators were selling pounds for dollars. In summer 1966, with the value of the pound falling in the currency markets, exchange controls were tightened by the Wilson government. Among the measures, tourists were banned from taking more than £50 out of the country in travellers’ cheques and remittances, plus £15 in cash;[b] this restriction was not lifted until 1979. Sterling was devalued by 14.3% to £1 = US$2.40 on 18 November 1967.[77][78]

Decimalisation[edit]

Until decimalisation, amounts in sterling were expressed in pounds, shillings, and pence, with various widely understood notations. The same amount could be stated as 32s. 6d., 32/6, £1. 12s. 6d., or £1/12/6. It was customary to specify some prices (for example professional fees and auction prices for works of art) in guineas (abbr: gn. or gns.), although guinea coins were no longer in use.

Formal parliamentary proposals to decimalise sterling were first made in 1824 when Sir John Wrottesley, MP for Staffordshire, asked in the House of Commons whether consideration had been given to decimalising the currency.[79] Wrottesley raised the issue in the House of Commons again in 1833,[80] and it was again raised by John Bowring, MP for Kilmarnock Burghs, in 1847[81] whose efforts led to the introduction in 1848 of what was in effect the first decimal coin in the United Kingdom, the florin, valued at one-tenth of a pound. However, full decimalisation was resisted, although the florin coin, re-designated as ten new pence, survived the transfer to a full decimal system in 1971, with examples surviving in British coinage until 1993.

John Benjamin Smith, MP for Stirling Burghs, raised the issue of full decimalisation again in Parliament in 1853,[82] resulting in the Chancellor of the Exchequer, William Gladstone, announcing soon afterwards that «the great question of a decimal coinage» was «now under serious consideration».[83] A full proposal for the decimalisation of sterling was then tabled in the House of Commons in June 1855, by William Brown, MP for Lancashire Southern, with the suggestion that the pound sterling be divided into one thousand parts, each called a «mil», or alternatively a farthing, as the pound was then equivalent to 960 farthings which could easily be rounded up to one thousand farthings in the new system.[84] This did not result in the conversion of sterling into a decimal system, but it was agreed to establish a Royal Commission to look into the issue.[85] However, largely due to the hostility to decimalisation of two of the appointed commissioners, Lord Overstone (a banker) and John Hubbard (Governor of the Bank of England), decimalisation in Britain was effectively quashed for over a hundred years.[86]

However, sterling was decimalised in various British colonial territories before the United Kingdom (and in several cases in line with William Brown’s proposal that the pound be divided into 1,000 parts, called mils). These included Hong Kong from 1863 to 1866;[87] Cyprus from 1955 until 1960 (and continued on the island as the division of the Cypriot pound until 1983); and the Palestine Mandate from 1926 until 1948.[88]

Later, in 1966, the UK Government decided to include in the Queen’s Speech a plan to convert sterling into a decimal currency.[89] As a result of this, on 15 February 1971, the UK decimalised sterling, replacing the shilling and the penny with a single subdivision, the new penny, which was worth 2.4d. For example, a price tag of £1/12/6. became £1.62+1⁄2. The word «new» was omitted from coins minted after 1981.

Free-floating pound[edit]

With the breakdown of the Bretton Woods system, sterling floated from August 1971 onwards. At first, it appreciated a little, rising to almost US$2.65 in March 1972 from US$2.42, the upper bound of the band in which it had been fixed. The sterling area effectively ended at this time, when the majority of its members also chose to float freely against sterling and the dollar.

1976 sterling crisis[edit]

UK bonds 1960–2022: the yield on UK Government benchmark ten-year bonds increased to over 15% in the 1970s and early 1980s.